- Italy

- /

- Gas Utilities

- /

- BIT:IG

Italgas (BIT:IG): Assessing Valuation as Quiet Momentum Drives Attention

Reviewed by Simply Wall St

Price-to-Earnings of 13.2x: Is it justified?

Italgas appears undervalued when considering its price-to-earnings (P/E) ratio of 13.2x, which is lower than both the Italian market P/E average and its peer group within the global gas utilities industry.

The price-to-earnings ratio is a popular metric that shows how much investors are willing to pay for each euro of a company’s earnings. For utilities like Italgas, a lower P/E compared to industry averages can be seen as a sign of attractive value, especially when paired with a consistent track record of earnings growth.

This lower valuation suggests the market may be underpricing Italgas’s stable profit growth and strong financial performance relative to its peers. Investors may find this an appealing entry point if current trends continue.

Result: Fair Value of €7.58 (ABOUT RIGHT)

See our latest analysis for Italgas.However, factors such as regulatory shifts or unexpected downturns in revenue growth could quickly challenge this steady upward trend for Italgas.

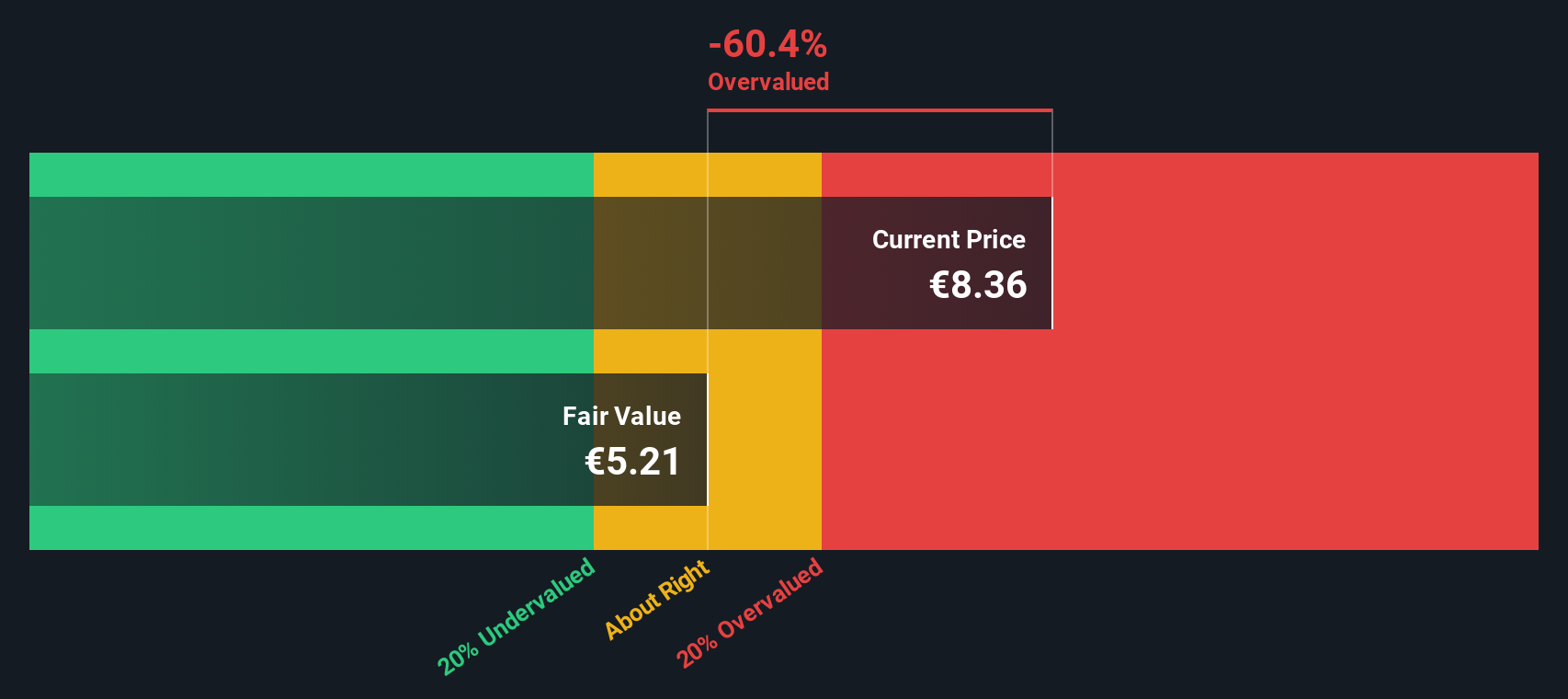

Find out about the key risks to this Italgas narrative.Another View: SWS DCF Model Paints a Different Picture

While traditional valuation suggests Italgas’s shares are attractively priced, the SWS DCF model takes a more cautious stance and hints that the stock may not be as undervalued as it first appears. Which outlook will the market trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Italgas Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your Italgas research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stock market opportunities do not wait, and new trends are emerging every week. You could be one smart next step away from your next breakthrough investment.

- Unlock the potential of future tech breakthroughs by scanning companies at the forefront of quantum computing stocks and watch your portfolio evolve alongside the latest innovations.

- Target reliable income streams by seeking out opportunities offering elevated yields through our handpicked selection of dividend stocks with yields > 3% investments.

- Catch stocks trading far below their intrinsic value and position yourself for long-term growth by using our collection of undervalued stocks based on cash flows opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About BIT:IG

Italgas

Engages in the distribution of natural gas in Italy, Greece, and Other European Union countries.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)