3 Stocks Estimated To Be Undervalued By Up To 33.5% Offering Investment Opportunities

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with U.S. stocks closing out a strong 2024 despite recent volatility and European indices experiencing varied performances, investors are keenly observing economic indicators such as inflation rates and manufacturing data. In this context of fluctuating market dynamics, identifying undervalued stocks can present compelling investment opportunities, particularly those estimated to be trading below their intrinsic value by significant margins.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Camden National (NasdaqGS:CAC) | US$42.01 | US$83.84 | 49.9% |

| Brickability Group (AIM:BRCK) | £0.626 | £1.25 | 49.8% |

| Decisive Dividend (TSXV:DE) | CA$6.00 | CA$11.94 | 49.8% |

| Brunel International (ENXTAM:BRNL) | €9.84 | €19.64 | 49.9% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.73 | €5.44 | 49.8% |

| EnomotoLtd (TSE:6928) | ¥1452.00 | ¥2887.72 | 49.7% |

| Zhende Medical (SHSE:603301) | CN¥20.99 | CN¥41.91 | 49.9% |

| ReadyTech Holdings (ASX:RDY) | A$3.14 | A$6.25 | 49.8% |

| Neosperience (BIT:NSP) | €0.572 | €1.14 | 49.8% |

| Vogo (ENXTPA:ALVGO) | €2.92 | €5.81 | 49.8% |

Let's explore several standout options from the results in the screener.

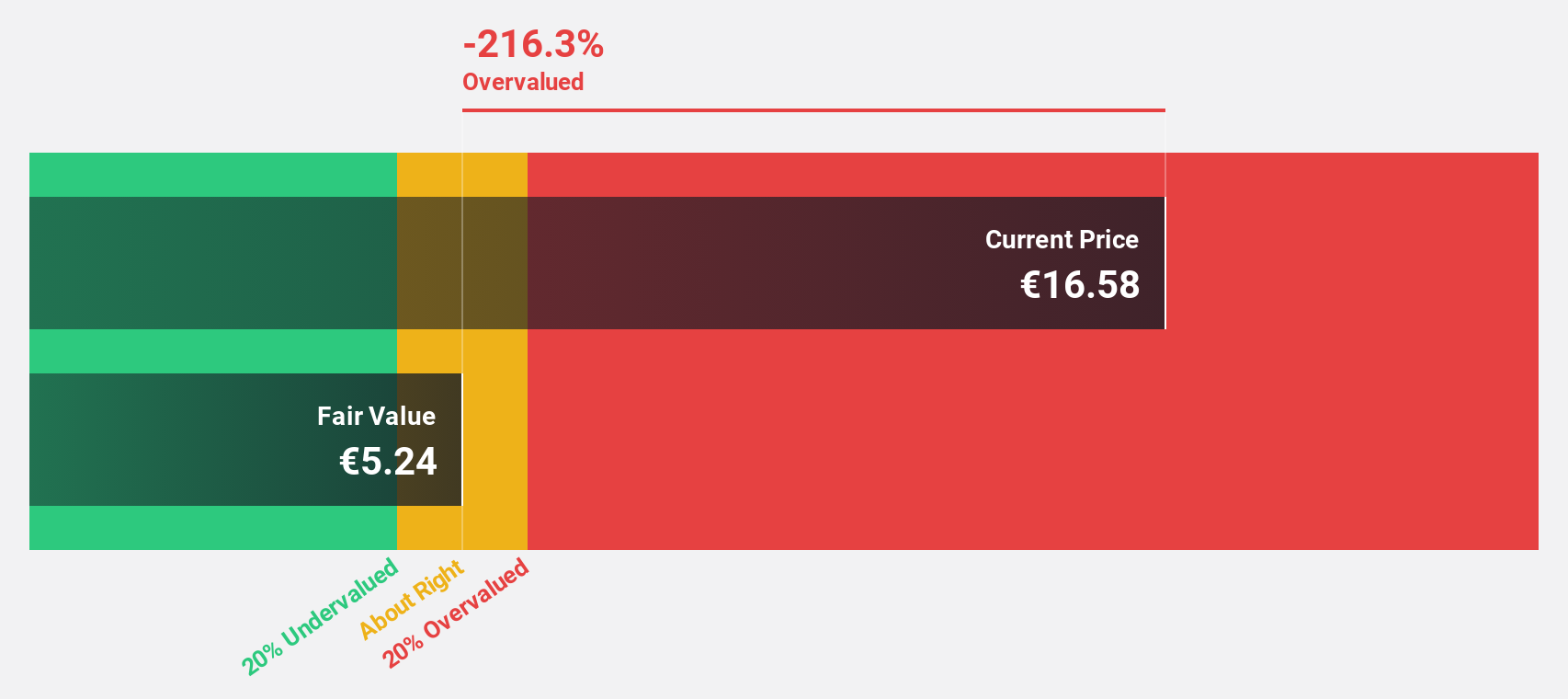

Fincantieri (BIT:FCT)

Overview: Fincantieri S.p.A. is a global player in the shipbuilding industry with a market cap of €2.38 billion.

Operations: The company's revenue segments include Shipbuilding (€5.92 billion), Offshore and Specialized Vessels (€1.17 billion), and Equipment, Systems and Infrastructure (€1.21 billion).

Estimated Discount To Fair Value: 32.1%

Fincantieri is trading at €7.38, significantly below its estimated fair value of €10.87, suggesting it may be undervalued based on discounted cash flow analysis. Despite past shareholder dilution, the company is expected to achieve profitability within three years with earnings forecasted to grow 77.82% annually. Although revenue growth is slower than 20% per year, strategic partnerships like the one with Lloyds Engineering Works Limited could enhance future prospects in defense manufacturing and contribute to sustainable growth.

- Our expertly prepared growth report on Fincantieri implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Fincantieri here with our thorough financial health report.

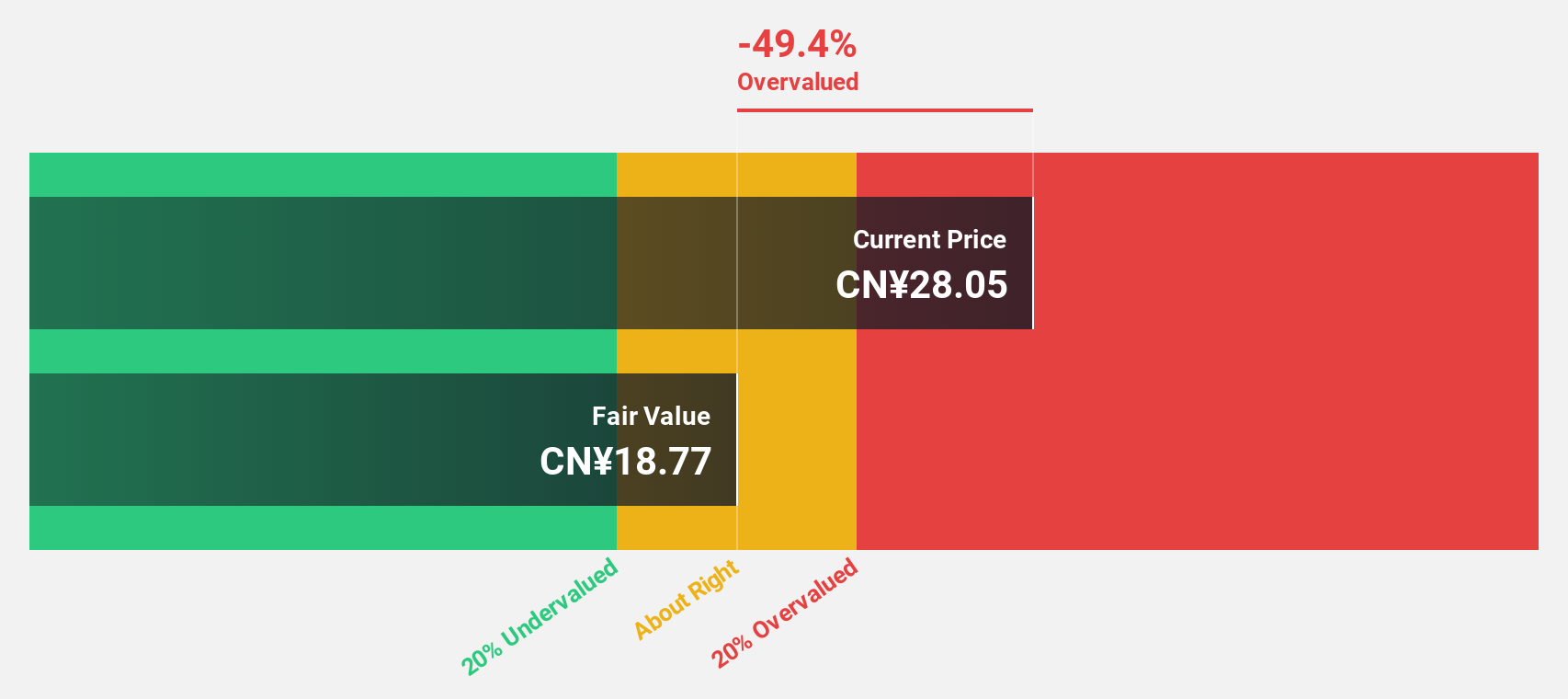

Suzhou Alton Electrical & Mechanical Industry (SZSE:301187)

Overview: Suzhou Alton Electrical & Mechanical Industry Co., Ltd. operates in the electrical and mechanical sector and has a market cap of CN¥6.55 billion.

Operations: I apologize, but it seems that the revenue segment details for Suzhou Alton Electrical & Mechanical Industry Co., Ltd. are missing from the provided text. If you can provide those details, I would be happy to help summarize them for you.

Estimated Discount To Fair Value: 19.1%

Suzhou Alton Electrical & Mechanical Industry is trading at CNY 36.2, below its fair value estimate of CNY 44.72, indicating potential undervaluation based on cash flows. The company reported strong earnings growth of 54.9% last year and forecasts suggest revenue will grow by over 20% annually, outpacing market expectations. However, its dividend yield of 2.76% lacks coverage from earnings or free cash flows, and future return on equity is projected to be modest at around 19.8%.

- The analysis detailed in our Suzhou Alton Electrical & Mechanical Industry growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Suzhou Alton Electrical & Mechanical Industry stock in this financial health report.

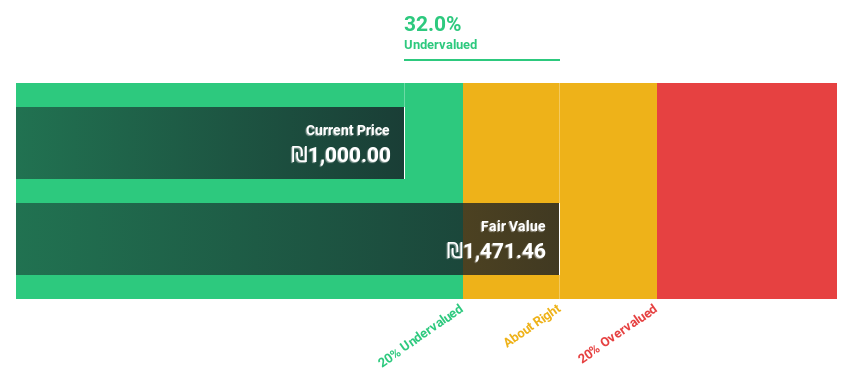

Elbit Systems (TASE:ESLT)

Overview: Elbit Systems Ltd. is a company that develops and supplies a range of systems and products for defense, homeland security, and commercial aviation across various global markets, with a market cap of ₪43.29 billion.

Operations: The company's revenue is primarily derived from its Aerospace segment at $1.90 billion, followed by Land systems at $1.57 billion, ESA at $1.56 billion, ISTAR and EW at $1.29 billion, and C4I and Cyber solutions contributing $786.72 million.

Estimated Discount To Fair Value: 33.5%

Elbit Systems, trading at ₪972.4, is undervalued with a fair value estimate of ₪1461.25. The company expects significant earnings growth over 20% annually, surpassing the Israeli market's average. Recent contracts totaling $637 million enhance its revenue outlook and cash flow potential, supporting its valuation case. Despite slower revenue growth than 20% per year, Elbit's strategic acquisitions and robust defense solutions position it well for future profitability improvements in a competitive market environment.

- The growth report we've compiled suggests that Elbit Systems' future prospects could be on the up.

- Take a closer look at Elbit Systems' balance sheet health here in our report.

Summing It All Up

- Investigate our full lineup of 890 Undervalued Stocks Based On Cash Flows right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Fincantieri, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:FCT

Undervalued with reasonable growth potential.