Nissan (TSE:7201): Examining Valuation as Market Sentiment Remains Subdued

Reviewed by Kshitija Bhandaru

Nissan Motor (TSE:7201) stock is in focus after recent market activity left some investors wondering about its next move. While share performance has shifted modestly over the past month, bigger questions remain regarding the company's current valuation and outlook.

See our latest analysis for Nissan Motor.

Momentum for Nissan Motor shares appears muted lately, with the YTD share price return in negative territory. While the latest trading brought only minor changes, the one-year total shareholder return of -0.13% highlights ongoing challenges as the company works to regain market confidence.

If you want a broader look at how other automakers are performing, see the full list of companies on our auto manufacturers screener: See the full list for free.

The central question for investors now is whether Nissan Motor's subdued stock price signals a compelling bargain, or if the market has already factored in any potential rebound and future growth.

Most Popular Narrative: 7% Overvalued

With the fair value estimate sitting below the last close of ¥359.5, the market appears to be pricing Nissan Motor above its narrative-driven fair value. This backdrop sets the stage for a deeper dive into the core assumptions that drive the story behind the company’s share price.

Deeper global partnerships and scaling via the Renault-Mitsubishi alliance, along with ongoing collaborations with other automakers (e.g. Honda), are expected to yield further R&D and manufacturing efficiencies, shared platform utilization, and technology advancements. These factors support long-term margin expansion through enhanced economies of scale.

Why does the most-followed outlook peg Nissan’s value above current fundamentals? The forecast centers on key shifts in alliances, tech leverage, and profit margin expansion. This is driven by ambitious cost and growth targets that could transform the earnings profile. Curious what pivotal bets tip the scales? The full narrative reveals the bold financial plays and revenue assumptions at the heart of this valuation.

Result: Fair Value of ¥335.94 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent losses and fierce competition in China continue to threaten Nissan's turnaround plans and could undermine even the most optimistic outlooks.

Find out about the key risks to this Nissan Motor narrative.

Another View: What Does the SWS DCF Model Say?

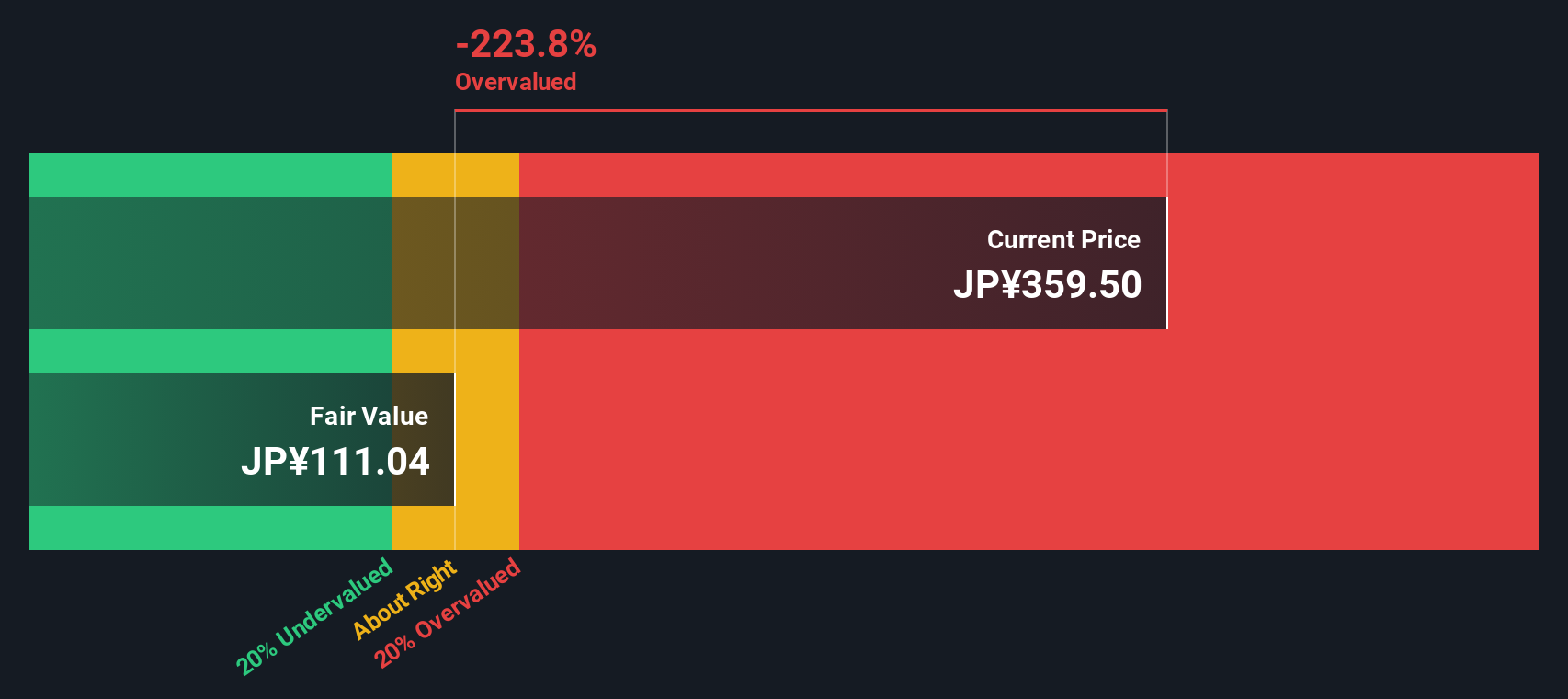

Taking a different approach from the market multiples, the SWS DCF model places Nissan Motor's fair value at just ¥111.04, which is far below the current share price. This suggests that, by this method, the stock could be significantly overvalued. Does the market know something the DCF does not, or are investors too optimistic about Nissan's recovery?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Nissan Motor Narrative

If these viewpoints do not resonate with your perspective or you would rather draw your own conclusions, you can craft your own Nissan Motor narrative using the data in just a few minutes. Do it your way

A great starting point for your Nissan Motor research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Great opportunities are waiting beyond Nissan Motor. Don’t let potential winners pass you by when you can quickly scan handpicked stocks with standout fundamentals and growth stories.

- Tap into future breakthroughs by checking out these 26 quantum computing stocks and see which companies are at the forefront of quantum computing innovation.

- Secure consistent income while minimizing risk with our shortlist of high-yield picks. Start with these 19 dividend stocks with yields > 3% offering dividends above 3%.

- Ride the next wave of digital revolution by reviewing these 78 cryptocurrency and blockchain stocks, connecting you to stocks poised to benefit from advancements in cryptocurrency and blockchain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nissan Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7201

Nissan Motor

Manufactures and sells vehicles and automotive parts worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives