- Italy

- /

- Real Estate

- /

- BIT:GAB

3 European Penny Stocks With Market Caps Up To €50M

Reviewed by Simply Wall St

The European markets have recently experienced a rally, with the STOXX Europe 600 Index reaching record levels, driven by gains in technology stocks and expectations of lower U.S. borrowing costs. For investors interested in smaller or newer companies, penny stocks—despite their somewhat outdated name—remain an intriguing area for potential growth opportunities. When these stocks are supported by strong financial health, they can offer surprising value and resilience even amid broader market fluctuations.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.05 | €1.4B | ✅ 5 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.15 | €17.08M | ✅ 4 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.26 | €43.3M | ✅ 4 ⚠️ 1 View Analysis > |

| DigiTouch (BIT:DGT) | €2.03 | €27.66M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €232.45M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.49 | DKK113.52M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.89 | €39.65M | ✅ 3 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.40 | SEK206.85M | ✅ 2 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.10 | €290.26M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 271 stocks from our European Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Gabetti Property Solutions (BIT:GAB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Gabetti Property Solutions S.p.A. operates through its subsidiaries to offer real estate services both in Italy and internationally, with a market cap of €41.75 million.

Operations: The company generates revenue through its real estate services primarily in Italy and internationally, with a segment adjustment of €223.62 million.

Market Cap: €41.75M

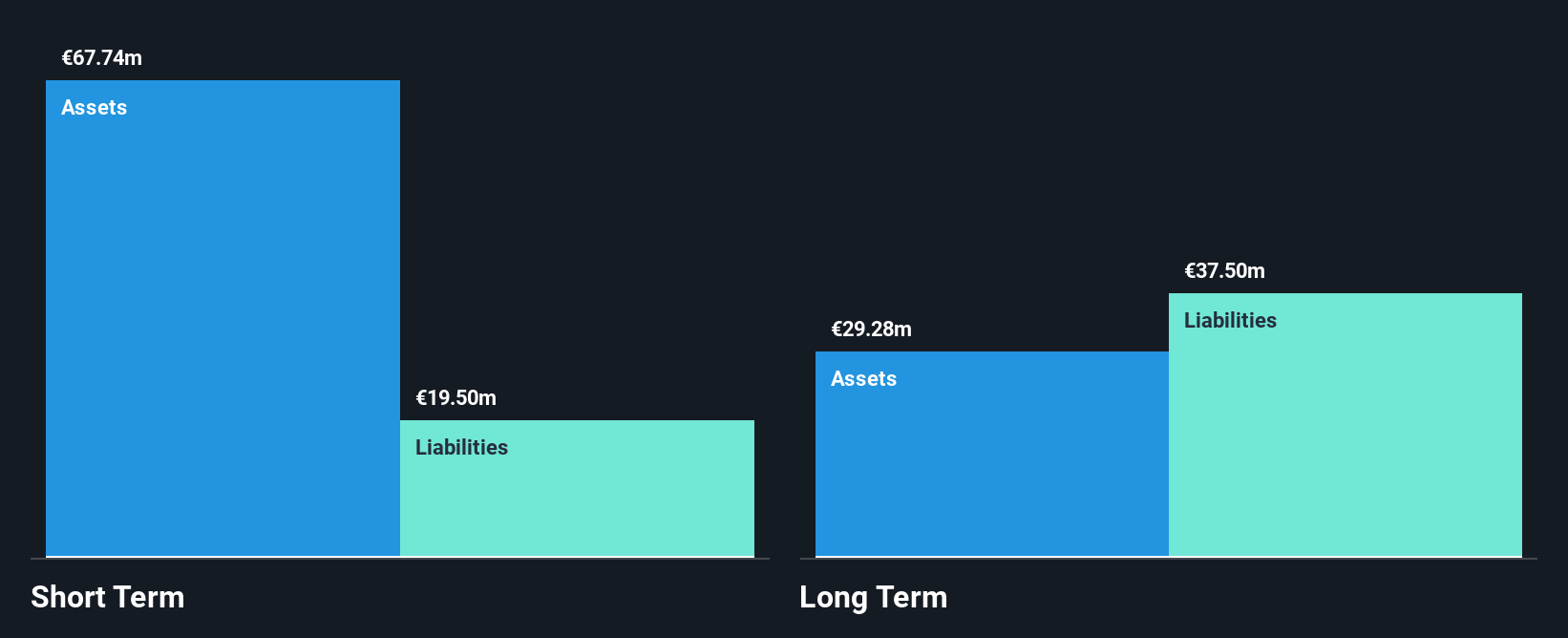

Gabetti Property Solutions S.p.A. has shown some resilience in the penny stock space, with recent earnings reflecting a slight revenue increase to €58.25 million for the half year ended June 30, 2025. Despite a net loss of €0.875 million, its interest payments are well covered by EBIT and operating cash flow effectively covers its debt. However, the company carries high debt levels with a net debt to equity ratio of 76.8%, though it has been reducing over time from 135.1% five years ago. The management team is relatively new with an average tenure of just 0.8 years.

- Navigate through the intricacies of Gabetti Property Solutions with our comprehensive balance sheet health report here.

- Explore Gabetti Property Solutions' analyst forecasts in our growth report.

Outdoorzy (WSE:OUT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Outdoorzy S.A. operates an online store in Poland and has a market cap of PLN14.92 million.

Operations: The company generates revenue of PLN9.22 million from online retail operations.

Market Cap: PLN14.92M

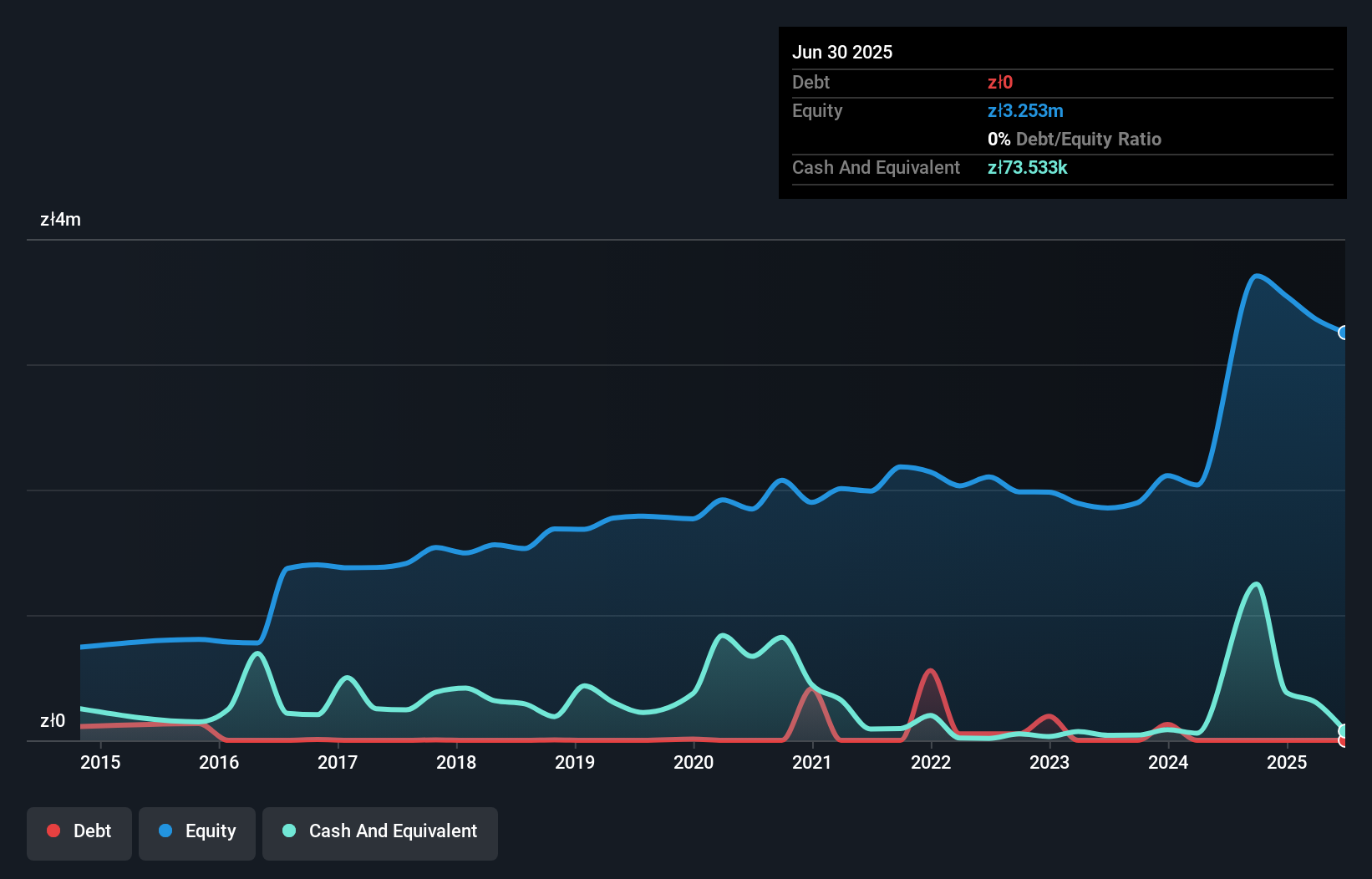

Outdoorzy S.A.'s recent financial performance highlights challenges typical of penny stocks, with a significant revenue drop to PLN 177.32 million for Q2 2025 and a net loss of PLN 10.83 million. The company is unprofitable, with earnings declining by an average of 52.8% annually over the past five years, and it has no meaningful revenue streams beyond its online retail operations. Despite this, Outdoorzy remains debt-free and maintains strong short-term asset coverage over liabilities (PLN6.1M vs PLN3M), though its share price volatility remains high compared to most Polish stocks. The board is experienced with an average tenure of 9.5 years.

- Click to explore a detailed breakdown of our findings in Outdoorzy's financial health report.

- Review our historical performance report to gain insights into Outdoorzy's track record.

Schweizer Electronic (XTRA:SCE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Schweizer Electronic AG, with a market cap of €12.44 million, is involved in the development, production, and distribution of printed circuit boards (PCBs) and embedding solutions globally.

Operations: The company's revenue is derived from Multilayer (€42.3 million), Metallized Circuits (€12.1 million), and Non-Metallized Circuits (€2.4 million).

Market Cap: €12.44M

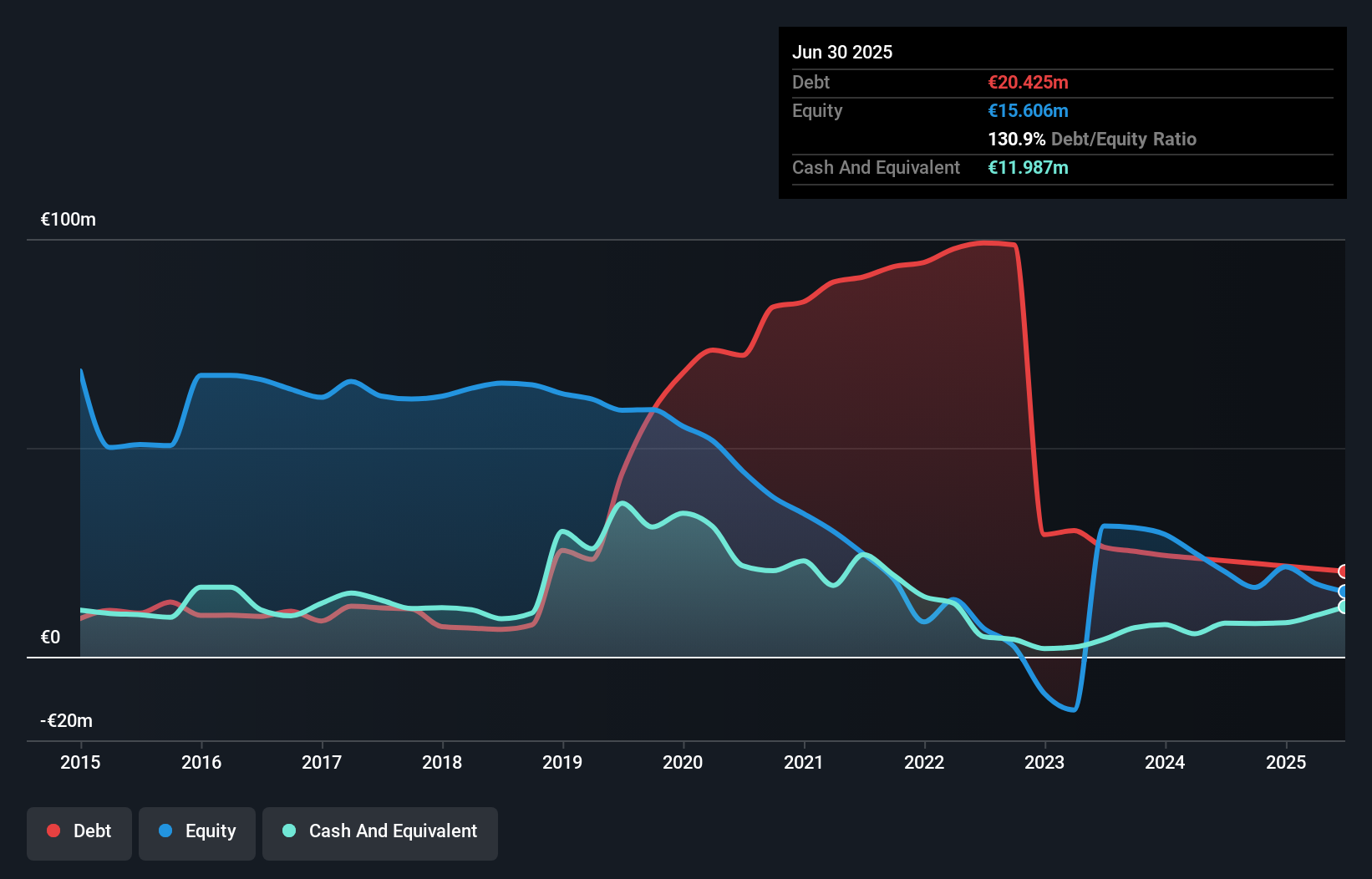

Schweizer Electronic AG, with a market cap of €12.44 million, has shown resilience in its financial performance despite being unprofitable. Recent earnings reports indicate sales of €82.23 million for the first half of 2025, reflecting an improvement from the previous year and a reduced net loss to €5.77 million. The company projects moderate sales growth between €145 million and €165 million for the year, supported by a strong order situation. While it faces high volatility and debt levels (net debt to equity at 54.1%), it benefits from an experienced management team and board, alongside sufficient cash runway exceeding three years due to positive free cash flow trends.

- Jump into the full analysis health report here for a deeper understanding of Schweizer Electronic.

- Evaluate Schweizer Electronic's prospects by accessing our earnings growth report.

Next Steps

- Unlock more gems! Our European Penny Stocks screener has unearthed 268 more companies for you to explore.Click here to unveil our expertly curated list of 271 European Penny Stocks.

- Curious About Other Options? Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:GAB

Gabetti Property Solutions

Through its subsidiaries, provides real estate services in Italy and internationally.

Undervalued with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)