As global markets continue to experience gains, with major indices like the Dow Jones Industrial Average and S&P 500 reaching record highs, investors are navigating a landscape shaped by geopolitical developments and domestic policy shifts. Amidst this backdrop of economic activity, dividend stocks remain an attractive option for those seeking steady income streams; their appeal is further amplified in times of market volatility where consistent returns can offer a measure of stability.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.01% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.53% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.63% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.08% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.44% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.44% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.89% | ★★★★★★ |

Click here to see the full list of 1967 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

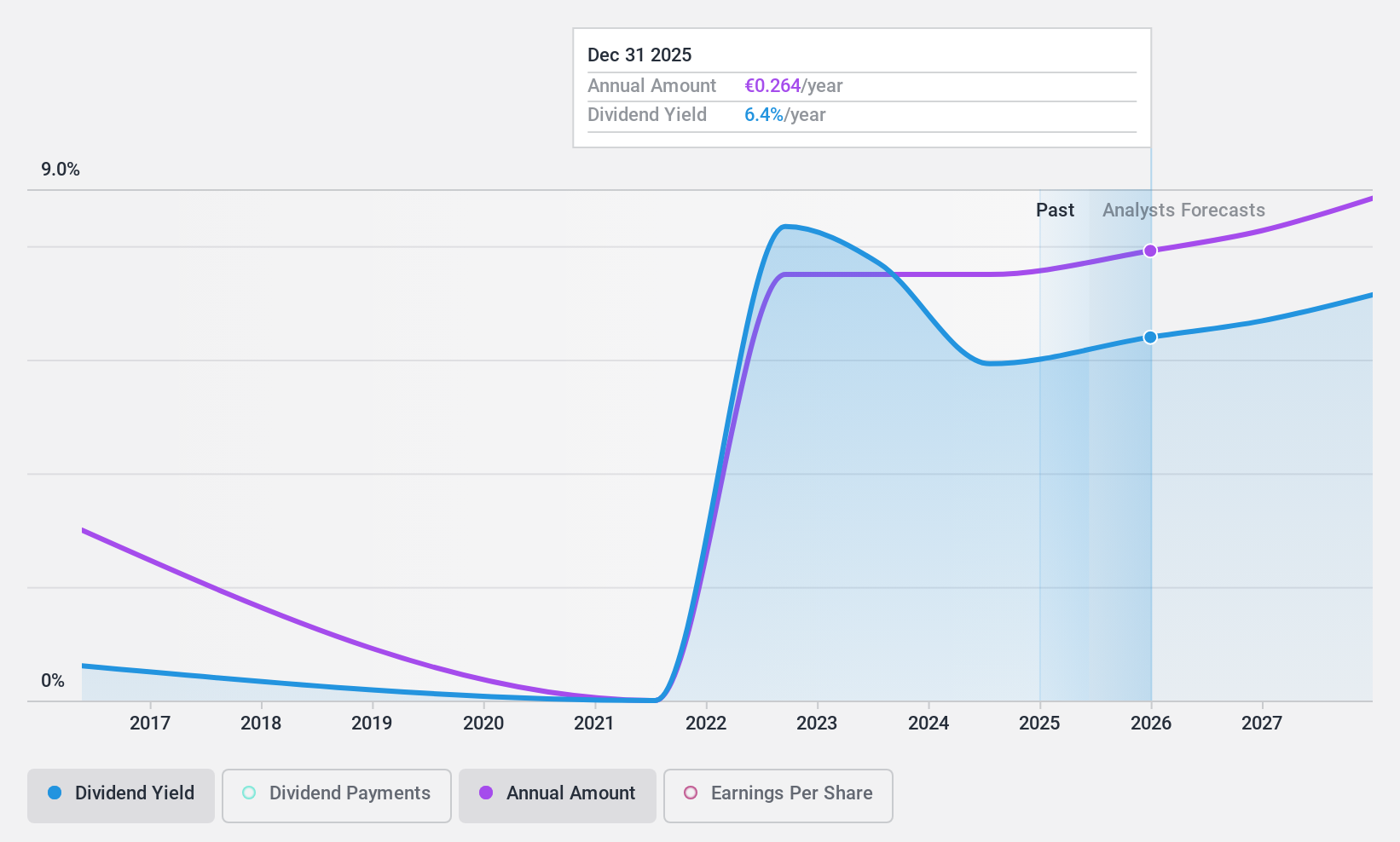

MFE-Mediaforeurope (BIT:MFEB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MFE-Mediaforeurope N.V. operates in the television industry in Italy and Spain, with a market cap of €1.87 billion.

Operations: MFE-Mediaforeurope N.V. generates its revenue primarily from television operations in Italy and Spain.

Dividend Yield: 6.3%

MFE-Mediaforeurope's dividend yield is among the top in Italy, supported by a payout ratio of 61.8% and cash flow coverage at 41.9%, indicating sustainability. However, its dividend history shows volatility with significant drops over the past decade, raising concerns about reliability. Despite this, recent earnings growth and undervaluation relative to peers highlight potential for future stability if earnings continue to improve as forecasted at 13.24% annually.

- Click here and access our complete dividend analysis report to understand the dynamics of MFE-Mediaforeurope.

- The valuation report we've compiled suggests that MFE-Mediaforeurope's current price could be quite moderate.

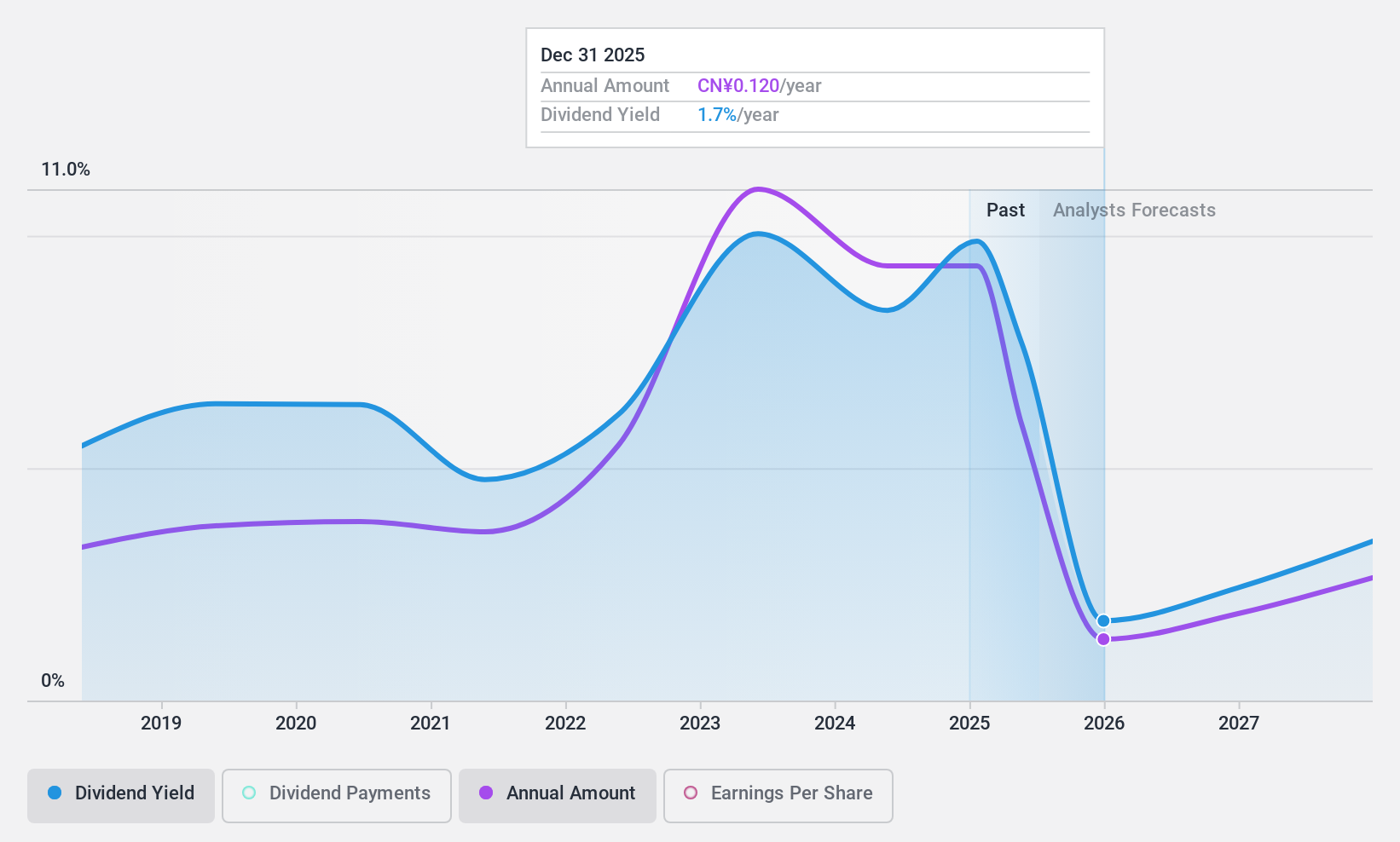

Anhui Hengyuan Coal Industry and Electricity PowerLtd (SHSE:600971)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Anhui Hengyuan Coal Industry and Electricity Power Co., Ltd is involved in the mining, production, washing, sale, and transportation of coal in China with a market cap of CN¥11.45 billion.

Operations: The company's revenue from its industrial segment is CN¥7.23 billion.

Dividend Yield: 8.9%

Anhui Hengyuan Coal Industry and Electricity Power Ltd offers a high dividend yield of 8.92%, placing it among the top dividend payers in China. However, its dividends have been unreliable and volatile over the past decade, with a payout ratio of 75.7% covered by earnings but not by free cash flows due to a cash payout ratio of 107.7%. Recent earnings have declined significantly, impacting profit margins from last year's performance.

- Delve into the full analysis dividend report here for a deeper understanding of Anhui Hengyuan Coal Industry and Electricity PowerLtd.

- According our valuation report, there's an indication that Anhui Hengyuan Coal Industry and Electricity PowerLtd's share price might be on the cheaper side.

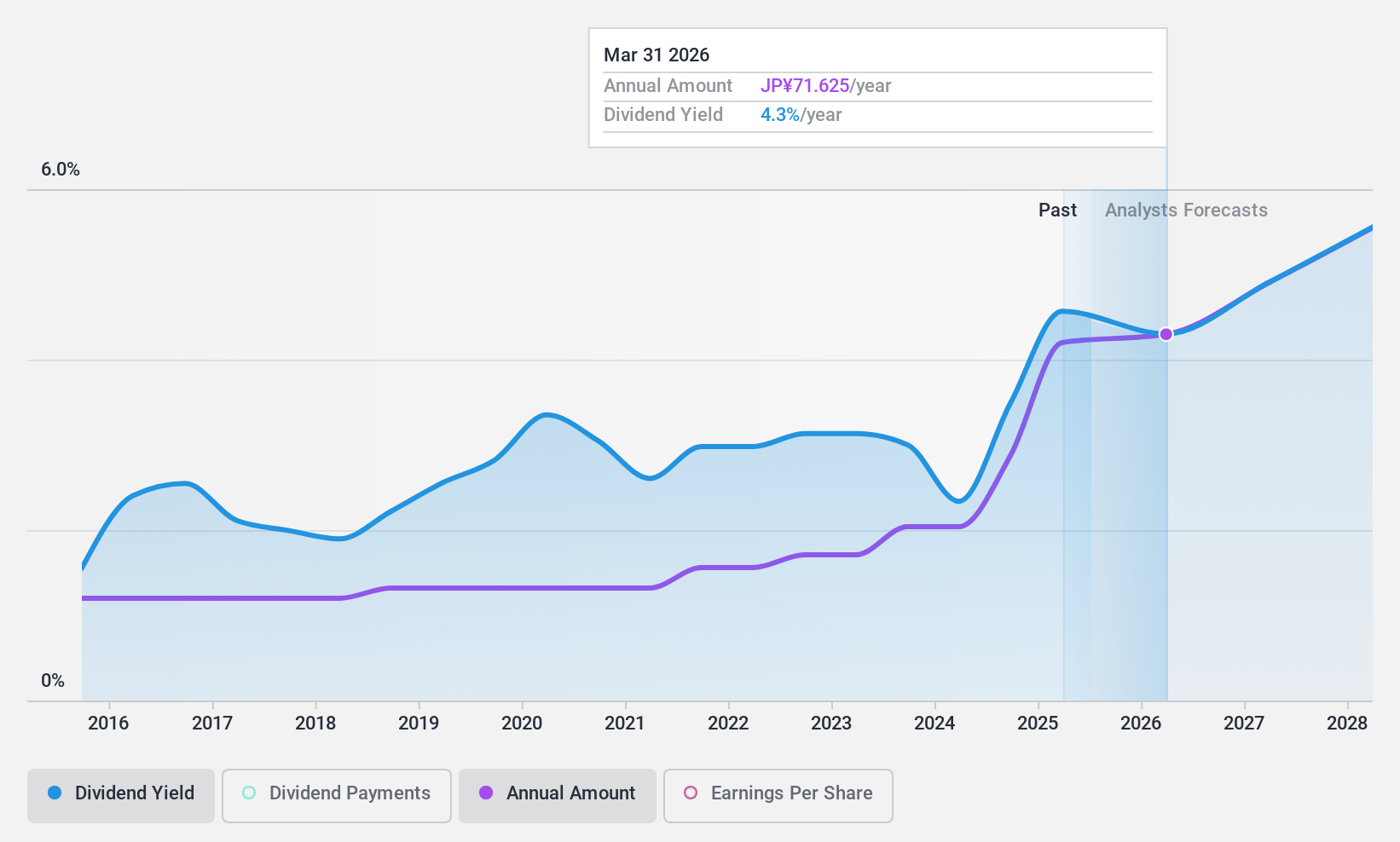

Shizuoka Financial GroupInc (TSE:5831)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shizuoka Financial Group Inc., along with its subsidiaries, offers a range of banking products and services and has a market cap of ¥737.07 billion.

Operations: Shizuoka Financial Group Inc., through its subsidiaries, generates revenue from diverse banking products and services.

Dividend Yield: 3.7%

Shizuoka Financial Group offers a stable dividend yield of 3.73%, slightly below Japan's top quartile. Its dividends have been reliably growing over the past decade, supported by a low payout ratio of 38.2%. Recent earnings show strong growth, with net income rising to ¥34.82 billion from ¥24.75 billion year-on-year, enhancing its capacity to sustain dividends. The company also announced a share buyback program worth ¥10 billion, potentially indicating confidence in its financial stability and future performance.

- Unlock comprehensive insights into our analysis of Shizuoka Financial GroupInc stock in this dividend report.

- Our valuation report here indicates Shizuoka Financial GroupInc may be undervalued.

Seize The Opportunity

- Embark on your investment journey to our 1967 Top Dividend Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5831

Shizuoka Financial GroupInc

Provides various banking products and services.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives