Downgrade: Here's How Analysts See Neosperience S.p.A. (BIT:NSP) Performing In The Near Term

Market forces rained on the parade of Neosperience S.p.A. (BIT:NSP) shareholders today, when the analysts downgraded their forecasts for this year. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting the analysts have soured majorly on the business.

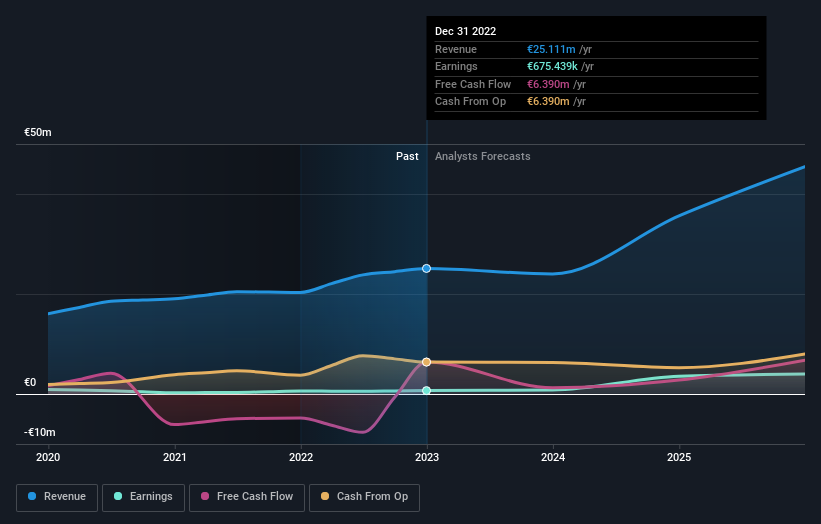

Following the latest downgrade, the three analysts covering Neosperience provided consensus estimates of €24m revenue in 2023, which would reflect a noticeable 4.4% decline on its sales over the past 12 months. Per-share earnings are expected to expand 14% to €0.04. Prior to this update, the analysts had been forecasting revenues of €31m and earnings per share (EPS) of €0.27 in 2023. Indeed, we can see that the analysts are a lot more bearish about Neosperience's prospects, administering a pretty serious reduction to revenue estimates and slashing their EPS estimates to boot.

See our latest analysis for Neosperience

The consensus price target fell 8.6% to €3.53, with the weaker earnings outlook clearly leading analyst valuation estimates. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values Neosperience at €4.30 per share, while the most bearish prices it at €3.00. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Neosperience's past performance and to peers in the same industry. We would highlight that sales are expected to reverse, with a forecast 4.4% annualised revenue decline to the end of 2023. That is a notable change from historical growth of 22% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 15% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Neosperience is expected to lag the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that Neosperience's revenues are expected to grow slower than the wider market. With a serious cut to this year's expectations and a falling price target, we wouldn't be surprised if investors were becoming wary of Neosperience.

So things certainly aren't looking great, and you should also know that we've spotted some potential warning signs with Neosperience, including dilutive stock issuance over the past year. For more information, you can click here to discover this and the 2 other concerns we've identified.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Neosperience might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:NSP

Low risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026