European Value Stocks Priced Below Estimated Intrinsic Worth

Reviewed by Simply Wall St

The European stock market has recently faced downward pressure, with the pan-European STOXX Europe 600 Index dropping by 0.75% amid heightened trade tensions following proposed tariffs from the U.S. administration. In this challenging environment, identifying stocks that are priced below their intrinsic value can offer investors potential opportunities to capitalize on market inefficiencies and position themselves for long-term gains.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Micro Systemation (OM:MSAB B) | SEK49.60 | SEK96.51 | 48.6% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €52.35 | €104.47 | 49.9% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.88 | €3.70 | 49.2% |

| adidas (XTRA:ADS) | €220.50 | €433.62 | 49.1% |

| Clemondo Group (OM:CLEM) | SEK10.80 | SEK21.24 | 49.2% |

| Absolent Air Care Group (OM:ABSO) | SEK215.00 | SEK416.92 | 48.4% |

| Lectra (ENXTPA:LSS) | €24.75 | €47.27 | 47.6% |

| dormakaba Holding (SWX:DOKA) | CHF733.00 | CHF1399.64 | 47.6% |

| Claranova (ENXTPA:CLA) | €2.805 | €5.45 | 48.5% |

| Northern Data (DB:NB2) | €25.02 | €49.53 | 49.5% |

Let's dive into some prime choices out of the screener.

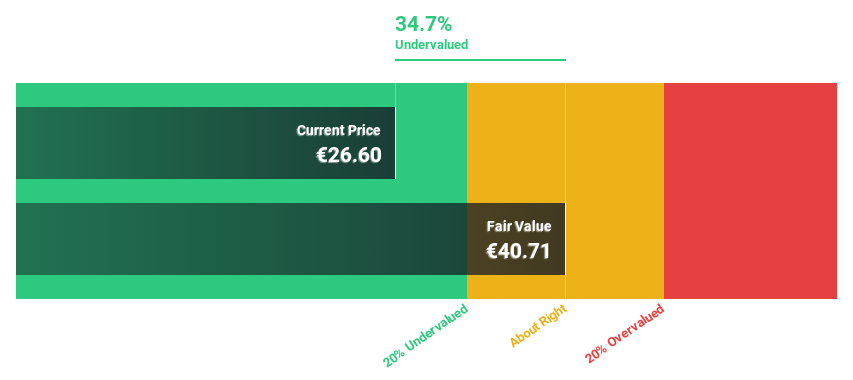

A.L.A. società per azioni (BIT:ALA)

Overview: A.L.A. società per azioni is a supply chain solutions provider serving the aerospace and defense, rail, and high-tech sectors with a market cap of €314.24 million.

Operations: The company's revenue is primarily derived from its Distribution segment at €140.29 million, followed by Service Providers at €120.54 million, Production at €23.15 million, and On Site Assembly at €5.91 million.

Estimated Discount To Fair Value: 26.7%

A.L.A. società per azioni is trading at €34.8, significantly below its estimated fair value of €47.49, reflecting a potential undervaluation based on cash flows. Despite a high level of non-cash earnings and debt not well covered by operating cash flow, the company's earnings grew 71.7% last year and are forecast to grow 22.3% annually, outpacing the Italian market's growth rate of 7.4%.

- Our earnings growth report unveils the potential for significant increases in A.L.A. società per azioni's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of A.L.A. società per azioni.

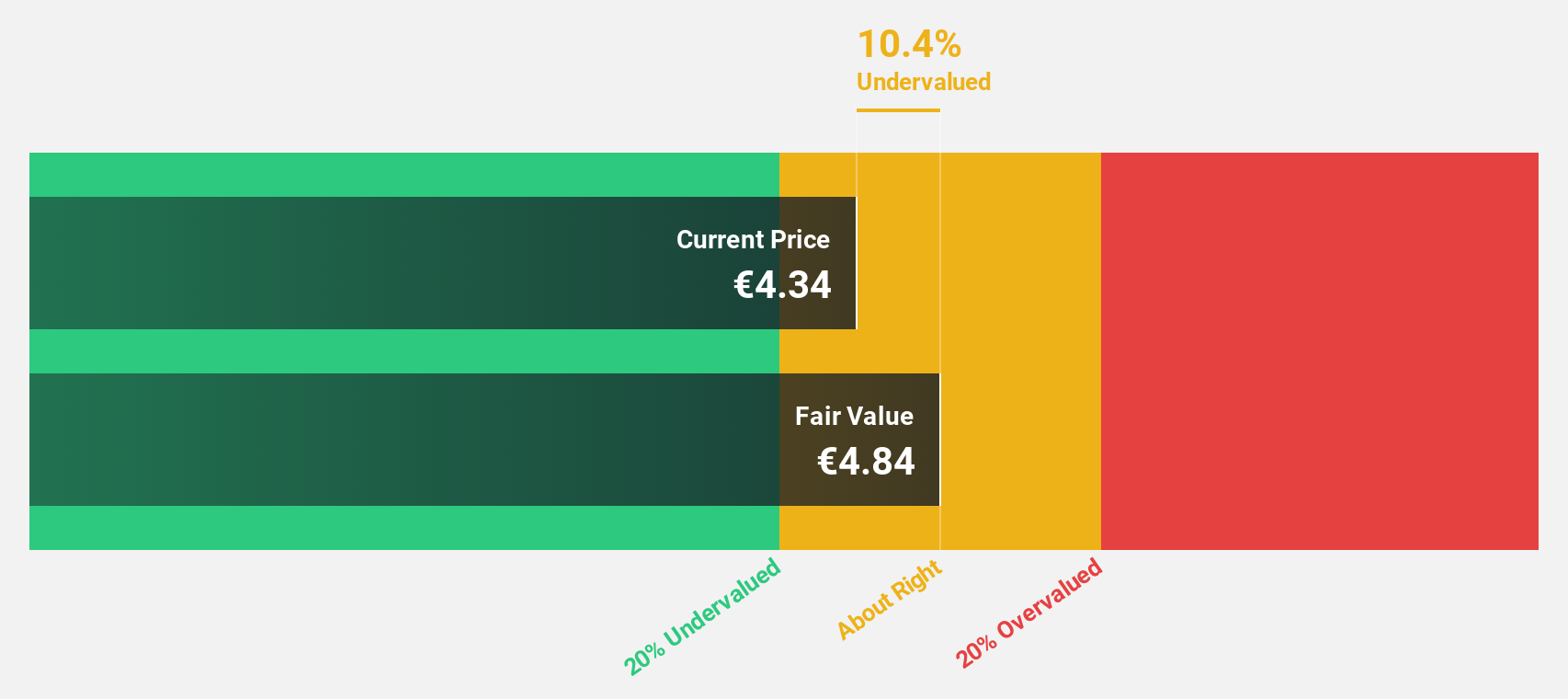

Datalogic (BIT:DAL)

Overview: Datalogic S.p.A. is a company that produces and distributes automatic data capture and process automation products across various regions including Italy, the Americas, the Asia Pacific, Europe, the Middle East, and Africa with a market cap of €248.65 million.

Operations: Datalogic's revenue is primarily derived from two segments: Data Capture, contributing €338.70 million, and Industrial Automation, generating €156.49 million.

Estimated Discount To Fair Value: 15%

Datalogic is trading at €4.64, 15% below its estimated fair value of €5.45, indicating potential undervaluation based on cash flows. Despite a recent quarterly net loss of €5.86 million and declining profit margins, earnings are projected to grow significantly at 57.72% annually over the next three years, outpacing both revenue growth and the Italian market's earnings growth rate of 7.4%. However, its dividend yield of 2.59% is not well covered by earnings or free cash flows.

- According our earnings growth report, there's an indication that Datalogic might be ready to expand.

- Unlock comprehensive insights into our analysis of Datalogic stock in this financial health report.

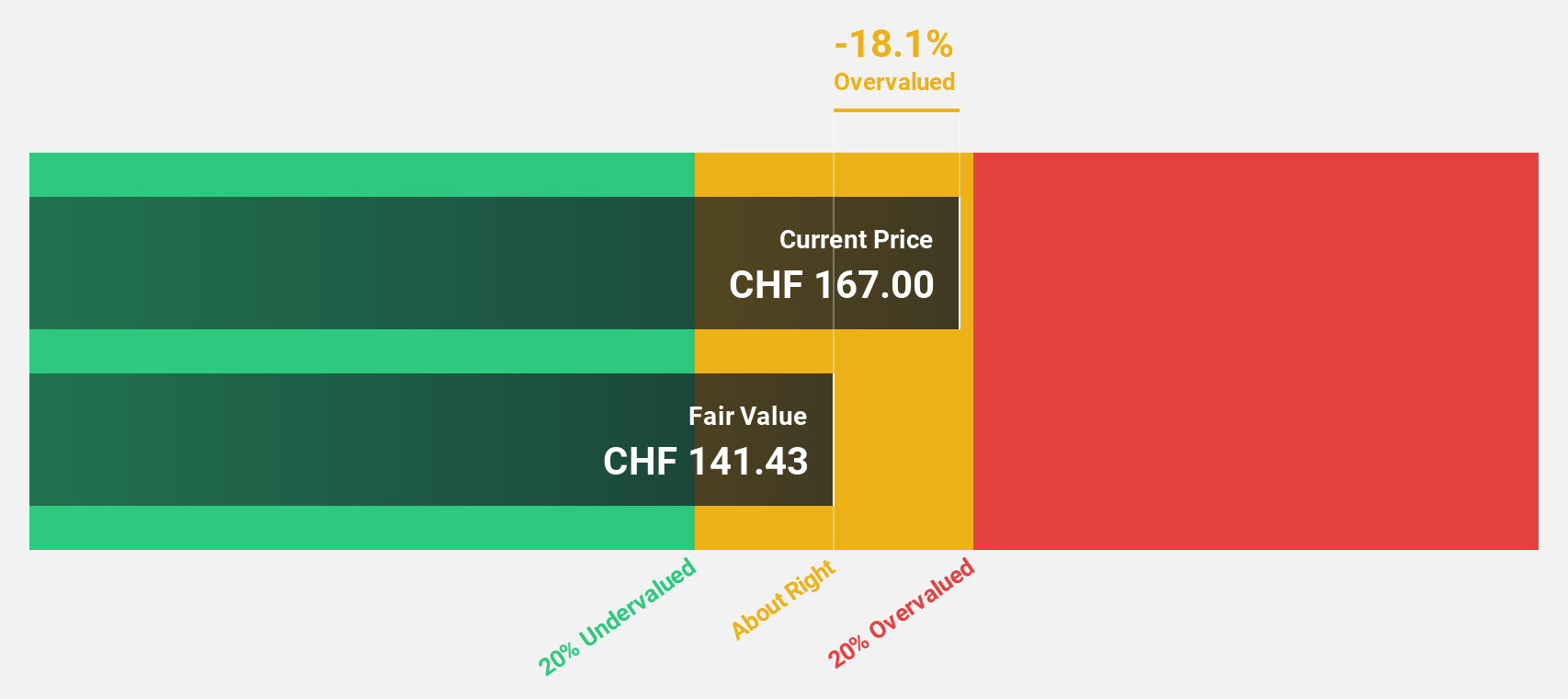

Cicor Technologies (SWX:CICN)

Overview: Cicor Technologies Ltd., along with its subsidiaries, develops and manufactures electronic components, devices, and systems globally, with a market cap of CHF548.70 million.

Operations: The company's revenue segments include the Advanced Substrates (AS) Division, generating CHF45.31 million, and the Electronic Manufacturing Services (EMS) Division, contributing CHF438.01 million.

Estimated Discount To Fair Value: 12.2%

Cicor Technologies, trading at CHF126, is slightly undervalued based on discounted cash flow analysis with an estimated fair value of CHF143.47. Despite recent shareholder dilution and high share price volatility, earnings are expected to grow significantly at 21.48% annually over the next three years, surpassing Swiss market averages. Recent strategic moves include a supply agreement with Mercury Mission Systems to enhance its European aerospace and defense presence, potentially boosting future revenue streams.

- Insights from our recent growth report point to a promising forecast for Cicor Technologies' business outlook.

- Take a closer look at Cicor Technologies' balance sheet health here in our report.

Make It Happen

- Click through to start exploring the rest of the 179 Undervalued European Stocks Based On Cash Flows now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CICN

Cicor Technologies

Develops, and manufactures electronic components, devices, and systems worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives