- Italy

- /

- Infrastructure

- /

- BIT:ENAV

What ENAV (BIT:ENAV)'s Malaysian Digital Tower Win Means for International Expansion Ambitions

Reviewed by Sasha Jovanovic

- ENAV, through its subsidiary Techno Sky, recently secured a contract to supply and implement a Remote Digital and Virtual Tower system at Senai Airport in Malaysia, with the project launch set for late 2025 and collaboration involving major partners including Leonardo and Next.

- This contract marks a meaningful expansion of ENAV’s digital air traffic management services into Asia, underlining the company’s international growth ambitions and technological edge beyond its traditional domestic market.

- We’ll examine how this move into the Asian market via the Malaysian contract could shape ENAV’s investment narrative going forward.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

ENAV Investment Narrative Recap

To be optimistic about ENAV as a shareholder, you would likely need to believe in the company's ability to leverage its digital air traffic management expertise for international growth and revenue diversification, lessening its reliance on Italian airspace trends. The recent Malaysian contract showcases ENAV's push into Asia, a move that supports its long-term ambitions but does not materially change the most immediate catalyst, which is continued strong growth in air traffic volumes across its regulated core business. However, near-term risks from sector-wide regulatory changes and cost inflation remain largely intact.

Of the recent company announcements, ENAV's revised 2025 earnings guidance stands out in relation to this contract. The guidance increase, driven by robust traffic and operational performance, points to management's confidence in near-term fundamentals, while international contract wins like the Malaysian project could provide optionality for incremental upside, but their financial contribution is likely limited during the initial rollout phase.

On the other hand, investors should also be mindful that ENAV's operating margins remain under pressure from rising expenses and cost inflation, especially if...

Read the full narrative on ENAV (it's free!)

ENAV's outlook anticipates €1.1 billion in revenue and €121.2 million in earnings by 2028. This scenario assumes a 3.8% annual revenue growth rate and an €11.3 million increase in earnings from the current €109.9 million.

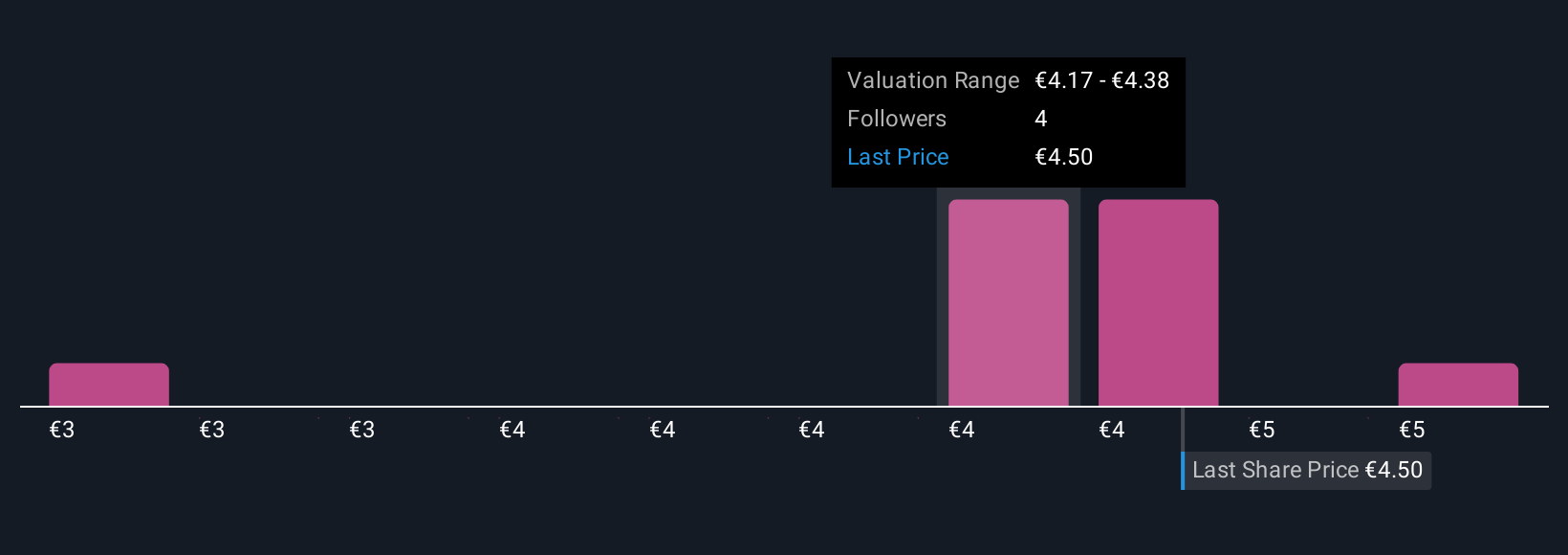

Uncover how ENAV's forecasts yield a €4.49 fair value, in line with its current price.

Exploring Other Perspectives

With four fair value estimates from the Simply Wall St Community ranging from €2.92 to €5.00, individual views on ENAV's worth differ substantially. As many participants focus on air traffic growth as a key driver, these varied opinions reinforce the importance of considering multiple viewpoints for a fuller picture.

Explore 4 other fair value estimates on ENAV - why the stock might be worth 35% less than the current price!

Build Your Own ENAV Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ENAV research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free ENAV research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ENAV's overall financial health at a glance.

No Opportunity In ENAV?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if ENAV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ENAV

ENAV

Provides air traffic control and management, and other air navigation services in Italy, the rest of Europe, and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)