As the European market experiences a wave of cautious optimism due to potential trade agreements with the U.S., the pan-European STOXX Europe 600 Index has seen a modest rise, supported by the European Central Bank's steady interest rates and resilience in eurozone business activity. In this environment, high growth tech stocks that demonstrate strong fundamentals and adaptability to evolving market conditions may be worth watching, as they have the potential to capitalize on technological advancements and economic shifts.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 28.42% | 47.04% | ★★★★★★ |

| Shoper | 14.28% | 23.79% | ★★★★★☆ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| Bonesupport Holding | 23.98% | 62.26% | ★★★★★★ |

| Lipigon Pharmaceuticals | 104.89% | 93.94% | ★★★★★☆ |

| Yubico | 16.27% | 23.90% | ★★★★★☆ |

| ContextVision | 5.83% | 39.78% | ★★★★★☆ |

| Aelis Farma | 79.30% | 106.93% | ★★★★★☆ |

| SyntheticMR | 18.81% | 47.40% | ★★★★★☆ |

| CD Projekt | 33.57% | 40.19% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Datalogic (BIT:DAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Datalogic S.p.A. is an Italian company that manufactures and sells automatic data capture and process automation products across various regions including Italy, the Americas, the Asia Pacific, and EMEA, with a market cap of approximately €254.28 million.

Operations: Datalogic generates revenue primarily from two segments: Data Capture (€338.70 million) and Industrial Automation (€156.49 million). The company's focus on these areas highlights its role in the automatic data capture and process automation industry across multiple regions globally.

Datalogic, despite a challenging year with a net earnings decline of 85.4%, is showing promising signs of recovery with an expected annual profit growth rate of 57.3%, significantly outpacing the Italian market average (7.2%). This rebound is underscored by its recent integration with B. Braun's OncoSafety Remote Control in its Memor 17 Healthcare mobile computer, enhancing oncology treatment accuracy and safety. Moreover, Datalogic's strategic focus on healthcare innovation aligns well with global tech trends towards specialized, high-impact solutions, positioning it favorably for future growth in this critical sector.

- Delve into the full analysis health report here for a deeper understanding of Datalogic.

Gain insights into Datalogic's historical performance by reviewing our past performance report.

TomTom (ENXTAM:TOM2)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TomTom N.V. develops and sells navigation and location-based products and services globally, with a market cap of €661.99 million.

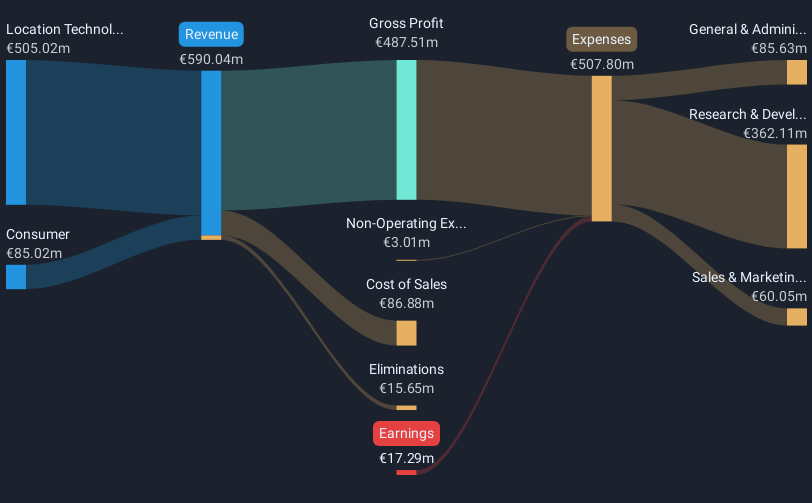

Operations: The company generates revenue primarily from its Location Technology segment, contributing €508.32 million, and its Consumer segment, which adds €79.82 million to the total.

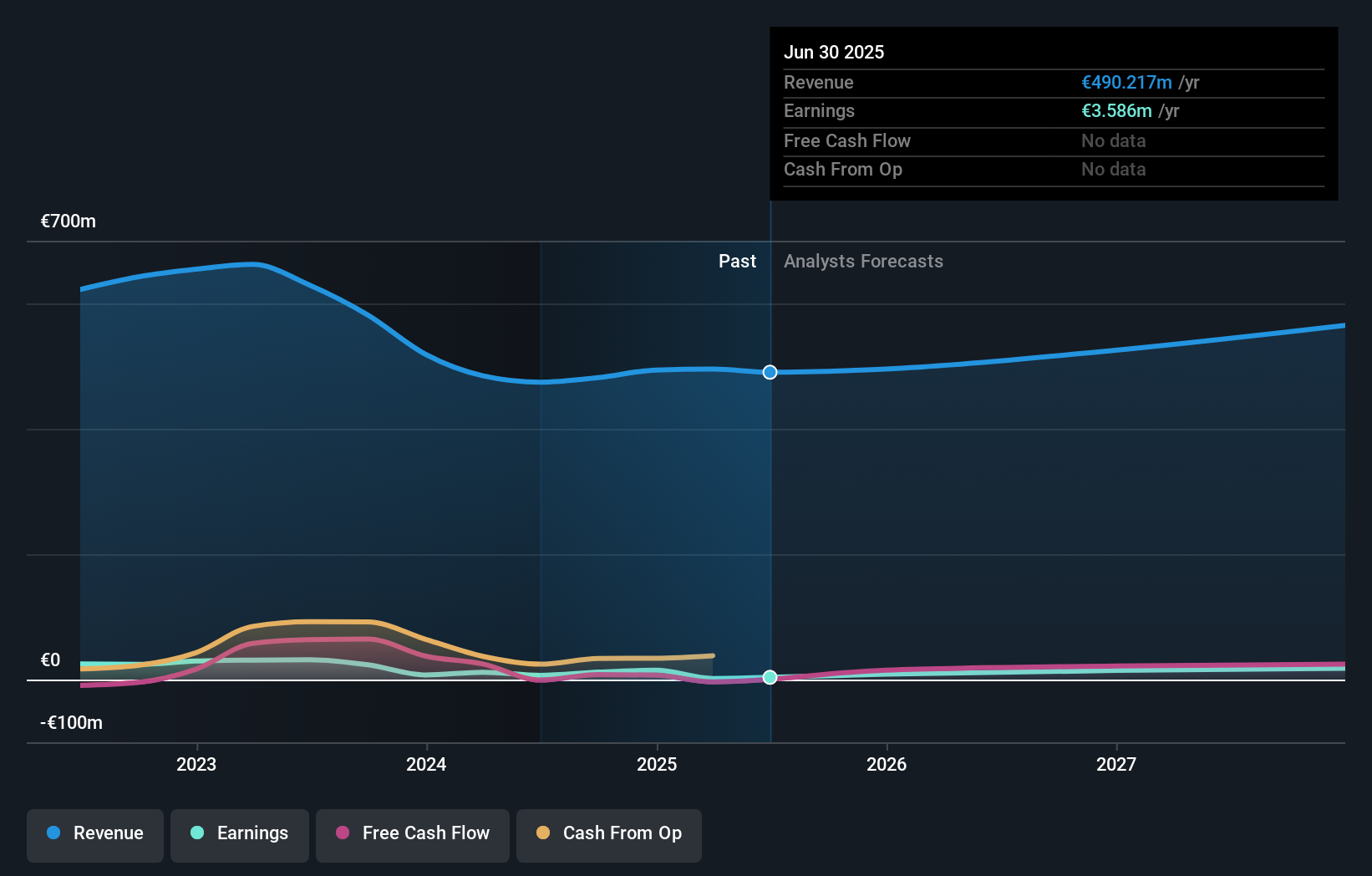

TomTom's recent financial performance reflects challenges, with a reported net loss widening from EUR 2.31 million to EUR 23.63 million year-over-year for Q2 2025 and sales slightly declining to EUR 286.6 million in the first half of the year. Despite these setbacks, strategic partnerships like those with NextBillion.ai and IFS indicate a forward-looking approach, integrating TomTom’s advanced mapping technologies into diverse industrial applications which could enhance operational efficiencies across mobility and logistics sectors. This integration supports not only improved route optimization but also positions TomTom at the forefront of digital navigation solutions tailored for complex fleet management tasks, potentially setting the stage for recovery and future profitability in an evolving tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of TomTom.

Assess TomTom's past performance with our detailed historical performance reports.

Gofore Oyj (HLSE:GOFORE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gofore Oyj offers digital transformation consultancy services to both private and public sectors globally, with a market capitalization of €288 million.

Operations: The company generates revenue primarily from its computer services segment, amounting to €183.72 million. Net profit margin trends indicate fluctuations over recent periods, reflecting changes in operational efficiency and cost management strategies.

Gofore Oyj's recent performance and strategic engagements highlight its evolving role in the European tech landscape. Despite a slight dip in monthly sales from EUR 17.0 million in April to EUR 13.2 million in June 2025, the company has secured a significant framework agreement with the Digital and Population Data Services Agency, potentially extending until 2031 and valued at approximately EUR 250 million. This partnership underscores Gofore's expertise in IT services, crucial for digital transformations within public sectors. Financially, Gofore anticipates a robust year with projected pro forma net sales of EUR 179.6 million, complemented by an expected annual earnings growth of 23.1%, surpassing the Finnish market average of 15.9%. These figures demonstrate Gofore's strong positioning to leverage ongoing digital shifts and expand its market presence effectively.

- Click to explore a detailed breakdown of our findings in Gofore Oyj's health report.

Review our historical performance report to gain insights into Gofore Oyj's's past performance.

Turning Ideas Into Actions

- Explore the 52 names from our European High Growth Tech and AI Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:DAL

Datalogic

Manufactures and sells automatic data capture and process automation products in Italy, the Americas, the Asia Pacific, rest of Europe, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives