- Finland

- /

- General Merchandise and Department Stores

- /

- HLSE:LINDEX

3 Promising Penny Stocks With Market Caps Over US$300M

Reviewed by Simply Wall St

As global markets navigate the complexities of cautious Federal Reserve commentary and political uncertainties, investors are seeking opportunities in various segments. Penny stocks, often associated with smaller or newer companies, continue to offer intriguing possibilities despite their somewhat outdated label. When these stocks exhibit strong financial health and solid fundamentals, they can present unique growth prospects that stand out in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.42 | MYR1.17B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.085 | £785.55M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.09 | HK$45.04B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.924 | £145.75M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.39 | £64.65M | ★★★★☆☆ |

Click here to see the full list of 5,830 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

MFE-Mediaforeurope (BIT:MFEB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: MFE-Mediaforeurope N.V. operates in the television industry in Italy and Spain with a market cap of €1.92 billion.

Operations: The company generates revenue primarily from its operations in Italy, contributing €2.02 billion, and Spain, contributing €796.4 million.

Market Cap: €1.92B

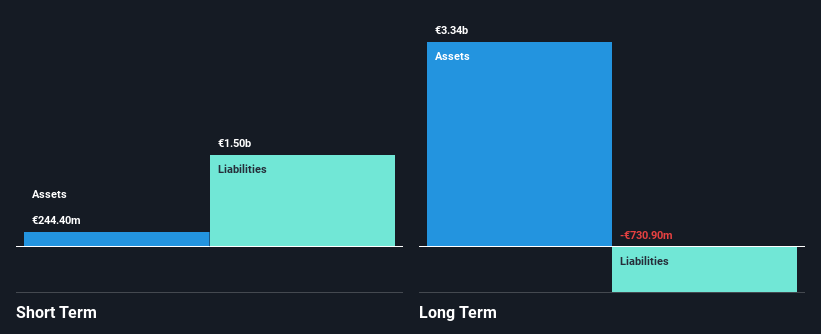

MFE-Mediaforeurope N.V. shows a mixed financial profile, appealing to some penny stock investors due to its valuation and profitability trends. The company reported sales of €2 billion for the first nine months of 2024, up from €1.86 billion in the previous year, with net income rising to €96.2 million from €71 million. Despite these gains, challenges persist; short-term assets do not cover liabilities, and shareholders experienced dilution over the past year. Positively, debt levels are well-managed with strong cash flow coverage and interest payments are comfortably covered by EBIT at 16.5 times.

- Click here and access our complete financial health analysis report to understand the dynamics of MFE-Mediaforeurope.

- Evaluate MFE-Mediaforeurope's prospects by accessing our earnings growth report.

Deceuninck (ENXTBR:DECB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Deceuninck NV designs, manufactures, recycles, and distributes multi-material window, door, and building solutions across Europe, North America, Turkey, and internationally with a market cap of €325.92 million.

Operations: The company's revenue is primarily derived from its Window and Door Systems segment, which accounts for €788.34 million, followed by Home Protection at €44.13 million and Outdoor Living at €27.98 million.

Market Cap: €325.92M

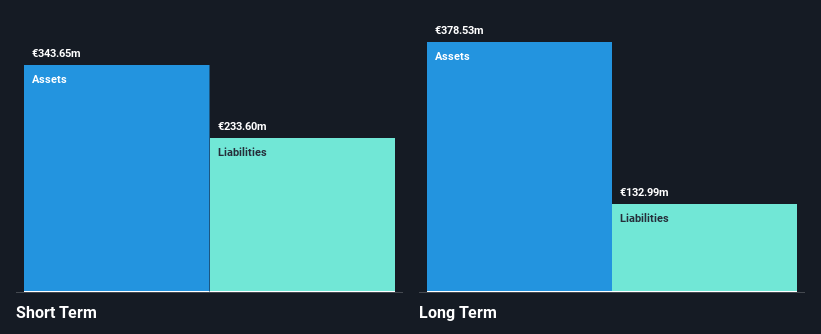

Deceuninck NV presents a complex picture for penny stock investors, with both strengths and challenges. The company trades significantly below its estimated fair value, suggesting potential undervaluation. However, recent financials reveal negative earnings growth and declining profit margins from 1.7% to 0.2%. While short-term assets comfortably cover liabilities, the debt level remains high with a net debt to equity ratio of 41.7%. Despite this, interest payments are well covered by EBIT at 12.1 times, indicating manageable financial health. The management team is relatively new, which may impact strategic direction in the near term.

- Jump into the full analysis health report here for a deeper understanding of Deceuninck.

- Gain insights into Deceuninck's future direction by reviewing our growth report.

Lindex Group Oyj (HLSE:LINDEX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lindex Group Oyj operates in the retail sector both in Finland and internationally, with a market capitalization of €441.23 million.

Operations: The company generates revenue from its Lindex segment, contributing €627.9 million, and its Stockmann segment, adding €313 million.

Market Cap: €441.23M

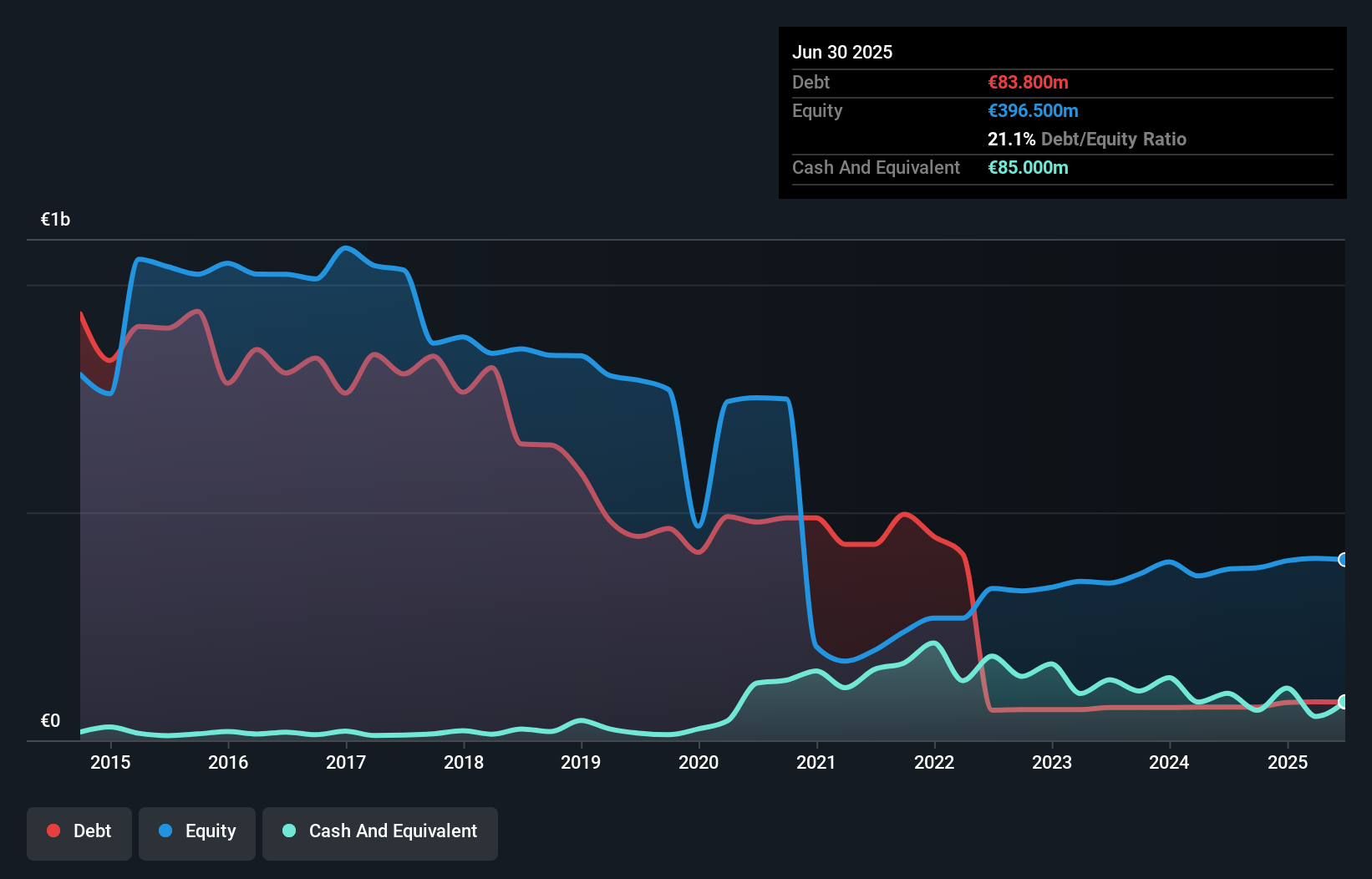

Lindex Group Oyj's recent strategic moves and financial metrics offer a mixed outlook for penny stock investors. The company has embarked on significant investments, such as the €110 million omnichannel distribution center in Sweden, aimed at long-term growth and efficiency improvements. However, current financials show challenges with a net loss of €6.5 million for the nine months ending September 2024, alongside declining profit margins from 6.3% to 0.3%. While short-term assets exceed liabilities, long-term liabilities remain uncovered by these assets. Despite a satisfactory net debt to equity ratio of 1.9%, interest coverage is weak at 1.6 times EBIT.

- Navigate through the intricacies of Lindex Group Oyj with our comprehensive balance sheet health report here.

- Understand Lindex Group Oyj's earnings outlook by examining our growth report.

Summing It All Up

- Explore the 5,830 names from our Penny Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Lindex Group Oyj, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:LINDEX

Lindex Group Oyj

Engages in the retailing business in Finland and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives