As European markets show resilience with the STOXX Europe 600 Index climbing 2.77% amid easing trade tensions, investors are keenly observing opportunities within the region's small-cap landscape. In this environment, identifying stocks that exhibit strong fundamentals and potential for growth can be particularly rewarding, especially as economic indicators suggest stability despite external uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Decora | 20.76% | 12.61% | 12.54% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| Viohalco | 91.31% | 12.25% | 17.37% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

RCS MediaGroup (BIT:RCS)

Simply Wall St Value Rating: ★★★★★☆

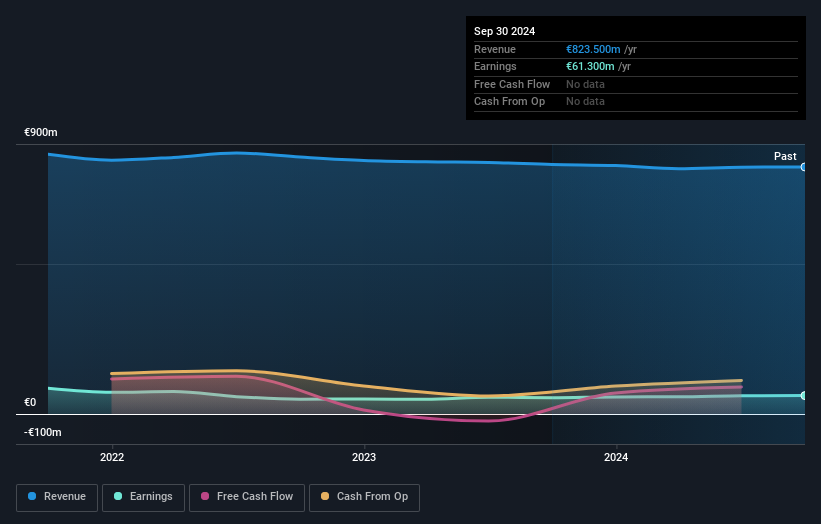

Overview: RCS MediaGroup S.p.A. operates as a multimedia publishing company offering services in Italy and internationally, with a market capitalization of approximately €513.25 million.

Operations: RCS MediaGroup generates revenue primarily through its Italy Newspapers segment (€369.40 million), Advertising and Sport (€283.30 million), and Unidad Editorial (€217.70 million). The Magazines Italy segment contributes €65.20 million, while Corporate and Other Activities add €80.90 million to the revenue stream.

RCS MediaGroup, a notable player in the media industry, showcases promising aspects with its earnings covered well by EBIT at 19.7 times interest payments and trading at 67.5% below estimated fair value. Over the past five years, RCS has seen earnings growth of 5% annually and successfully reduced its debt-to-equity ratio from 56.6% to 11.4%. Despite recent shareholder dilution, RCS reported a net income increase to €62 million for the year ending December 2024, up from €57 million prior. The company’s financial health is bolstered by having more cash than total debt and positive free cash flow status.

- Get an in-depth perspective on RCS MediaGroup's performance by reading our health report here.

Evaluate RCS MediaGroup's historical performance by accessing our past performance report.

Clínica Baviera (BME:CBAV)

Simply Wall St Value Rating: ★★★★☆☆

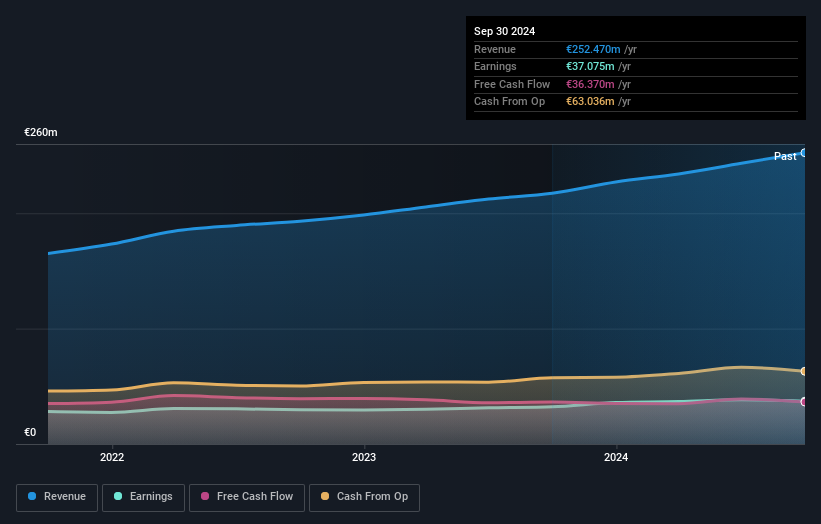

Overview: Clínica Baviera, S.A. is a medical company that operates a network of ophthalmology clinics across Spain and Europe, with a market capitalization of €567.76 million.

Operations: Clínica Baviera generates revenue primarily from its ophthalmology services, amounting to €265.72 million.

Clínica Baviera, a nimble player in the healthcare sector, showcases its robust financial health with earnings growth of 11.8% over the past year and an impressive 22.1% annual increase over five years. The company reported sales of €265.72 million for 2024, up from €227.07 million in the previous year, with net income rising to €40.21 million from €35.97 million. Its debt-to-equity ratio has significantly decreased to 7.3%, and interest payments are well-covered by EBIT at a factor of 60x, indicating strong management of liabilities and operational efficiency despite recent equity offerings on April 2nd, 2025.

- Take a closer look at Clínica Baviera's potential here in our health report.

Review our historical performance report to gain insights into Clínica Baviera's's past performance.

Caisse Régionale de Crédit Agricole Mutuel de Normandie-Seine Société coopérative (ENXTPA:CCN)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel de Normandie-Seine Société coopérative provides a range of banking products and services to diverse clients in France with a market capitalization of approximately €586.93 million.

Operations: Caisse Régionale de Crédit Agricole Mutuel de Normandie-Seine Société coopérative generates revenue primarily from its Retail Bank segment, amounting to €344.17 million.

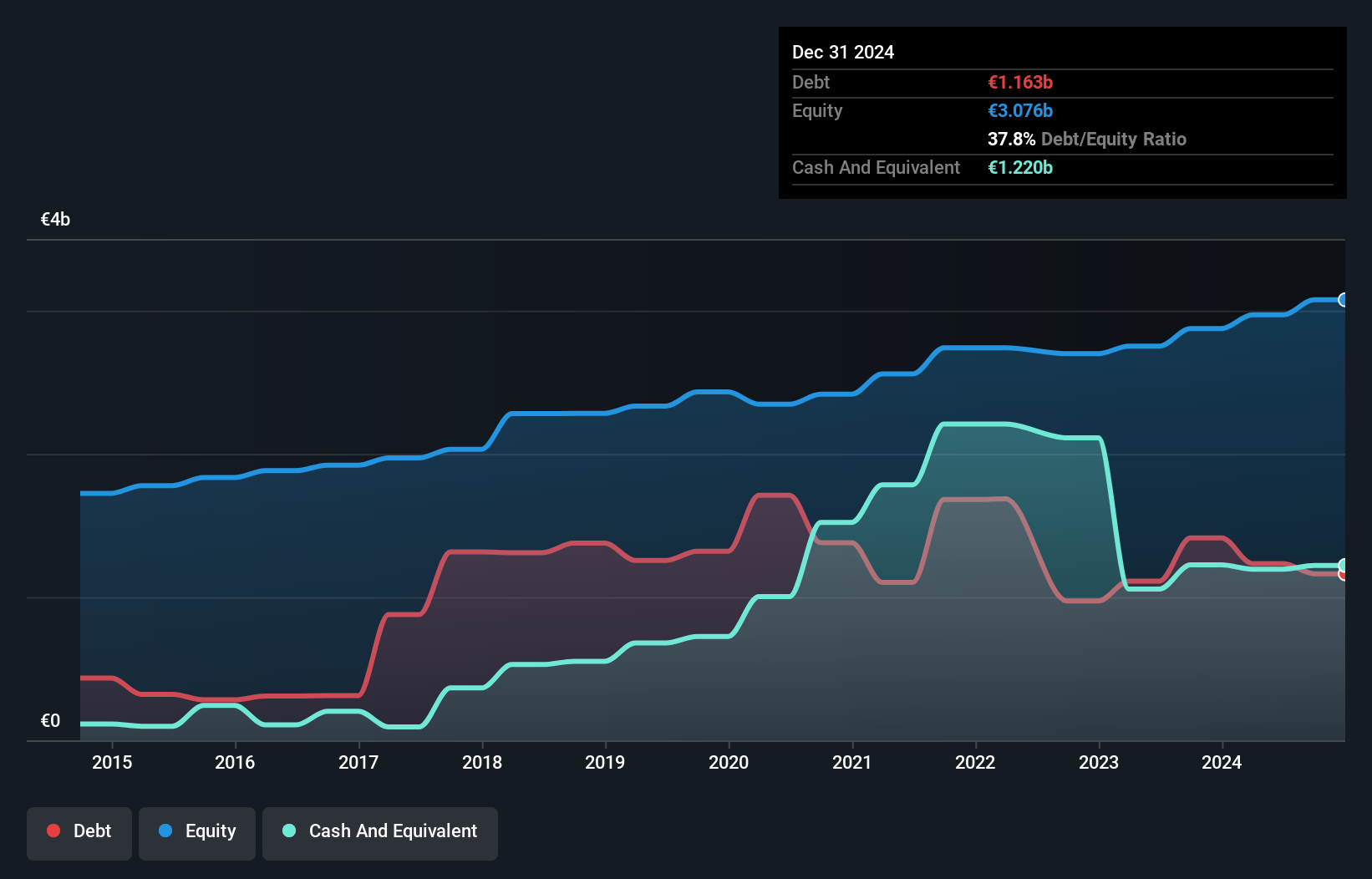

Caisse Régionale de Crédit Agricole Mutuel de Normandie-Seine, with assets totaling €24.6 billion and equity of €3.1 billion, is an intriguing player in the financial sector. The bank's total deposits and loans each stand at €20 billion, indicating a balanced approach to its financial operations. Its non-performing loans are kept in check at 1.2%, supported by a robust bad loan allowance of 113%. Despite earnings growth of 2.6% annually over five years, it lagged behind the industry’s pace last year with only a 1.3% increase compared to the sector's 6.2%.

Next Steps

- Click here to access our complete index of 350 European Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:RCS

RCS MediaGroup

Provides multimedia publishing services in Italy, Spain, and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)