Philogen And 2 Other Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

As European markets experience a lift from easing trade tensions and optimism surrounding potential U.S. interest rate cuts, the pan-European STOXX Europe 600 Index has seen a notable rise of 1.18%. In this environment, identifying stocks that can capitalize on favorable economic conditions and exhibit growth potential becomes crucial for enhancing one's portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 3.60% | 33.84% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Philogen (BIT:PHIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Philogen S.p.A. is a biotechnology company focused on developing drugs for oncology and chronic inflammatory diseases, operating in Switzerland and the European Union, with a market cap of €947.80 million.

Operations: Philogen generates revenue primarily from its biotechnology segment, amounting to €77.65 million.

Philogen has recently turned profitable, a notable achievement given the biotech industry's 65% growth benchmark. Despite this, its earnings are projected to drop by 36.9% annually over the next three years. The company boasts a robust financial position with cash exceeding total debt and impressive interest coverage of 423 times EBIT, highlighting its ability to manage obligations effectively. However, share price volatility remains high in recent months. Philogen's strategic withdrawal of Nidlegy's marketing application underscores challenges in clinical data readiness but reflects confidence in the drug's efficacy for melanoma treatment as clinical trials continue.

- Get an in-depth perspective on Philogen's performance by reading our health report here.

Gain insights into Philogen's historical performance by reviewing our past performance report.

Boozt (OM:BOOZT)

Simply Wall St Value Rating: ★★★★★★

Overview: Boozt AB (publ) operates as an online retailer offering a wide range of fashion, apparel, shoes, accessories, kids' items, home goods, sports equipment, and beauty products with a market capitalization of approximately SEK5.95 billion.

Operations: The company generates revenue primarily through its online platforms, Boozt.com and Booztlet.com, with sales figures of SEK6.55 billion and SEK1.68 billion, respectively.

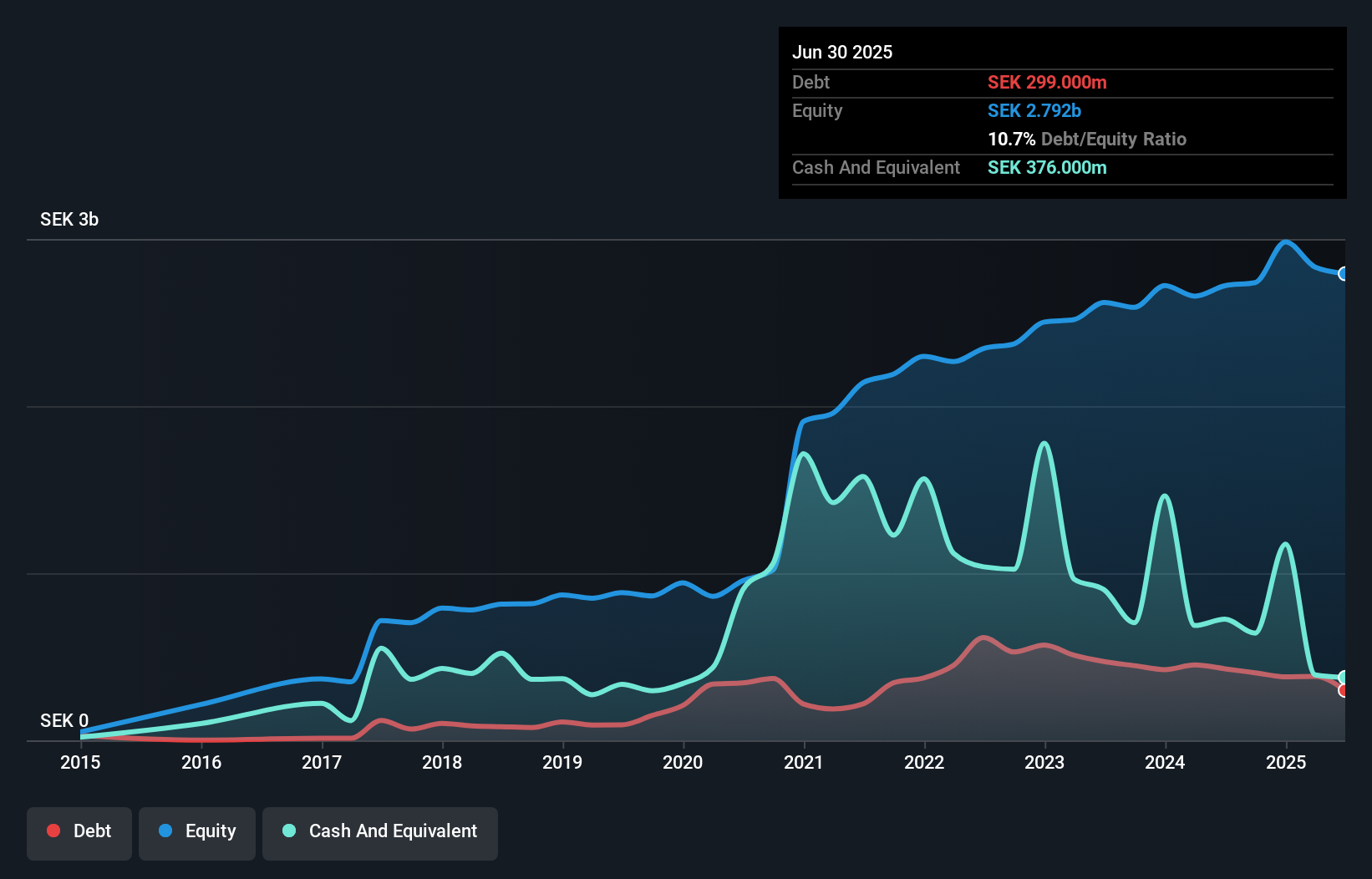

Boozt, a nimble player in the European market, has seen its debt to equity ratio shrink from 35.9% to 10.7% over five years, showcasing prudent financial management. This retailer is trading at a significant discount of 56.5% below its estimated fair value and boasts earnings growth of 54.9% last year, outpacing the industry average of 20.2%. Recently, Boozt repurchased shares worth SEK 94 million, signaling confidence in its valuation despite challenges like geopolitical uncertainties and inventory issues that could affect profit margins currently at a solid 4.2%.

HMS Bergbau (XTRA:HMU)

Simply Wall St Value Rating: ★★★★★☆

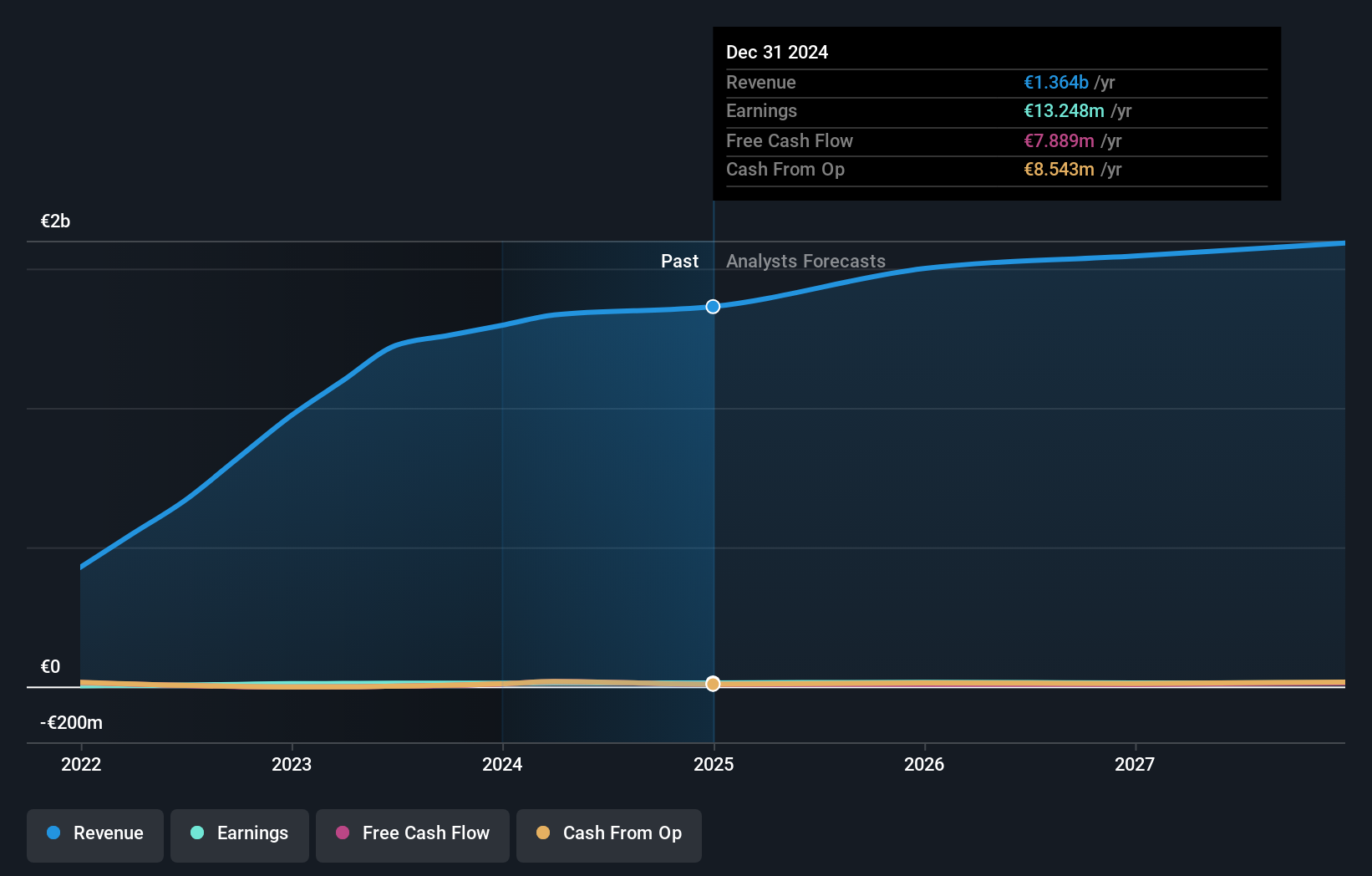

Overview: HMS Bergbau AG, with a market cap of €247.64 million, is involved in the global trading and distribution of coal and other energy raw materials to sectors such as energy production, cement manufacturing, and industrial consumption.

Operations: The company generates revenue primarily from the trading and distribution of coal, amounting to approximately €1.36 billion. The focus on this single revenue stream highlights its specialization in the energy raw materials sector.

HMS Bergbau, a notable player in the European energy sector, has demonstrated robust financial health with its interest payments well covered by EBIT at 50.9 times. Over the past year, earnings grew by 6.5%, outpacing the industry average of -2.5%. Despite this growth, future earnings are expected to decrease slightly by an average of 0.2% annually over the next three years. The company trades at a significant discount of 33.9% below estimated fair value and maintains high-quality earnings alongside positive free cash flow trends, although its share price has been quite volatile recently.

- Click to explore a detailed breakdown of our findings in HMS Bergbau's health report.

Understand HMS Bergbau's track record by examining our Past report.

Key Takeaways

- Access the full spectrum of 328 European Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Boozt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BOOZT

Boozt

Sells fashion, apparel, shoes, accessories, kids, home, sports, and beauty products online.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)