As European markets experience a positive upswing, with the pan-European STOXX Europe 600 Index climbing 3.44% amid easing tariff concerns, investors are keenly observing opportunities for stocks that may be trading below their estimated value. In such an environment, identifying undervalued stocks involves looking for companies with strong fundamentals that have been overlooked by the market, potentially offering growth prospects as economic conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Qt Group Oyj (HLSE:QTCOM) | €56.85 | €110.78 | 48.7% |

| Sword Group (ENXTPA:SWP) | €31.55 | €62.62 | 49.6% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.92 | €3.75 | 48.7% |

| Pexip Holding (OB:PEXIP) | NOK47.00 | NOK92.81 | 49.4% |

| Truecaller (OM:TRUE B) | SEK75.00 | SEK149.96 | 50% |

| Net Insight (OM:NETI B) | SEK2.845 | SEK5.56 | 48.8% |

| Etteplan Oyj (HLSE:ETTE) | €10.45 | €20.86 | 49.9% |

| dormakaba Holding (SWX:DOKA) | CHF699.00 | CHF1395.20 | 49.9% |

| Fodelia Oyj (HLSE:FODELIA) | €6.88 | €13.43 | 48.8% |

| Obiz (ENXTPA:ALBIZ) | €4.38 | €8.72 | 49.8% |

We're going to check out a few of the best picks from our screener tool.

TXT e-solutions (BIT:TXT)

Overview: TXT e-solutions S.p.A. offers software and service solutions both in Italy and internationally, with a market cap of €420.10 million.

Operations: The company generates revenue from three main segments: Smart Solutions (€63.96 million), Digital Advisory (€48.92 million), and Software Engineering (€191.66 million).

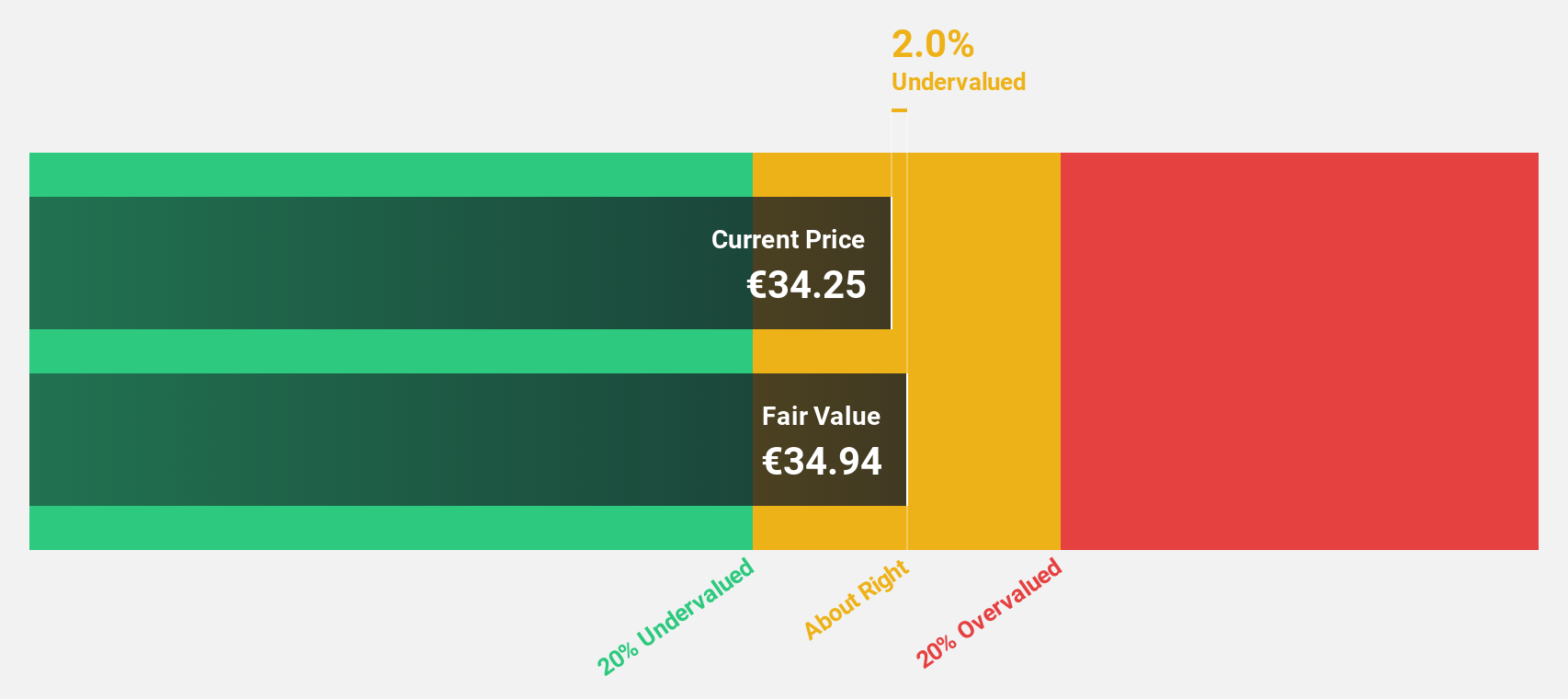

Estimated Discount To Fair Value: 12.3%

TXT e-solutions, trading at €33.1, is undervalued relative to its estimated fair value of €37.74. Despite a modest undervaluation, the company shows strong revenue growth potential at 12.6% annually, outpacing the Italian market's 4.3%. Earnings are expected to grow significantly by 20.8% per year over the next three years, indicating robust financial health despite debt not being well-covered by operating cash flow. Recent strategic moves include seeking acquisitions and partnerships in aviation training solutions, enhancing diversification and market reach.

- The analysis detailed in our TXT e-solutions growth report hints at robust future financial performance.

- Get an in-depth perspective on TXT e-solutions' balance sheet by reading our health report here.

Ion Beam Applications (ENXTBR:IBAB)

Overview: Ion Beam Applications SA designs, produces, and markets solutions for cancer diagnosis and treatments in Belgium, the United States, and internationally with a market cap of €329.76 million.

Operations: The company generates revenue through its Dosimetry segment, which contributes €65.88 million, and its Proton Therapy and Other Accelerators segment, accounting for €436.36 million.

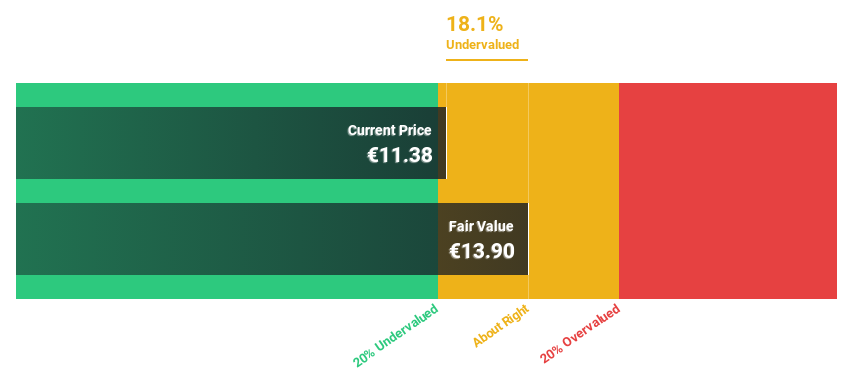

Estimated Discount To Fair Value: 19.4%

Ion Beam Applications (IBA) is trading at €11.2, slightly below its estimated fair value of €13.9, indicating modest undervaluation based on cash flows. The company's earnings are expected to grow significantly at 32.7% annually, surpassing the Belgian market's growth rate of 14.7%. Recent developments include a contract for proton therapy systems with Apollo Hospitals in India and a new supply agreement for Taiwan, enhancing IBA's global footprint in advanced cancer treatment solutions.

- Our comprehensive growth report raises the possibility that Ion Beam Applications is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Ion Beam Applications.

Absolent Air Care Group (OM:ABSO)

Overview: Absolent Air Care Group AB (publ) is engaged in designing, developing, selling, installing, and maintaining air filtration units, with a market cap of SEK2.67 billion.

Operations: The company's revenue segments are not provided in the text.

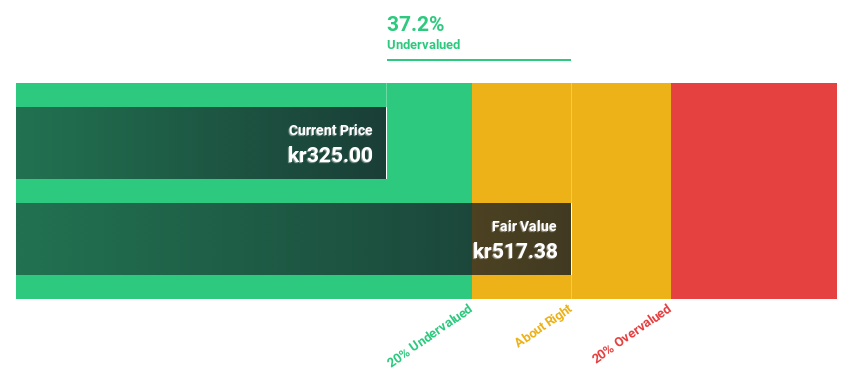

Estimated Discount To Fair Value: 44.2%

Absolent Air Care Group is trading at SEK 236, significantly below its estimated fair value of SEK 422.59, suggesting undervaluation based on discounted cash flows. Despite a recent decline in quarterly earnings to SEK 12.85 million from SEK 49.7 million last year, the company forecasts robust annual earnings growth of 31%, outpacing the Swedish market's growth rate of 16.4%. Revenue is also expected to grow faster than the market average at 13.9% annually.

- Insights from our recent growth report point to a promising forecast for Absolent Air Care Group's business outlook.

- Dive into the specifics of Absolent Air Care Group here with our thorough financial health report.

Make It Happen

- Navigate through the entire inventory of 169 Undervalued European Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TXT e-solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:TXT

TXT e-solutions

Provides software and service solutions in Italy and internationally.

Good value with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.