- Italy

- /

- Renewable Energy

- /

- BIT:ERG

Is There Room for Growth in ERG Stock After Recent 7% Climb?

Reviewed by Bailey Pemberton

Deciding what to do with ERG stock right now might feel a bit like standing at a crossroads, wondering which path holds the better payoff. On one hand, the stock closed recently at 21.98 and has enjoyed a decent pick-me-up over the past week and month, rising 5.2% and 7.1% respectively. Year to date, ERG is up 8.1%. However, taking a step back, the view changes. Over the past year, the stock has slipped 2.1%. Looking further out, the 3-year return paints a cautious picture, dropping by 11.9%. Over the last five years, ERG boasts a respectable 17.2% gain, which puts these ups and downs into a wider context.

Much of this mixed performance can be traced to broader market factors shifting sentiment. Investors are weighing the outlook for the sector, leading to a recent bounce as risk appetite improved. But there is always the question of whether it is actually undervalued, or if this is simply a typical market reaction.

Interestingly, based on six standard undervaluation checks, ERG’s valuation score currently sits at 0 out of 6. In other words, it is not triggering undervaluation alerts on any major metric right now. However, digging deeper into how stocks get valued and what that really means for your decision might tell a different story.

ERG scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: ERG Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation tool that estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to their present value. This approach looks beyond current earnings and focuses instead on how much money a company is expected to bring in for shareholders going forward.

For ERG, the most recently reported Free Cash Flow stands at €196.7 million. Analysts provide forecasts up to five years out, while estimates for further years are extended by financial modeling. According to these projections, ERG's Free Cash Flow could grow to around €255.4 million by 2035. The annual cash flows are expected to fluctuate but generally increase slightly over the coming decade, with key projections including €244.2 million in 2026 and €233 million in 2028, all based on analyst and industry estimates.

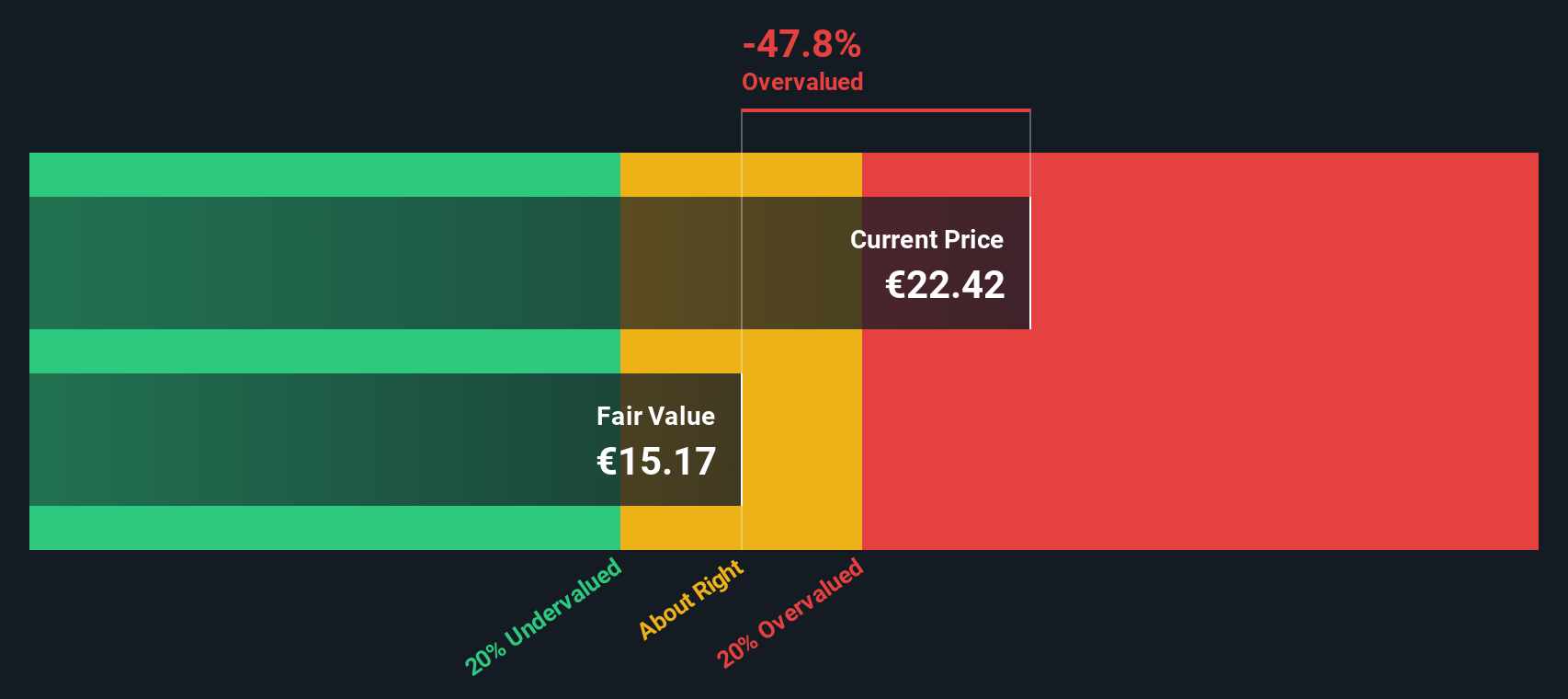

These projected figures are all discounted back to today's value, resulting in an estimated intrinsic value of €15.16 per share for ERG. Given the current market price of €21.98, the DCF model suggests the stock is approximately 45.0% overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ERG may be overvalued by 45.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: ERG Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation measure, particularly for profitable companies like ERG. It allows investors to gauge how much the market is willing to pay for each euro of earnings generated, providing a straightforward sense of relative value.

The “right” PE ratio for a company depends on several factors, including growth prospects and perceived risk. High-growth or lower-risk companies tend to command higher PE multiples, while those with slower growth or elevated risk usually trade below the industry norm.

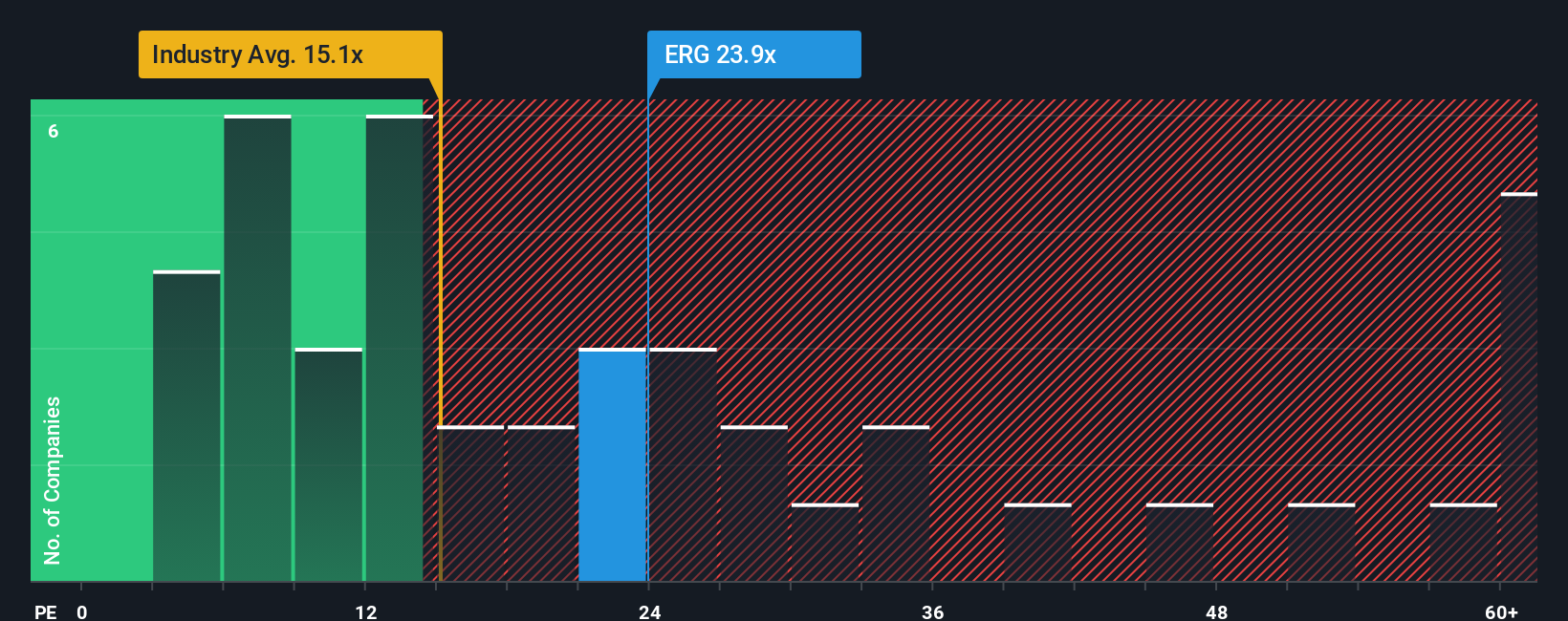

As of now, ERG is priced at a PE ratio of 23.4x. For comparison, the average PE ratio for the Renewable Energy industry is 16.0x, and ERG’s peer group sits close by at 16.0x as well. At first glance, ERG’s multiple is notably higher than both its peers and the broader industry.

To move beyond simple averages, Simply Wall St evaluates what PE ratio is “fair” for ERG given its specific growth forecasts, profit margins, market capitalization, and risk profile. This Fair Ratio, which takes into account these customized factors, stands at 17.3x. This is considered a more tailored and accurate benchmark because industry and peer multiples can miss key company-specific details that matter for long-term investors.

With a current PE ratio of 23.4x compared to the Fair Ratio of 17.3x, ERG stock appears to be trading at a premium to what would be considered fair value based on the company’s unique outlook and risk.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ERG Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about ERG’s future, combining your own assumptions about revenues, profits, and margins with the numbers to arrive at what you think the company is worth.

This approach lets you connect the business’s real-world strategy, opportunities, and risks directly to a financial forecast, making your investment decision much more personal and meaningful. With Narratives, it is easy to see how your expectations lead to your version of fair value, not just the one the market or analysts present.

On Simply Wall St’s Community page, millions of investors use Narratives to quickly build, update, and share these perspectives. It is designed to be simple and accessible for everyone. As news, earnings, or market shifts occur, Narratives update dynamically, helping you stay on top of changing fair values and adjust your strategy as needed.

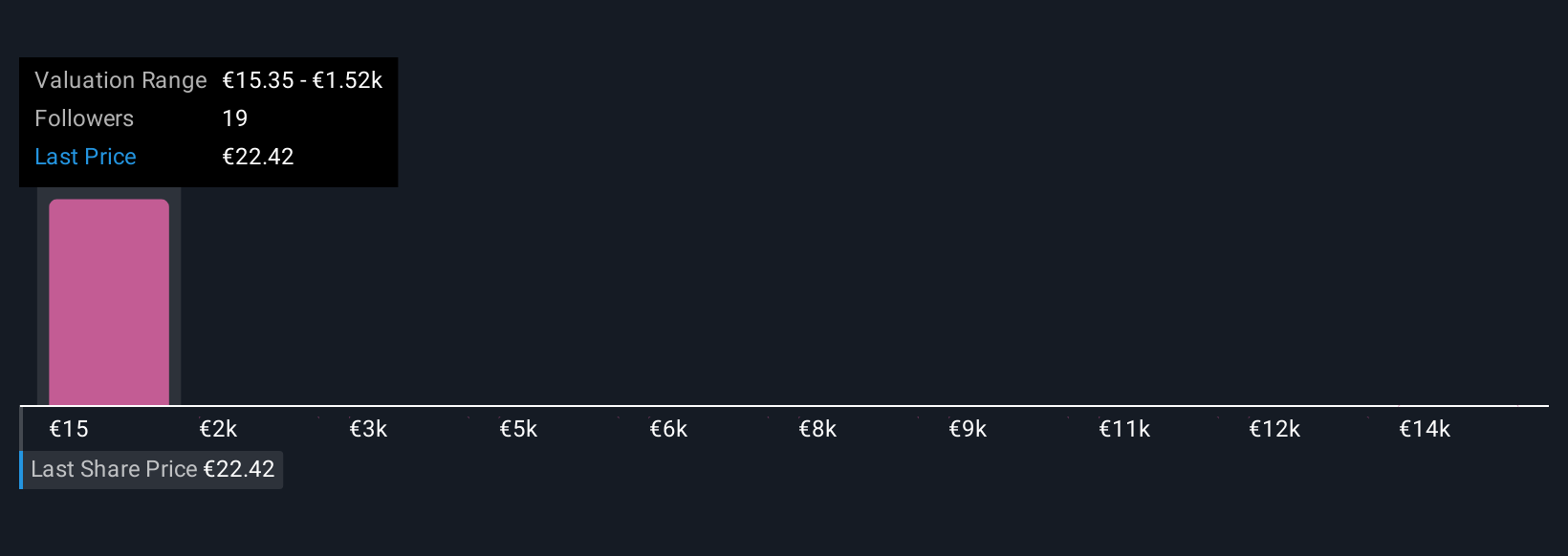

This tool empowers you to compare your fair value with the current price, so you can decide confidently when to buy, hold, or sell. For example, looking at ERG, the most optimistic Narrative estimates a fair value of €29.4 per share, while the most cautious user puts it at just €20.0, reflecting different beliefs about growth, risks, and potential.

Do you think there's more to the story for ERG? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ERG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ERG

ERG

Through its subsidiaries, produces energy through renewable sources in Italy, France, Germany, the United Kingdom, Poland, Bulgaria, Sweden, Romania, and Spain.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)