High Growth Tech Stocks Including None With Promising Potential

Reviewed by Simply Wall St

As global markets navigate mixed performances with the S&P 500 and Nasdaq Composite achieving significant annual gains, investors face a landscape marked by economic uncertainties such as declining manufacturing activity in the U.S. and China, alongside adjustments in GDP forecasts. In this environment, identifying high-growth tech stocks involves assessing companies that can demonstrate resilience through innovation and adaptability to shifting market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1258 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Wiit (BIT:WIIT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wiit S.p.A. is a company that offers cloud services to businesses both in Italy and internationally, with a market capitalization of €508.48 million.

Operations: Wiit S.p.A. specializes in providing cloud services to businesses across Italy and internationally. The company focuses on delivering tailored solutions that cater to the specific needs of its clients, leveraging advanced technology to support business operations.

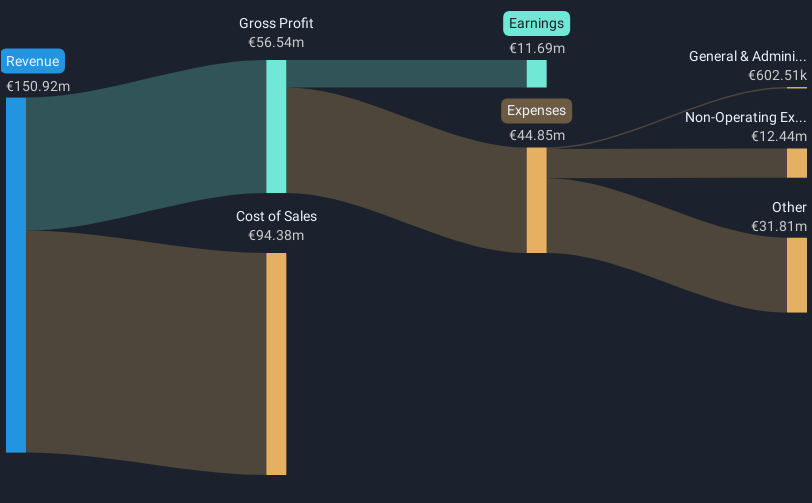

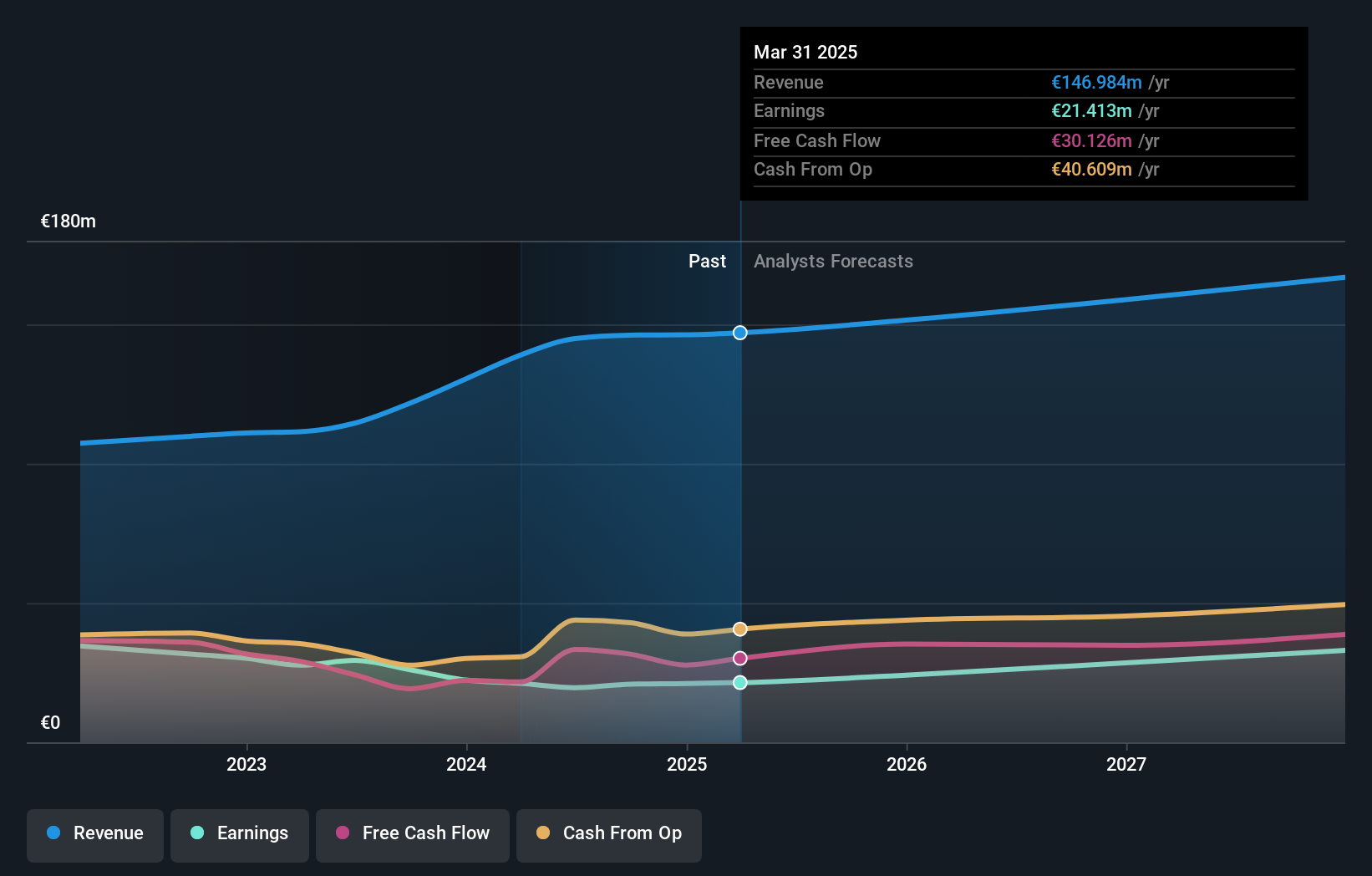

Wiit's recent performance underscores its robust position in the tech sector, with a notable increase in sales to EUR 112.19 million and net income rising to EUR 10.19 million over nine months. This growth trajectory is complemented by a projected annual revenue increase of 7.4% and earnings growth of 28.42%, outpacing the Italian market averages significantly. The company's commitment to innovation is evident from its R&D investments, aligning with industry trends towards enhanced digital infrastructure services. Moreover, Wiit's strategic focus has led to earnings growth surpassing the IT industry average by 12.7 percentage points last year, positioning it well for sustained competitive advantage in an evolving market landscape.

F-Secure Oyj (HLSE:FSECURE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: F-Secure Oyj is a cybersecurity company that provides security solutions in Finland and internationally, with a market capitalization of €315.81 million.

Operations: The company generates revenue primarily through its Consumer Security segment, which accounted for €146.13 million.

F-Secure Oyj, navigating through a challenging tech landscape, reported an uptick in sales to EUR 109.22 million from EUR 93.46 million year-over-year, despite a slight dip in net income from EUR 19.15 million to EUR 17.66 million over the same period. This performance is underpinned by a steady revenue growth forecast at 3.6% annually, slightly outpacing the Finnish market's 2.7%. However, its earnings growth forecast at approximately 16% annually highlights potential for improvement against a backdrop of an industry grappling with faster-paced changes. The company's R&D focus remains robust but requires alignment with broader industry innovations to harness higher growth trajectories effectively.

- Unlock comprehensive insights into our analysis of F-Secure Oyj stock in this health report.

Examine F-Secure Oyj's past performance report to understand how it has performed in the past.

Global Security Experts (TSE:4417)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Global Security Experts Inc. is a cybersecurity education company based in Japan with a market capitalization of ¥39.57 billion.

Operations: Global Security Experts Inc. primarily focuses on providing cybersecurity education services within Japan. The company's revenue model is centered around educational programs and training solutions designed to enhance cybersecurity awareness and skills.

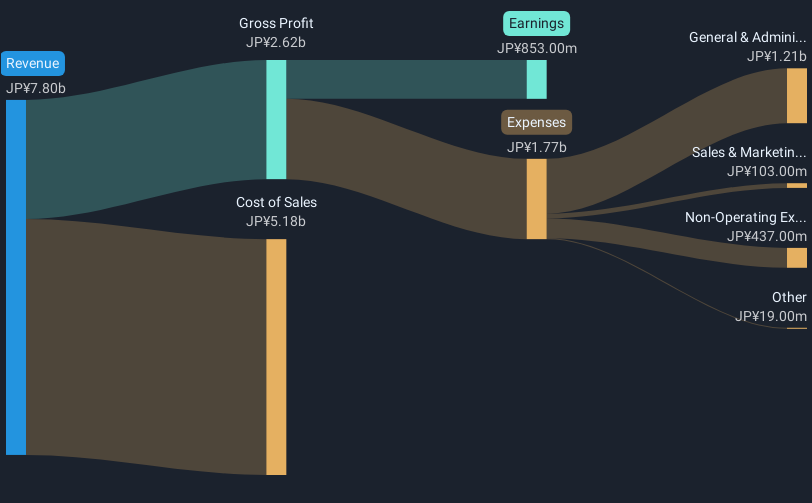

Global Security Experts stands out in the tech sector with a robust annual revenue growth rate of 17.1%, surpassing the Japanese market's average of 4.2%. This performance is complemented by an impressive earnings increase, projected at 26.3% annually, which notably exceeds Japan's market growth rate of 7.8%. The company also demonstrates a commitment to innovation with substantial R&D investments that have fueled its earnings growth by 40.1% over the past year, significantly outpacing the IT industry's growth of 10.3%. These financial indicators, coupled with a forecasted Return on Equity of an exceptional 42.4% in three years, position Global Security Experts as a formidable entity within high-tech sectors, despite its high debt levels and volatile share price movements recently.

- Click here and access our complete health analysis report to understand the dynamics of Global Security Experts.

Gain insights into Global Security Experts' past trends and performance with our Past report.

Summing It All Up

- Navigate through the entire inventory of 1258 High Growth Tech and AI Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wiit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:WIIT

Wiit

Provides cloud services for various businesses in Italy and internationally.

High growth potential with solid track record.

Market Insights

Community Narratives