- Italy

- /

- Basic Materials

- /

- BIT:CEM

Shareholders May Be More Conservative With Cementir Holding N.V.'s (BIT:CEM) CEO Compensation For Now

The share price of Cementir Holding N.V. (BIT:CEM) has increased significantly over the past few years. However, the earnings growth has not kept up with the share price momentum, suggesting that some other factors may be driving the price direction. The upcoming AGM on 21 April 2021 may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

See our latest analysis for Cementir Holding

Comparing Cementir Holding N.V.'s CEO Compensation With the industry

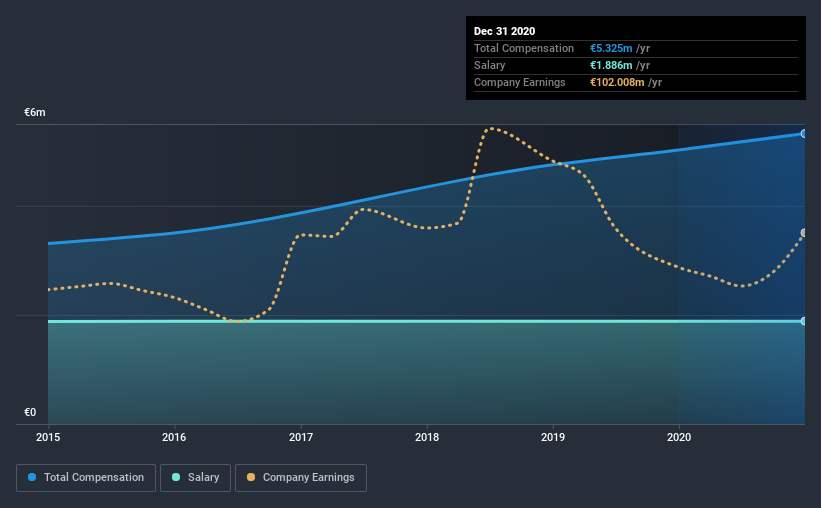

According to our data, Cementir Holding N.V. has a market capitalization of €1.4b, and paid its CEO total annual compensation worth €5.3m over the year to December 2020. That's a modest increase of 6.0% on the prior year. We think total compensation is more important but our data shows that the CEO salary is lower, at €1.9m.

On examining similar-sized companies in the industry with market capitalizations between €835m and €2.7b, we discovered that the median CEO total compensation of that group was €1.4m. This suggests that Francesco Caltagirone is paid more than the median for the industry. Furthermore, Francesco Caltagirone directly owns €78m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €1.9m | €1.9m | 35% |

| Other | €3.4m | €3.1m | 65% |

| Total Compensation | €5.3m | €5.0m | 100% |

On an industry level, roughly 37% of total compensation represents salary and 63% is other remuneration. Although there is a difference in how total compensation is set, Cementir Holding more or less reflects the market in terms of setting the salary. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Cementir Holding N.V.'s Growth

Cementir Holding N.V. saw earnings per share stay pretty flat over the last three years. Its revenue is up 1.1% over the last year.

A lack of EPS improvement is not good to see. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Cementir Holding N.V. Been A Good Investment?

We think that the total shareholder return of 39%, over three years, would leave most Cementir Holding N.V. shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us question whether these strong returns will continue. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 2 warning signs for Cementir Holding that investors should be aware of in a dynamic business environment.

Important note: Cementir Holding is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Cementir Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:CEM

Cementir Holding

Manufactures and distributes grey and white cement, ready-mix concrete, aggregates, and concrete products in Nordic and Baltic, Belgium, North America, Turkiye, Egypt, and Asia Pacific.

Flawless balance sheet, undervalued and pays a dividend.