- Belgium

- /

- Entertainment

- /

- ENXTBR:KIN

3 Intriguing Stocks That Investors Might Be Undervaluing By Up To 49.4%

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with U.S. stocks closing out a strong two-year performance despite recent volatility and economic indicators like the Chicago PMI pointing to contraction, investors are increasingly on the lookout for opportunities that may have been overlooked. In this context, identifying undervalued stocks can be particularly appealing as they offer potential value against a backdrop of fluctuating indices and economic forecasts.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥27.90 | CN¥55.57 | 49.8% |

| Fevertree Drinks (AIM:FEVR) | £6.605 | £13.12 | 49.7% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.68 | CN¥43.25 | 49.9% |

| Zhende Medical (SHSE:603301) | CN¥21.05 | CN¥42.00 | 49.9% |

| AeroEdge (TSE:7409) | ¥1763.00 | ¥3511.45 | 49.8% |

| Vault Minerals (ASX:VAU) | A$0.33 | A$0.66 | 49.9% |

| Mr. Cooper Group (NasdaqCM:COOP) | US$94.43 | US$187.71 | 49.7% |

| Shandong Weigao Orthopaedic Device (SHSE:688161) | CN¥24.03 | CN¥47.76 | 49.7% |

| Vogo (ENXTPA:ALVGO) | €2.91 | €5.81 | 49.9% |

| Genscript Biotech (SEHK:1548) | HK$9.63 | HK$19.15 | 49.7% |

Let's take a closer look at a couple of our picks from the screened companies.

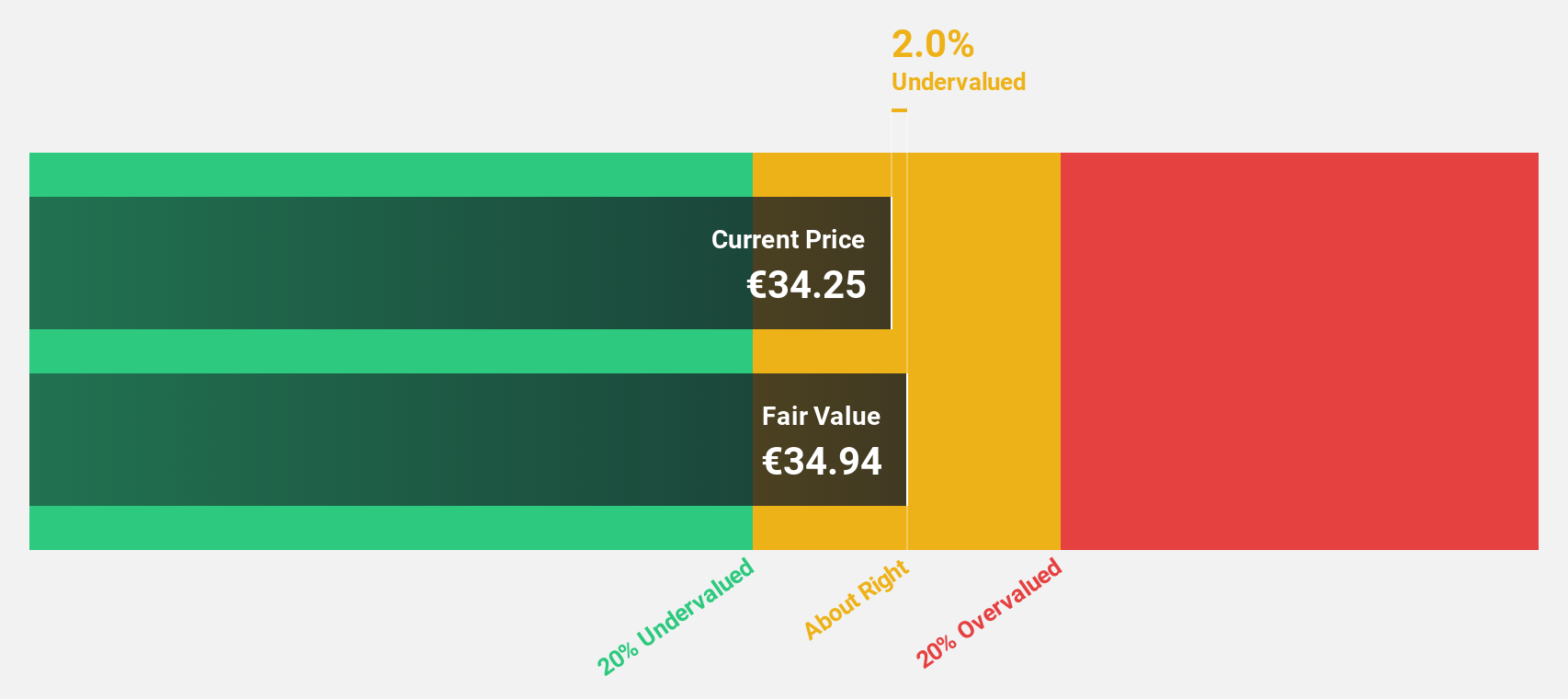

TXT e-solutions (BIT:TXT)

Overview: TXT e-solutions S.p.A. offers software and service solutions both in Italy and internationally, with a market capitalization of €439.31 million.

Operations: The company's revenue is derived from three main segments: Smart Solutions (€57.03 million), Digital Advisory (€43.22 million), and Software Engineering (€184.35 million).

Estimated Discount To Fair Value: 41.7%

TXT e-solutions is trading at €36.35, significantly below its estimated fair value of €62.36, highlighting potential undervaluation based on cash flows. Despite revenue growth forecasts of 12.7% annually—slower than the ideal 20%—earnings are expected to grow significantly at over 20% annually, outpacing the Italian market's average growth rate. Recent earnings reports show strong sales and net income improvements compared to last year, though debt coverage by operating cash flow remains a concern.

- The analysis detailed in our TXT e-solutions growth report hints at robust future financial performance.

- Navigate through the intricacies of TXT e-solutions with our comprehensive financial health report here.

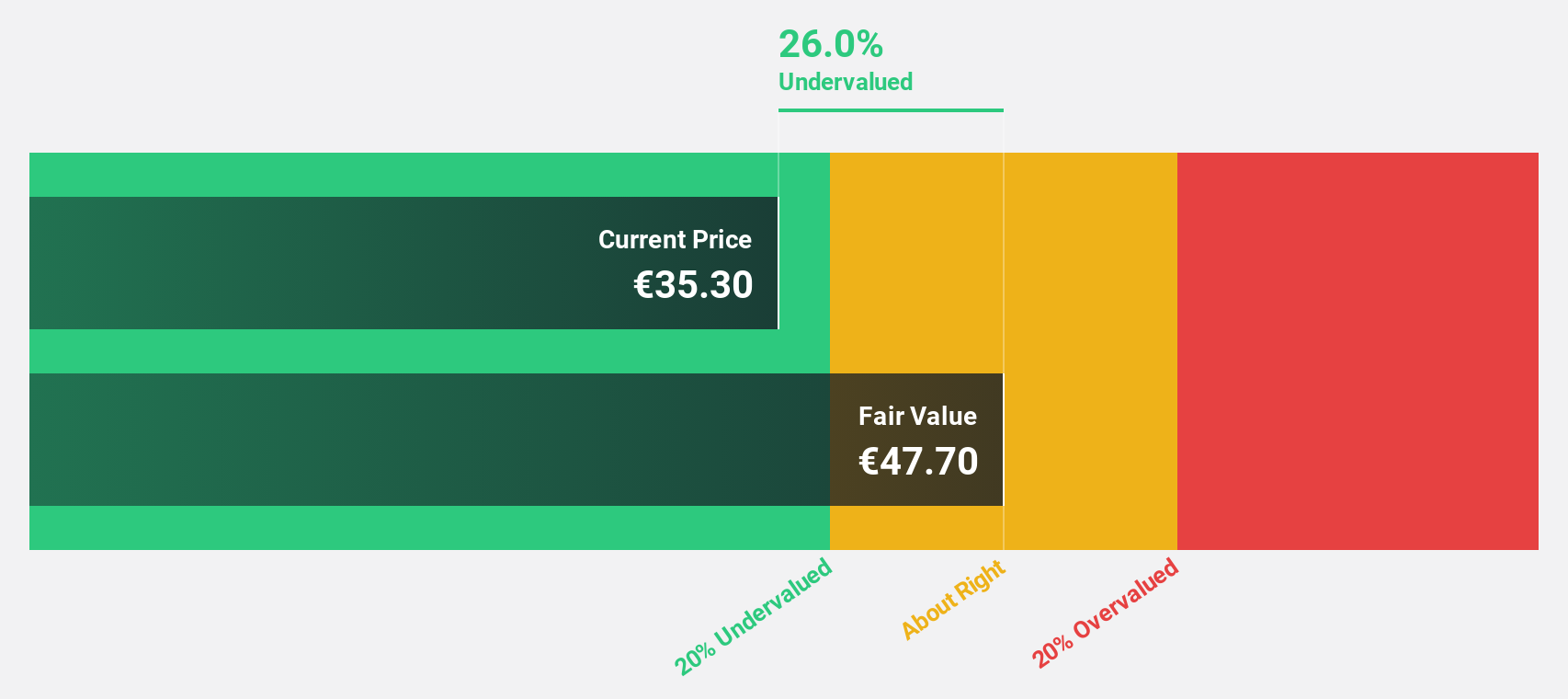

Kinepolis Group (ENXTBR:KIN)

Overview: Kinepolis Group NV operates cinema complexes across Belgium, the Netherlands, France, Spain, Luxembourg, Switzerland, Poland, Canada, and the United States with a market cap of €1.05 billion.

Operations: The company's revenue segments include €294.05 million from box office, €177.61 million from in-theatre sales, €13.88 million from real estate, and €4.07 million from film distribution.

Estimated Discount To Fair Value: 35.5%

Kinepolis Group is trading at €39.4, significantly below its estimated fair value of €61.12, indicating undervaluation based on cash flows. While revenue growth is forecasted at 4.6% annually, slower than the Belgian market's 6.9%, earnings are expected to grow significantly at 25.5% per year, surpassing the market average of 19.1%. Despite a high debt level, Kinepolis's strong earnings growth potential and attractive valuation present key investment considerations.

- Our expertly prepared growth report on Kinepolis Group implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Kinepolis Group.

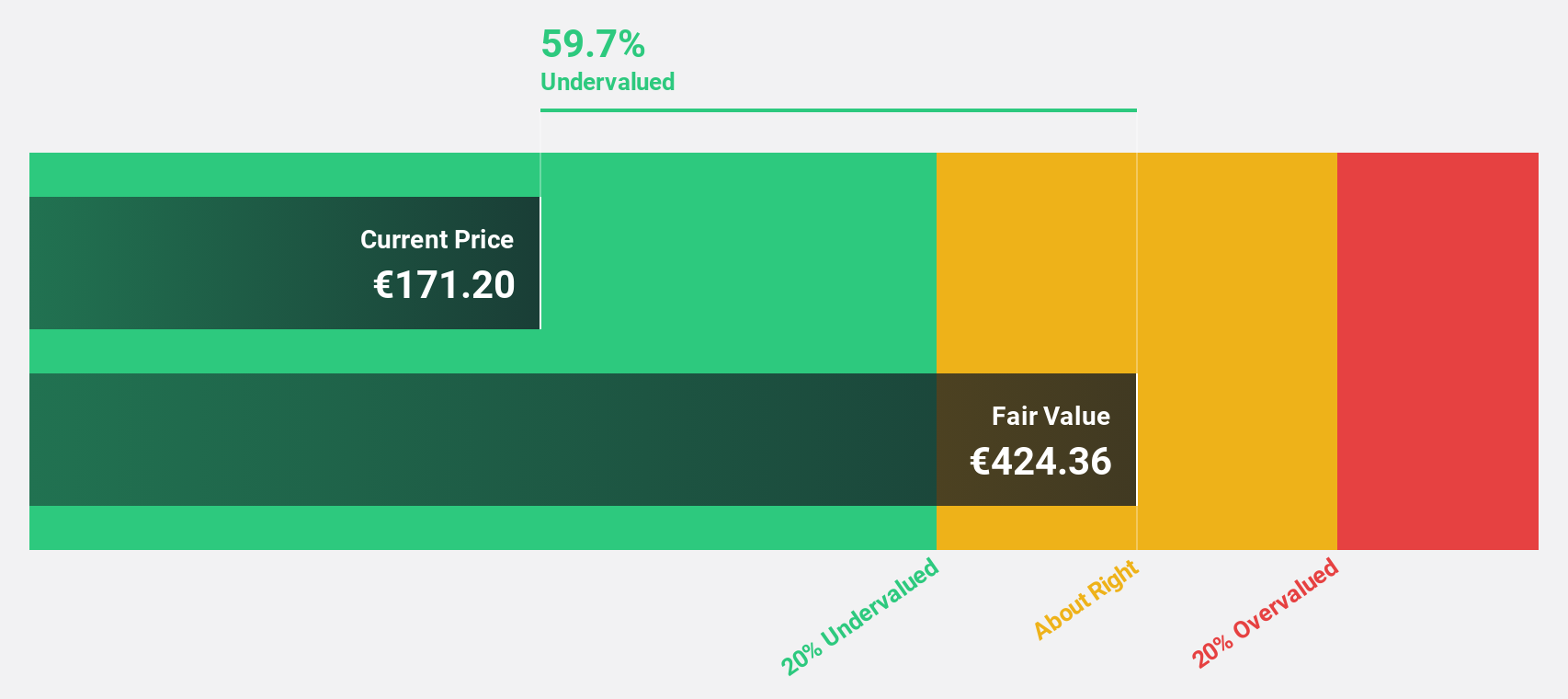

DO & CO (WBAG:DOC)

Overview: DO & CO Aktiengesellschaft is a catering service provider operating in Austria, Turkey, Great Britain, the United States, Spain, Germany, and internationally with a market cap of €2.02 billion.

Operations: The company's revenue is derived from three main segments: Airline Catering (€1.60 billion), International Event Catering (€317.15 million), and Restaurants, Lounges & Hotels (€156.81 million).

Estimated Discount To Fair Value: 49.4%

DO & CO is trading at €184, substantially below its estimated fair value of €363.54, reflecting undervaluation based on cash flows. Despite high share price volatility and past shareholder dilution, earnings grew 36.1% last year and are projected to rise 17.8% annually, outpacing the Austrian market's growth rate of 9.4%. Revenue is expected to grow at 6.1% per year, also exceeding the market average of 0.7%, supporting its investment appeal.

- Insights from our recent growth report point to a promising forecast for DO & CO's business outlook.

- Unlock comprehensive insights into our analysis of DO & CO stock in this financial health report.

Summing It All Up

- Click this link to deep-dive into the 893 companies within our Undervalued Stocks Based On Cash Flows screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinepolis Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:KIN

Kinepolis Group

Operates cinema complexes in Belgium, the Netherlands, France, Spain, Luxembourg, Switzerland, Poland, Canada, and the United States.

Undervalued with reasonable growth potential.