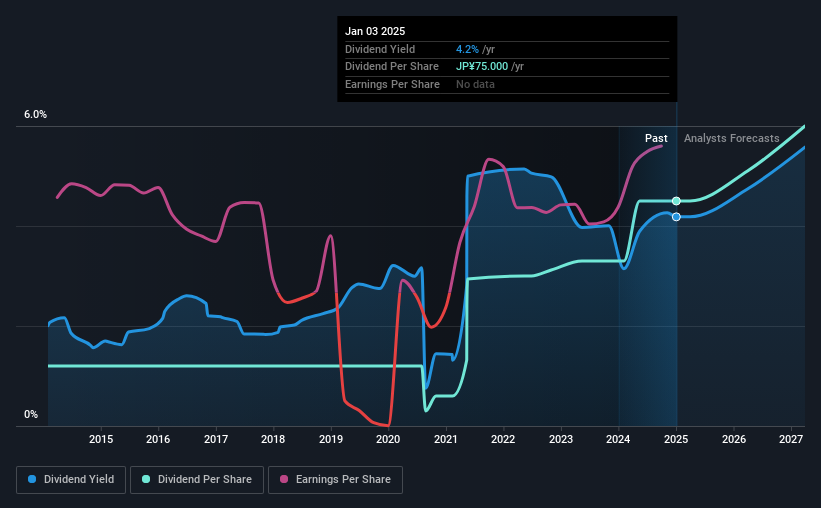

Fukoku Co.,Ltd.'s (TSE:5185) investors are due to receive a payment of ¥37.50 per share on 11th of June. This will take the dividend yield to an attractive 4.2%, providing a nice boost to shareholder returns.

See our latest analysis for FukokuLtd

FukokuLtd's Projected Earnings Seem Likely To Cover Future Distributions

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. However, based ont he last payment, FukokuLtd was earning enough to cover the dividend pretty comfortably. The business is earning enough to make the dividend feasible, but the cash payout ratio of 90% shows that most of the cash is going back to the shareholders, which could constrain growth prospects going forward.

The next year is set to see EPS grow by 9.7%. If the dividend continues on this path, the payout ratio could be 35% by next year, which we think can be pretty sustainable going forward.

FukokuLtd Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2015, the dividend has gone from ¥20.00 total annually to ¥75.00. This works out to be a compound annual growth rate (CAGR) of approximately 14% a year over that time. So, dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

The Dividend Looks Likely To Grow

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. It's encouraging to see that FukokuLtd has been growing its earnings per share at 48% a year over the past five years. Earnings per share is growing at a solid clip, and the payout ratio is low which we think is an ideal combination in a dividend stock as the company can quite easily raise the dividend in the future.

In Summary

In summary, it's great to see that the company can raise the dividend and keep it in a sustainable range. On the plus side, the dividend looks sustainable by most measures but it is let down by the lack of cash flows. This looks like it could be a good dividend stock going forward, but we would note that the payout ratio has been at higher levels in the past so it could happen again.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 1 warning sign for FukokuLtd that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5185

FukokuLtd

Manufactures and sells rubber, metal and synthetic resin, and bio and medical related products in Japan, Southeast Asia, India, the United States, Europe, China, South Korea, and internationally.

Flawless balance sheet 6 star dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026