As European markets rebound, buoyed by the ECB's rate cuts and a delay in U.S. tariff hikes, investors are increasingly eyeing opportunities in smaller-cap stocks that have shown resilience amid broader market fluctuations. In this environment, identifying stocks with strong fundamentals and growth potential can be key to enhancing your portfolio's performance.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nederman Holding | 69.60% | 11.43% | 16.35% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Decora | 20.76% | 12.61% | 12.54% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Viohalco | 91.31% | 12.25% | 17.37% | ★★★★☆☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

| BAUER | 78.29% | 4.31% | nan | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Caltagirone (BIT:CALT)

Simply Wall St Value Rating: ★★★★★★

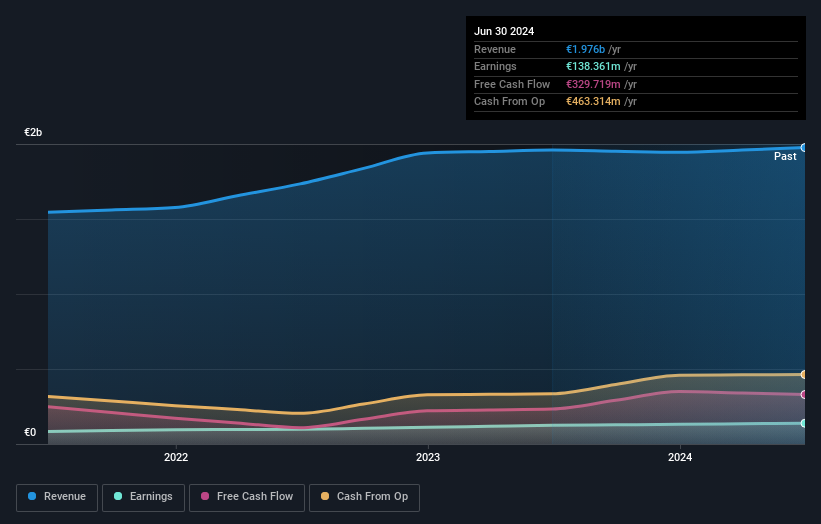

Overview: Caltagirone SpA operates through its subsidiaries in sectors such as cement manufacturing, media, real estate, and publishing, with a market capitalization of approximately €821.62 million.

Operations: Caltagirone generates significant revenue from its Cement, Concrete and Aggregates segment, amounting to €1.64 billion. The Publishing and Constructions segments contribute €112.65 million and €186.77 million, respectively. Management of Properties adds another €35.27 million to the revenue stream.

Caltagirone, a notable player in Europe's market landscape, stands out with its impressive financial health. The company has more cash than total debt and reduced its debt-to-equity ratio from 35.8% to 9.9% over the past five years, showcasing prudent financial management. Its earnings grew by 10.5%, outpacing the Basic Materials industry's -6.4%, indicating robust performance amidst sector challenges. Trading at 90% below estimated fair value suggests potential undervaluation opportunities for investors seeking growth prospects in this space. Additionally, Caltagirone announced an annual dividend of €0.27 per share, reflecting confidence in future profitability and shareholder returns.

- Click here and access our complete health analysis report to understand the dynamics of Caltagirone.

Gain insights into Caltagirone's historical performance by reviewing our past performance report.

GVS (BIT:GVS)

Simply Wall St Value Rating: ★★★★★☆

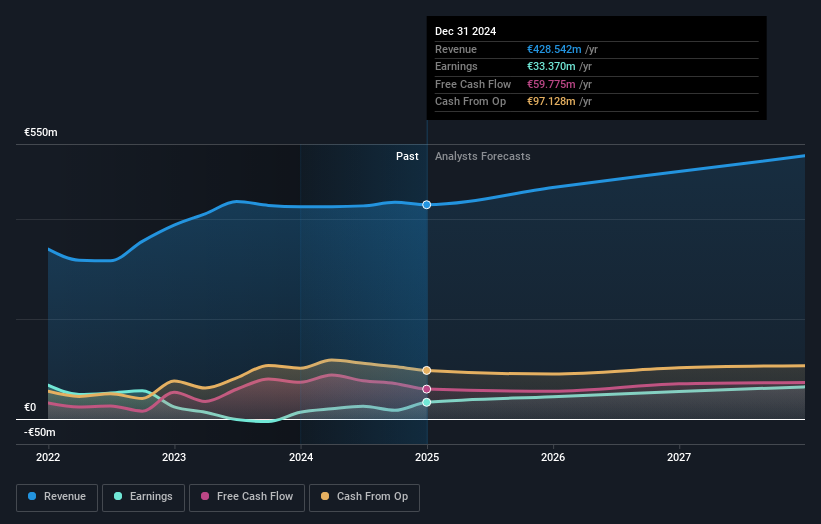

Overview: GVS S.p.A. is a company that, along with its subsidiaries, specializes in producing and selling filter solutions for the healthcare and life sciences, energy and mobility, and health and safety sectors both in Italy and globally, with a market cap of approximately €783.84 million.

Operations: GVS generates revenue primarily from its Plastics & Rubber segment, amounting to €428.54 million. The company's financial performance is influenced by its ability to manage costs within this key segment.

GVS, a noteworthy player in the machinery sector, has shown impressive earnings growth of 144.5% over the past year, outpacing the industry's -17.2%. The company's net debt to equity ratio stands at a satisfactory 37.5%, down from 163.7% five years ago, indicating improved financial health. Despite a large one-off loss of €18.8M impacting recent results, GVS's interest payments are well covered by EBIT with a coverage of 3.8x and it trades at 1.4% below estimated fair value, suggesting potential for value realization as earnings are forecast to grow annually by 20.94%.

STIF Société anonyme (ENXTPA:ALSTI)

Simply Wall St Value Rating: ★★★★☆☆

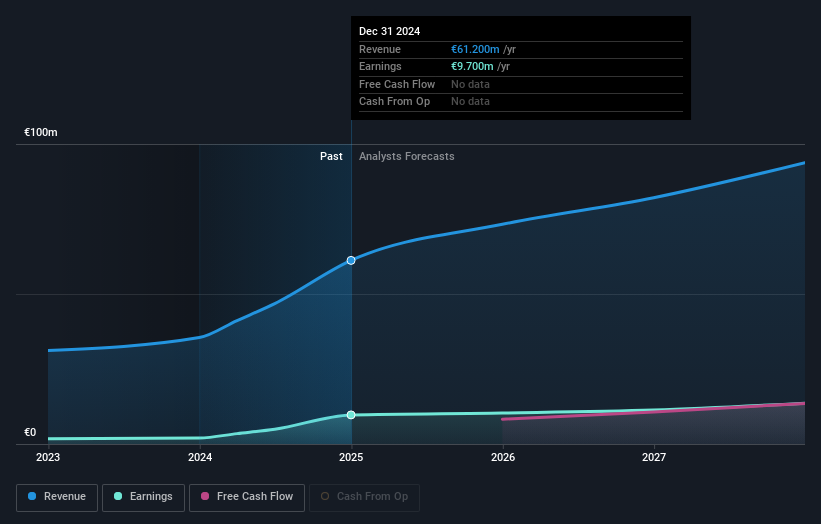

Overview: STIF Société anonyme manufactures and sells components for the handling of bulk products in France, with a market cap of €241.37 million.

Operations: STIF Société anonyme generates revenue through the sale of components for handling bulk products. The company's market capitalization is €241.37 million, reflecting its valuation in the market.

STIF Société anonyme, a smaller player in the European market, has shown impressive growth with sales reaching €61.2 million for 2024, up from €35.5 million the previous year. Net income also saw a significant jump to €9.7 million from €2 million, showcasing robust performance. The company announced an annual dividend of €0.59 per share payable in June 2025, reflecting strong financial health and shareholder value focus. Despite its size, STIF's recent earnings surge and attractive valuation suggest potential for continued growth within its sector while maintaining investor interest through strategic dividends.

- Navigate through the intricacies of STIF Société anonyme with our comprehensive health report here.

Evaluate STIF Société anonyme's historical performance by accessing our past performance report.

Next Steps

- Take a closer look at our European Undiscovered Gems With Strong Fundamentals list of 359 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:GVS

GVS

Produces and sells filter solutions for applications in the healthcare and life sciences, energy and mobility, and health and safety sectors in Italy and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives