- Italy

- /

- Renewable Energy

- /

- BIT:ERG

ERG (BIT:ERG) Valuation: Is There More Upside After Recent Share Price Gains?

Reviewed by Kshitija Bhandaru

See our latest analysis for ERG.

ERG’s share price has managed to build some upward momentum in recent months, reflecting renewed investor interest and optimism about its growth prospects. While the latest price stands at €21.78, the stock’s 5-year total shareholder return of 16.8% highlights the reward of long-term holding even as short-term performance has been flatter.

If ERG’s steady progress has you thinking bigger, this is a great moment to expand your search and explore fast growing stocks with high insider ownership

With shares steadily climbing but trading close to analysts’ price targets, the big question is whether ERG is still undervalued or if the market has already factored in its future growth outlook. Could there be more upside ahead?

Most Popular Narrative: 3.5% Undervalued

With ERG closing at €21.78 and the current most followed narrative placing fair value at €22.58, analyst consensus sees a modest gap between market price and upside. This provides a basis for understanding what underpins analysts’ confidence.

Ongoing capacity expansion through disciplined M&A and organic growth, including entry into the U.S. market, continued greenfield or repowering initiatives across Europe, and the ramp-up of storage and flexibility assets positions ERG to capture increased electricity demand stemming from the electrification of transport and industry, directly impacting revenue growth.

Curious what financial leap ERG needs to make for this valuation to hold up? The narrative hints at ambitious expansion plans and future profit margins rarely seen in utilities. Want to see the precise forecasts driving analysts’ price targets? Get the details that elevate this fair value projection above the crowd.

Result: Fair Value of €22.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent low wind conditions or increased competition for new contracts could challenge ERG's ability to deliver the forecasted earnings growth.

Find out about the key risks to this ERG narrative.

Another View: What Do the Numbers Say?

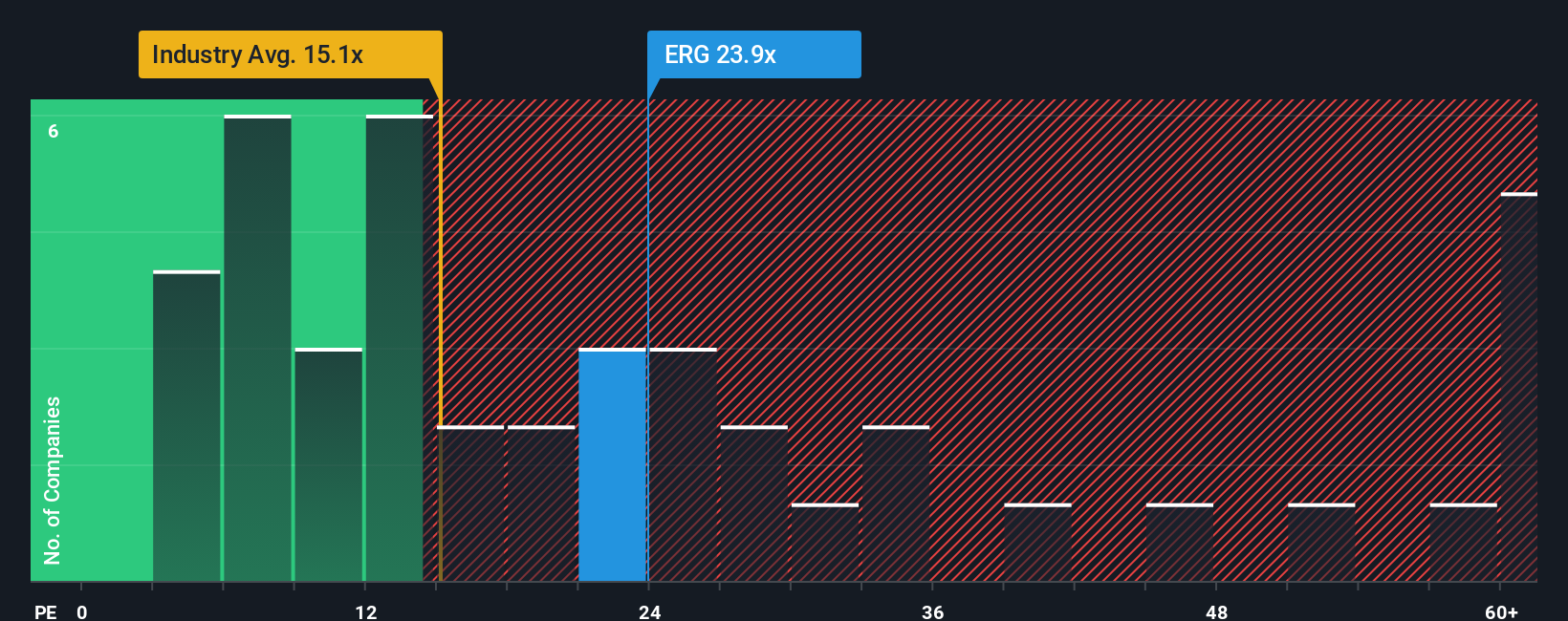

Looking at the current price-to-earnings ratio, ERG trades at 23.2x. This places it above both the European industry average of 14.4x and its peer average of 16.1x. This figure is also well above the fair ratio of 17.2x, suggesting the market could re-rate the shares lower if future results disappoint. Are investors paying too much for expected growth, or is there more room for optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ERG Narrative

If you have a different perspective or want to dig into the numbers your way, it's quick and easy to shape your own view in just a few minutes with Do it your way.

A great starting point for your ERG research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize this moment to expand your portfolio with opportunities you might otherwise miss. Check out these handpicked ideas and get ahead of other investors:

- Catch up on industry breakthroughs and profit potential as you scan these 23 AI penny stocks taking the lead in artificial intelligence innovation.

- Pursue reliable income and shield your portfolio from volatility by reviewing these 19 dividend stocks with yields > 3% with yields above 3%.

- Position yourself for the next fintech wave by evaluating these 78 cryptocurrency and blockchain stocks gaining ground in the digital asset space.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ERG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ERG

ERG

Through its subsidiaries, produces energy through renewable sources in Italy, France, Germany, the United Kingdom, Poland, Bulgaria, Sweden, Romania, and Spain.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion