As European markets experience a notable upswing, with the STOXX Europe 600 Index rising by 2.35% and major country indexes following suit, investor interest in smaller-cap opportunities has been piqued. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. These smaller or newer companies, when built on solid financials, can lead to significant returns; we've selected three examples of penny stocks that combine balance sheet strength with potential for outsized gains.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.64 | €82.4M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €0.94 | €13.96M | ✅ 4 ⚠️ 5 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €228.7M | ✅ 3 ⚠️ 3 View Analysis > |

| Enervit (BIT:ENV) | €3.80 | €67.64M | ✅ 2 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.06 | €64.91M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.345 | €384.03M | ✅ 4 ⚠️ 1 View Analysis > |

| High (ENXTPA:HCO) | €3.91 | €76.25M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.255 | €311.69M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.818 | €27.39M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 281 stocks from our European Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Cyberoo (BIT:CYB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cyberoo S.p.A. offers managed and cyber security services in Italy, with a market cap of €57.15 million.

Operations: The company's revenue is derived from Managed Services (€4.57 million), Digital Transformation (€0.11 million), and Cyber Security & Device Security (€18.13 million).

Market Cap: €57.15M

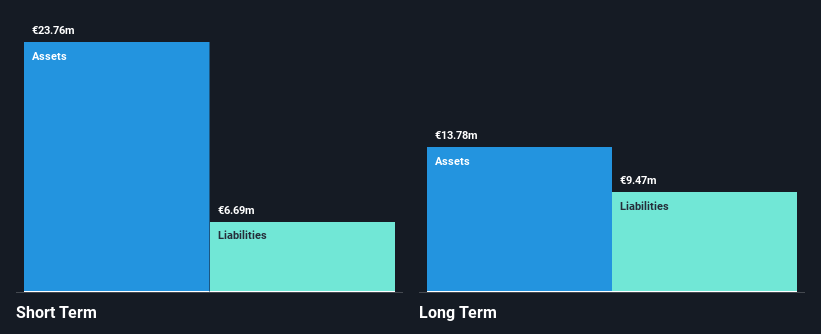

Cyberoo S.p.A., with a market cap of €57.15 million, offers managed and cyber security services in Italy. The company demonstrates financial stability with short-term assets exceeding both its short and long-term liabilities, and a satisfactory net debt to equity ratio of 13.8%. Despite a decrease in net income from €0.87 million to €0.31 million year-over-year for the half year ended June 2025, Cyberoo's earnings growth over the past five years has been significant at 47.6% annually, although recent growth slowed to 4.2%. It trades at a favorable price-to-earnings ratio compared to the Italian market average.

- Click here and access our complete financial health analysis report to understand the dynamics of Cyberoo.

- Learn about Cyberoo's future growth trajectory here.

Tecma Solutions (BIT:TCM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tecma Solutions S.p.A. is a tech company that creates technology and digital content for real estate businesses, with a market cap of €18.25 million.

Operations: The company's revenue is primarily generated from its Core segments, with €0.93 million from R&D and €15.04 million from Operations, while the Non-Core segment contributes €0.10 million.

Market Cap: €18.25M

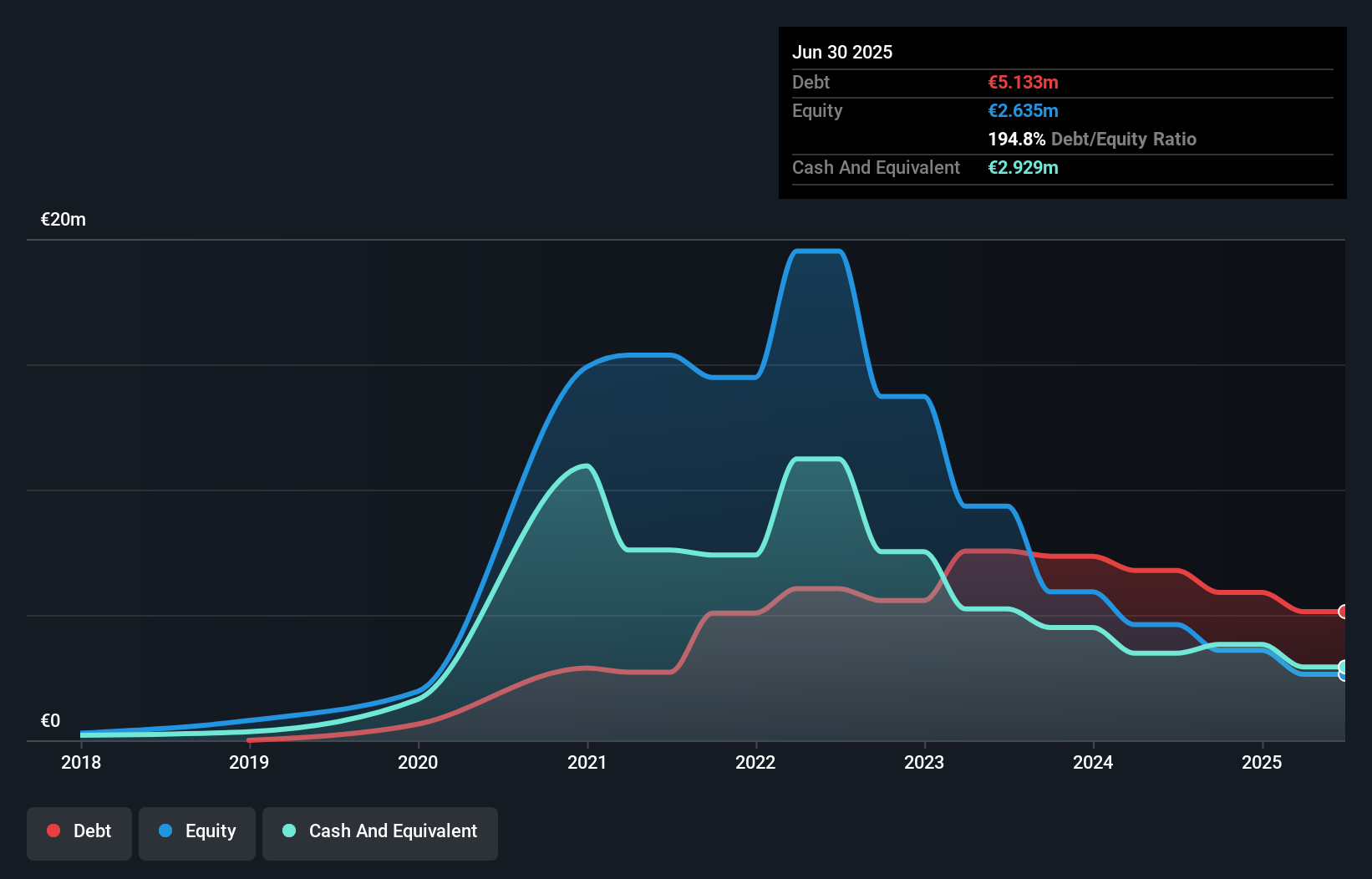

Tecma Solutions S.p.A., with a market cap of €18.25 million, operates in the tech sector for real estate businesses. Despite being unprofitable, it reported half-year revenue of €7.53 million as of June 2025, slightly down from the previous year. The company has a high net debt to equity ratio of 83.7%, indicating significant leverage, yet its short-term assets cover both short and long-term liabilities comfortably. While earnings are forecasted to grow significantly at over 100% annually, past losses have increased by 24.7% per year over five years. Tecma maintains a stable cash runway exceeding three years due to positive free cash flow growth.

- Get an in-depth perspective on Tecma Solutions' performance by reading our balance sheet health report here.

- Evaluate Tecma Solutions' prospects by accessing our earnings growth report.

Nextedia (ENXTPA:ALNXT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nextedia S.A. operates in France, offering cybersecurity, cloud and digital workspace, and customer experience solutions, with a market cap of €17.12 million.

Operations: The company generates its revenue primarily from Direct Marketing, which amounts to €62.04 million.

Market Cap: €17.12M

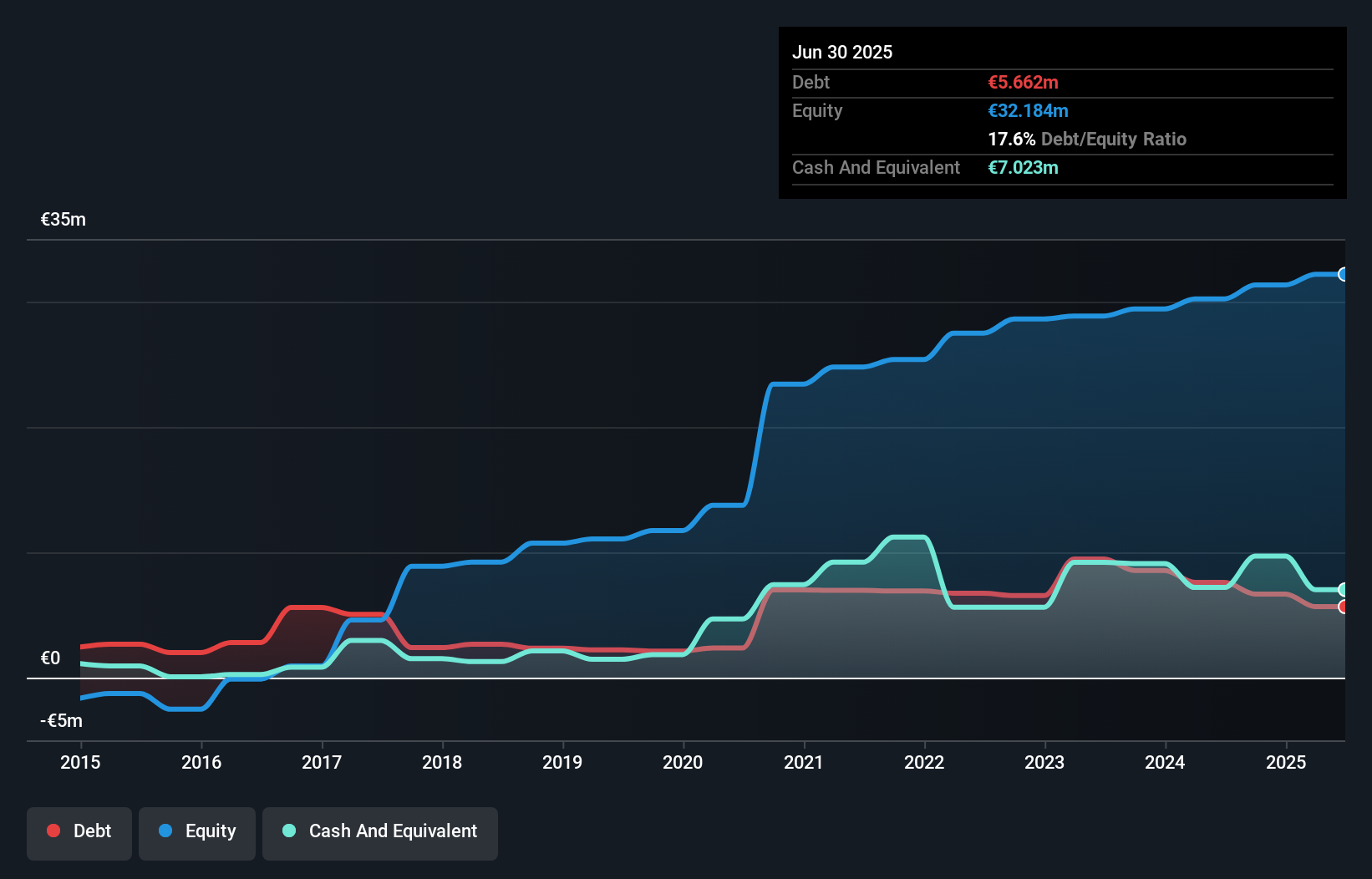

Nextedia S.A., with a market cap of €17.12 million, demonstrates both strengths and challenges typical of penny stocks. Despite a decline in half-year sales to €28.9 million, net income improved slightly to €0.9 million from the previous year. The company's short-term assets comfortably cover liabilities, and it maintains more cash than debt, indicating financial stability. Earnings grew by 39.7% over the past year, outpacing the IT industry average decline of 5.6%. However, its Return on Equity remains low at 6%, and earnings have historically declined by 11.8% annually over five years despite recent growth acceleration.

- Navigate through the intricacies of Nextedia with our comprehensive balance sheet health report here.

- Explore Nextedia's analyst forecasts in our growth report.

Next Steps

- Click here to access our complete index of 281 European Penny Stocks.

- Seeking Other Investments? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:CYB

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026