- Italy

- /

- Other Utilities

- /

- BIT:IRE

Iren (BIT:IRE): Taking a Fresh Look at Valuation After Recent Gains and Market Shifts

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 3.3% Undervalued

Analysts currently view Iren as modestly undervalued based on expected long-term earnings and margin enhancement. The narrative anticipates meaningful upside driven by internal investments and sector trends, but highlights only a slight gap between the current share price and its fair value estimate.

The integration of EGEA is on track to deliver further operational synergies through 2026. This is evidenced by already meeting a majority of EBITDA targets, which is expected to drive additional profit growth and enhance earnings predictability as scale efficiencies are realized.

Can Iren’s margin expansion and large-scale integration really mean more upside than the price suggests? One critical assumption in this narrative is a future profit level that sets expectations higher than most of its direct peers. Want to uncover why analysts believe steady revenue, higher margins, and premium valuation multiples could point to value hiding in plain sight? The details behind their calculations may surprise you.

Result: Fair Value of €2.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising competition in supply and uncertainty around regulatory decisions could strain margins and cast doubt on the company’s long-term growth outlook.

Find out about the key risks to this Iren narrative.Another View: Discounted Cash Flow Tells a Different Story

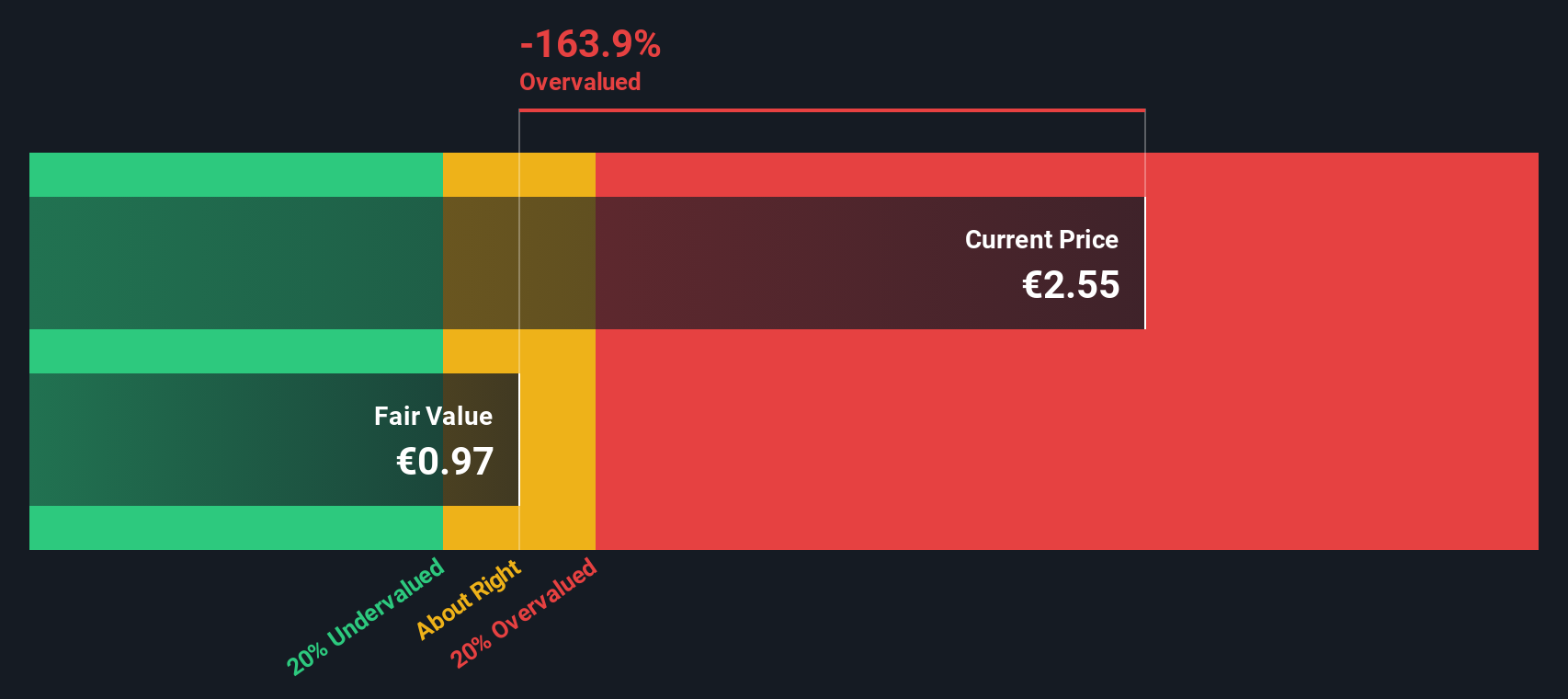

Looking through the lens of the SWS DCF model, Iren appears overvalued compared to its calculated fair value. This stands in direct contrast to the earlier multiple-based outlook. Can a cash flow model offer more insight?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Iren Narrative

If you see things differently or want to dig deeper into the numbers, it is easy to shape your own view in just a few minutes. Do it your way.

A great starting point for your Iren research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not sit on the sidelines and miss tomorrow’s big outperformers. Let the Simply Wall Street Screener power your next move to smarter investments.

- Catch opportunities in fast-growing companies at bargain prices by using our undervalued stocks based on cash flows for undervalued stocks with strong cash flow potential.

- Spot emerging trends in artificial intelligence with our expert-picked AI penny stocks to stay at the forefront of the AI boom.

- Boost potential returns with stable income streams by targeting dividend stocks with yields > 3% featuring stocks offering yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:IRE

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives