The European market has recently experienced a downturn, with the pan-European STOXX Europe 600 Index ending lower amid rising tariff threats from the U.S., which have contributed to economic uncertainty and a contraction in business activity. In this challenging environment, identifying high-growth tech stocks requires careful consideration of their ability to innovate and adapt to shifting trade dynamics while maintaining robust financial health and competitive positioning.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Archos | 21.07% | 36.58% | ★★★★★★ |

| Yubico | 20.18% | 30.36% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Bonesupport Holding | 29.14% | 56.14% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| CD Projekt | 33.48% | 37.39% | ★★★★★★ |

| XTPL | 86.66% | 143.68% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Seco (BIT:IOT)

Simply Wall St Growth Rating: ★★★★☆☆

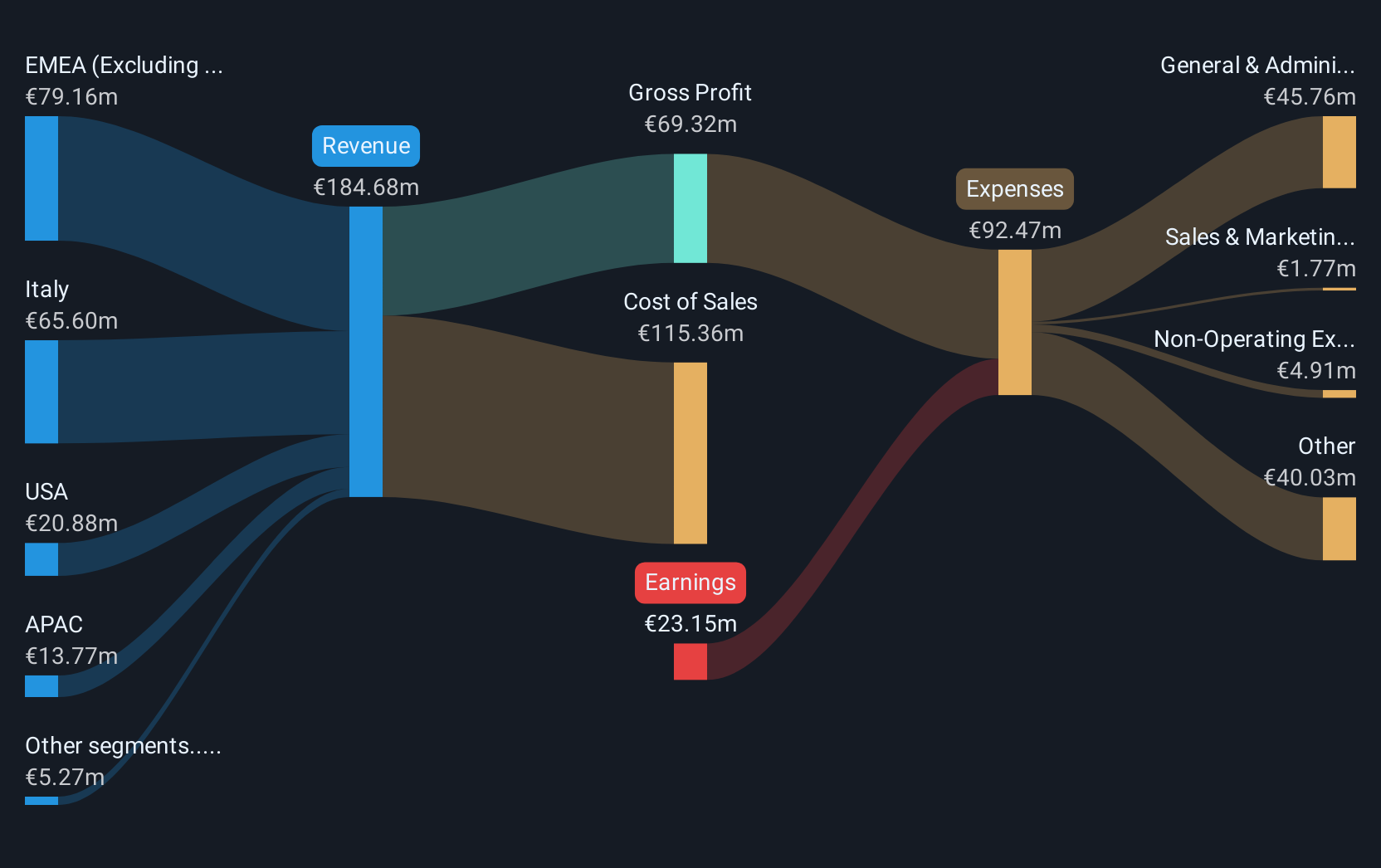

Overview: Seco S.p.A. is a technology company that specializes in developing and delivering innovative solutions for the digitization of industrial products and processes across various regions including Italy, Europe, the Middle East, Africa, the United States, and Asia-Pacific, with a market cap of €331.13 million.

Operations: Seco focuses on providing advanced technological solutions that enhance the digitization of industrial products and processes globally. The company operates in multiple regions, including Europe, the Middle East, Africa, the U.S., and Asia-Pacific.

Seco S.p.A. stands out in the European tech landscape, not just for its commitment to innovation but also for its strategic movements in the market. Despite a recent net loss of €2.02 million in Q1 2025, down from a modest profit last year, the company's aggressive R&D investment strategy signals a robust blueprint for future growth; historically, such expenditures have been linked to fostering significant technological advancements. Moreover, with revenue projections set over €50 million for Q2 2025 and maintaining a gross profit margin target above 50%, Seco is positioning itself well against slower industry growth rates. The firm’s participation in key Italian investment conferences further underscores its active role in shaping industry discussions and potential market opportunities.

- Click here and access our complete health analysis report to understand the dynamics of Seco.

Evaluate Seco's historical performance by accessing our past performance report.

Better Collective (OM:BETCO)

Simply Wall St Growth Rating: ★★★★☆☆

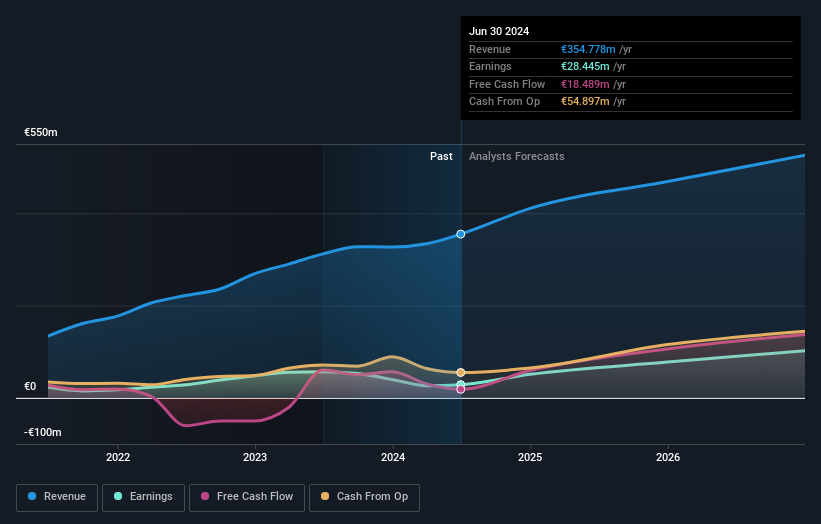

Overview: Better Collective A/S operates as a digital sports media company across Europe, North America, and internationally, with a market capitalization of SEK7.71 billion.

Operations: The company generates revenue primarily through affiliate marketing and advertising services within the sports betting industry. Its operations are centered on digital platforms that connect users with betting operators, leveraging data insights to enhance user engagement. The business model focuses on performance-based marketing, where earnings are tied to the success of referred customers.

Better Collective A/S, a key figure in Europe's high-growth tech sector, is navigating through a transformative phase with notable financial dynamics. Despite a dip in Q1 2025 sales to €82.59 million from €95.03 million the previous year, the company maintains a robust earnings forecast with expected revenue between €320 million and €350 million for 2025. This outlook is supported by an aggressive R&D investment strategy that not only underscores its commitment to innovation but also aligns with its impressive annual earnings growth forecast of 30.9%. Moreover, Better Collective's strategic focus on enhancing interactive media and services has enabled it to outperform industry growth rates, positioning it well for future market expansions.

Cicor Technologies (SWX:CICN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cicor Technologies Ltd. is a global company that develops and manufactures electronic components, devices, and systems, with a market cap of CHF542.17 million.

Operations: Cicor operates through two primary divisions: Advanced Substrates (AS) and Electronic Manufacturing Services (EMS), generating CHF45.31 million and CHF438.01 million in revenue, respectively. The EMS division is the larger contributor to the company's revenue stream.

Cicor Technologies, a pivotal entity in Europe's tech landscape, particularly in aerospace and defense electronics, has demonstrated a robust trajectory with an earnings growth of 131.7% over the past year, significantly outpacing the industry average of 38.1%. This surge is underpinned by strategic expansions such as the acquisition of a manufacturing operation from Mercury Mission Systems and entering into a high-value supply agreement expected to bolster revenues substantially. With an annual revenue growth forecast at 11.4%, Cicor not only surpasses the Swiss market's 4.2% but also aligns its R&D pursuits to cater to escalating demands in defense products globally, ensuring sustained technological advancement and market relevance.

- Click to explore a detailed breakdown of our findings in Cicor Technologies' health report.

Examine Cicor Technologies' past performance report to understand how it has performed in the past.

Taking Advantage

- Discover the full array of 226 European High Growth Tech and AI Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CICN

Cicor Technologies

Develops, and manufactures electronic components, devices, and systems worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives