Assessing Mitsubishi Motors (TSE:7211) Valuation After Recent Share Price Weakness

Reviewed by Kshitija Bhandaru

Mitsubishi Motors (TSE:7211) shares have edged slightly lower over the past month, with the stock slipping around 5% in that period. Trading activity suggests investors are considering broader industry dynamics and recent company performance.

See our latest analysis for Mitsubishi Motors.

The recent slide in Mitsubishi Motors' share price, down nearly 23% year-to-date, reflects a shift in sentiment as momentum fades in the short term. Yet, despite the bumpy ride, investors who held on for the past five years have seen total returns of more than 100%. This underscores that longer holding periods can still pay off, even as the pace cools.

If the industry winds sweeping through auto stocks have you interested in what else could be moving, consider checking out See the full list for free.

With the recent correction, investors are left to wonder if Mitsubishi Motors is now presenting an undervalued opportunity, or if the market is already accounting for potential growth ahead. Is there real upside still to be found?

Most Popular Narrative: 7.1% Undervalued

Analyst consensus sets Mitsubishi Motors’ fair value at ¥422.5, just above the last close of ¥392.7. This slim margin points to expectations that the stock could edge higher if the narrative’s future assumptions play out as forecasted.

Strategic focus on hybrid and plug-in hybrid vehicle rollouts, especially in the ASEAN and Japanese markets, positions Mitsubishi to capitalize on consumer shifts to cleaner vehicles and anticipated regulatory tightening. This is likely to boost top-line revenue and support higher market share.

Want to see the targets driving this optimistic view? The underlying story hinges on an earnings leap and bolder margins that are far above what you might expect from a mature automaker. Curious about the numbers that are fueling these big fair value projections? Check out the narrative to uncover how analysts think Mitsubishi’s fortunes could reshape the share price.

Result: Fair Value of ¥422.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensified price competition and sluggish recovery in key ASEAN markets could seriously pressure Mitsubishi's margins and dampen expected revenue growth.

Find out about the key risks to this Mitsubishi Motors narrative.

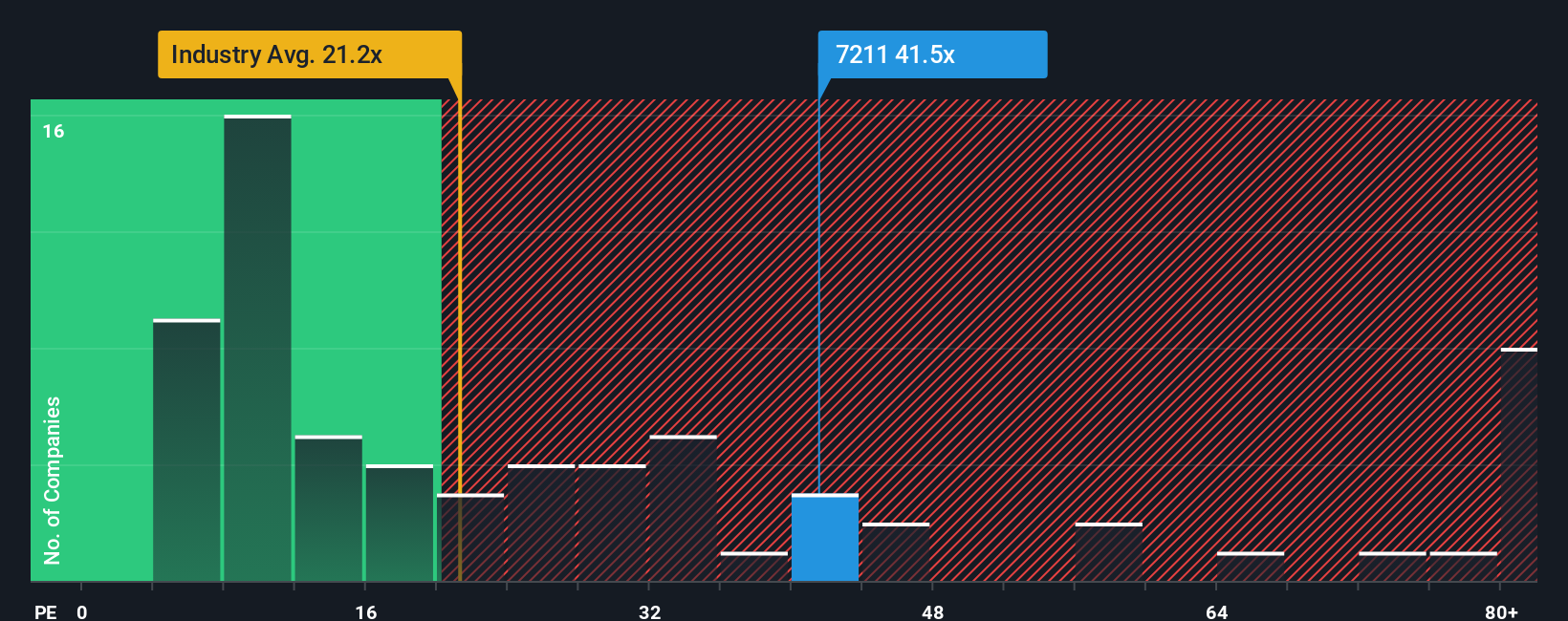

Another View: Looking at Valuation Multiples

Not everyone shares the same optimism about Mitsubishi Motors’ valuation. Compared to peers and the wider Asian Auto sector, the company’s current price-to-earnings ratio is a lofty 42.9x, well above the peer average of 18.5x and industry average of 21.7x. Even the fair ratio, which is what the market could shift toward, is estimated at 37.3x. When a company trades this far above its reference points, investors face a real risk that price expectations may have run too far ahead of fundamentals. Could this premium signal hidden strength or set up disappointment if growth stalls?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mitsubishi Motors Narrative

If you see the story differently or want to dig into the numbers yourself, you can build and share your own perspective in just a few minutes as well, so why not Do it your way

A great starting point for your Mitsubishi Motors research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investing means always having your finger on the pulse of emerging trends and high-potential opportunities. Don’t let another unique angle slip past you. See what your watchlist is missing.

- Uncover bargains with impressive upside by tracking these 892 undervalued stocks based on cash flows before Wall Street catches up to their true worth.

- Capture reliable income streams by checking out these 19 dividend stocks with yields > 3% with generous yields and sustainable payouts.

- Tap into breakthroughs in medicine and data by reviewing these 33 healthcare AI stocks driving innovation in healthcare technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7211

Mitsubishi Motors

Engages in the development, production, and sale of passenger vehicles, and related parts and components in Japan, Europe, North America, Oceania, the rest of Asia, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives