Nissan (TSE:7201) Valuation: How Recent Share Fluctuations Could Signal Opportunity or Risk

Reviewed by Kshitija Bhandaru

See our latest analysis for Nissan Motor.

Despite recent choppiness, Nissan Motor’s share price has been trending lower in 2024, with a year-to-date decline of nearly 26% and a 1-year total shareholder return of -11%. There was a notable rebound in the past 90 days; however, momentum overall remains subdued as investors balance near-term headwinds with potential recovery themes.

If the action in automotive stocks has your attention, it’s worth taking the next step and exploring See the full list for free.

So the big question for investors now is whether Nissan Motor’s recent share weakness and lagging longer-term returns signal an undervalued opportunity, or if the market has already accounted for all realistic growth ahead.

Most Popular Narrative: 5% Overvalued

Despite Nissan Motor's latest close of ¥351.70, the most widely followed narrative suggests that the company’s fair value is notably lower. This puts the spotlight on the drivers behind the narrative’s current view and why Nissan may not be as cheap as some expect.

Aggressive cost reduction initiatives under the Re:Nissan plan, including plant consolidation, fixed and variable cost savings, engineering process improvements, and supply chain optimization, are designed to significantly improve operating earnings and net margins. Tangible benefits are expected from 2026 onward as restructuring milestones are completed.

Want to know which financial forecasts make up the core of this valuation? The narrative leans on bold earnings growth and a step-change in profit margins. Curious what numbers analysts are betting on to support their targeted price? Unlock those assumptions and see the full calculation within the narrative.

Result: Fair Value of ¥336 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cash outflows and fierce competition in China could still present significant challenges to Nissan’s recovery trajectory and long-term margin improvement.

Find out about the key risks to this Nissan Motor narrative.

Another View: Valuation Based on Sales Ratio

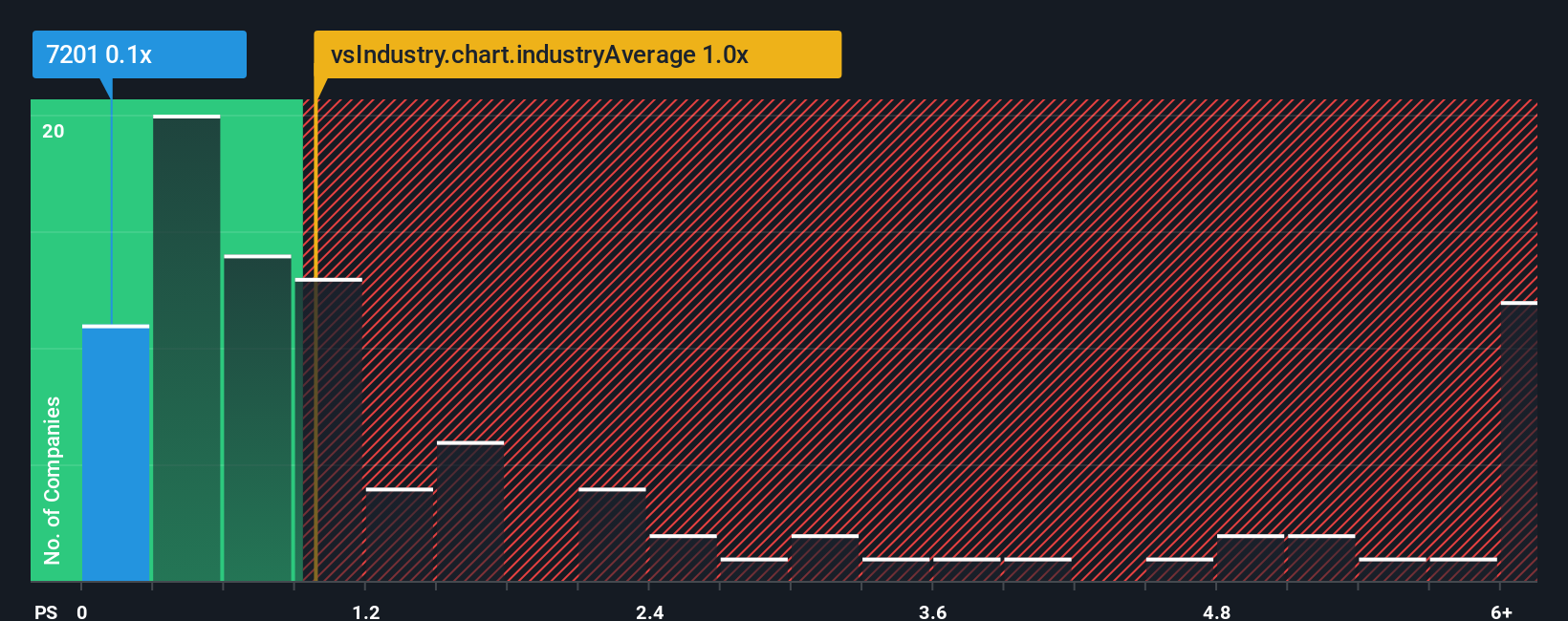

Looking at Nissan Motor from a different angle, its price-to-sales ratio is just 0.1x. This figure is well below both the Asian auto industry average of 1x and its closest peers at 0.3x. Even compared to its own fair ratio of 0.5x, the stock appears considerably discounted, possibly signaling an opportunity. However, this gap could be a warning sign, or it may reflect the market overlooking Nissan’s turnaround potential.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nissan Motor Narrative

If the current thesis does not reflect your outlook or you prefer to take a hands-on approach, you can analyze the data, test your own assumptions, and shape a unique valuation in just a few minutes. Do it your way

A great starting point for your Nissan Motor research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize fresh opportunities by checking out next-level stocks driving tomorrow’s trends. Don’t overlook these investment themes, or you could miss out on the next big move:

- Grow your portfolio with income potential by targeting these 18 dividend stocks with yields > 3% that offer attractive yields and the power of compounding returns.

- Capitalize on emerging breakthroughs by reviewing these 24 AI penny stocks that are propelling artificial intelligence forward across key markets.

- Position yourself ahead of trends by evaluating these 79 cryptocurrency and blockchain stocks powering the future of finance and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nissan Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7201

Nissan Motor

Manufactures and sells vehicles and automotive parts worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives