Investors more bullish on MFE-Mediaforeurope (BIT:MFEB) this week as stock advances 7.1%, despite earnings trending downwards over past five years

It's possible to achieve returns close to the market-weighted average return by buying an index fund. A talented investor can beat the market with a diversified portfolio, but even then, some stocks will under-perform. While the MFE-Mediaforeurope N.V. (BIT:MFEB) share price is down 50% over half a decade, the total return to shareholders (which includes dividends) was 374%. That's better than the market which returned 113% over the same time. But it's up 7.1% in the last week.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

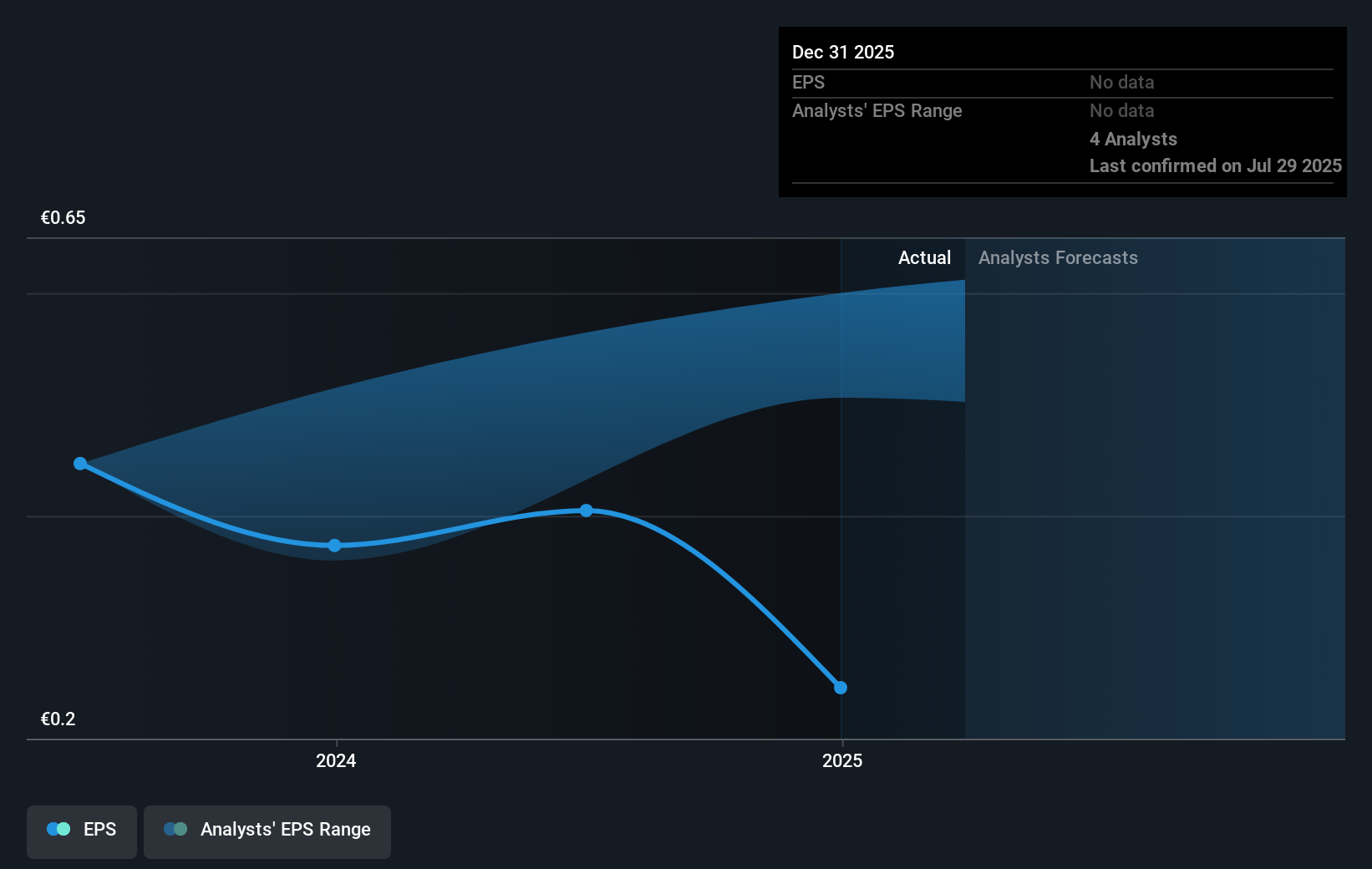

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Looking back five years, both MFE-Mediaforeurope's share price and EPS declined; the latter at a rate of 16% per year. This fall in the EPS is worse than the 13% compound annual share price fall. So the market may previously have expected a drop, or else it expects the situation will improve.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, MFE-Mediaforeurope's TSR for the last 5 years was 374%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

MFE-Mediaforeurope shareholders gained a total return of 2.0% during the year. But that return falls short of the market. On the bright side, the longer term returns (running at about 37% a year, over half a decade) look better. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for MFE-Mediaforeurope that you should be aware of.

MFE-Mediaforeurope is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Italian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:MFEB

MFE-Mediaforeurope

Operates in the television industry in Italy and Spain.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026