- France

- /

- Professional Services

- /

- ENXTPA:CEN

Exploring Europe's Undiscovered Gems In May 2025

Reviewed by Simply Wall St

As Europe navigates a complex economic landscape marked by easing trade tensions and fluctuating business activity, the pan-European STOXX Europe 600 Index has recently seen a notable rise, reflecting optimism in the market. In this environment, identifying stocks that demonstrate resilience and potential for growth can be particularly rewarding, especially those that are well-positioned to benefit from current economic trends and geopolitical shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Decora | 20.76% | 12.61% | 12.54% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Viohalco | 91.31% | 12.25% | 17.37% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Pharmanutra (BIT:PHN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pharmanutra S.p.A. is a pharmaceutical and nutraceutical company that focuses on researching, designing, developing, and marketing nutritional supplements and medical devices across Italy and various international regions, with a market cap of €516.65 million.

Operations: Pharmanutra generates revenue primarily from the Italian market (€70.24 million) and international markets (€39.34 million), with a smaller contribution from Akern (€5.92 million). The company's market cap is €516.65 million, reflecting its significant presence in both domestic and foreign markets.

Pharmanutra, a nimble player in the personal products sector, has been making waves with its impressive earnings growth of 29.4% over the past year, outpacing the industry average of 10.3%. The company boasts high-quality earnings and maintains a robust financial position with interest payments well covered by EBIT at 72 times. Despite an increase in its debt-to-equity ratio from 20.1% to 36.3% over five years, Pharmanutra holds more cash than total debt, indicating solid fiscal health. Recent events include a dividend announcement of €1 per share and participation in the Euronext Milan STAR Conference, highlighting active shareholder engagement and market presence.

- Navigate through the intricacies of Pharmanutra with our comprehensive health report here.

Examine Pharmanutra's past performance report to understand how it has performed in the past.

Groupe CRIT (ENXTPA:CEN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Groupe CRIT SA operates in the temporary work and recruitment services sector both in France and internationally, with a market capitalization of approximately €716.55 million.

Operations: Groupe CRIT generates revenue primarily from its Temporary Work segment, contributing €2.60 billion, and its Multiservices segment, which includes Airport Services at €422.80 million and Other Services at €130.30 million. The company experienced a reduction in revenue due to BU eliminations amounting to -€33.80 million.

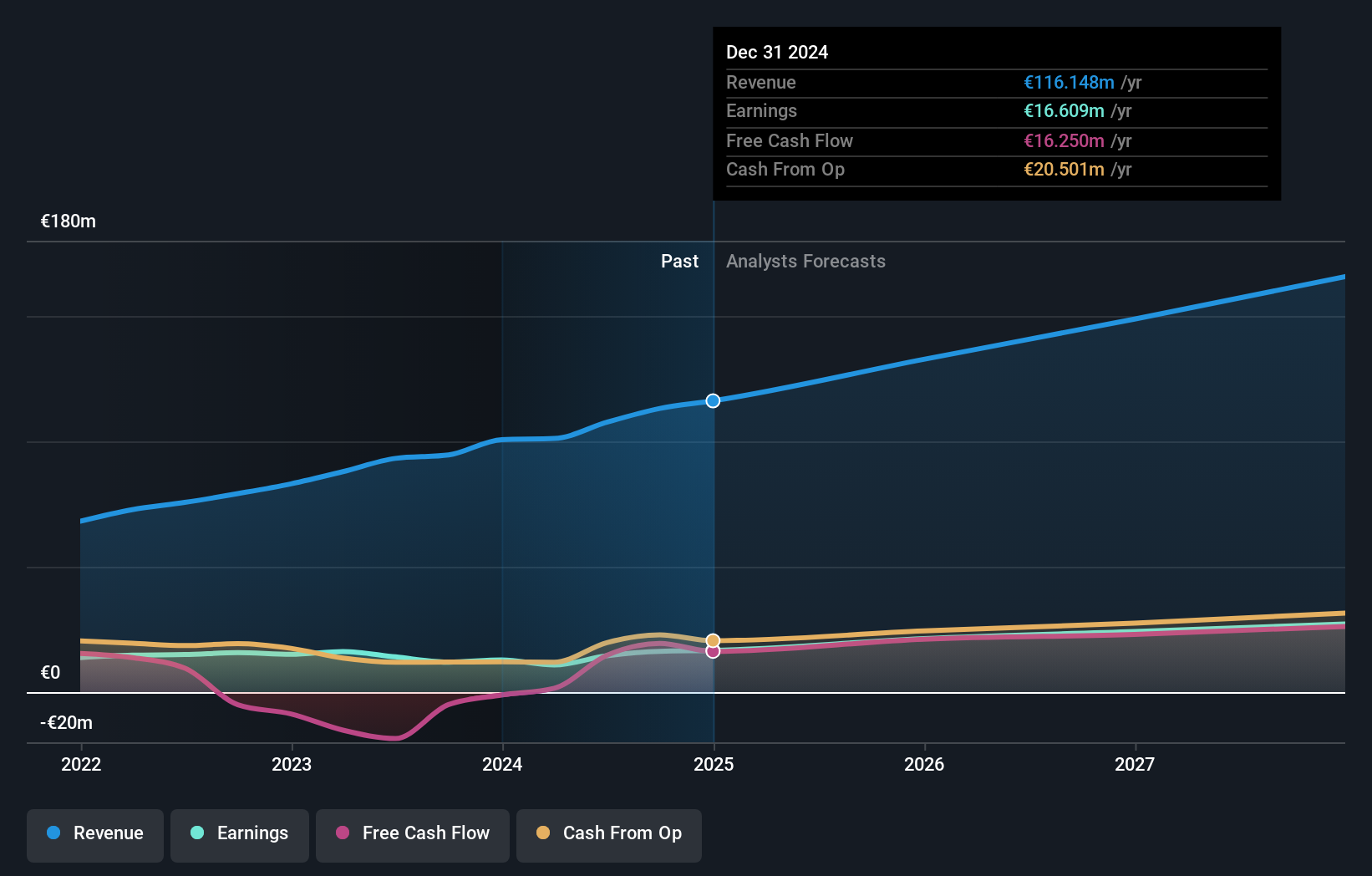

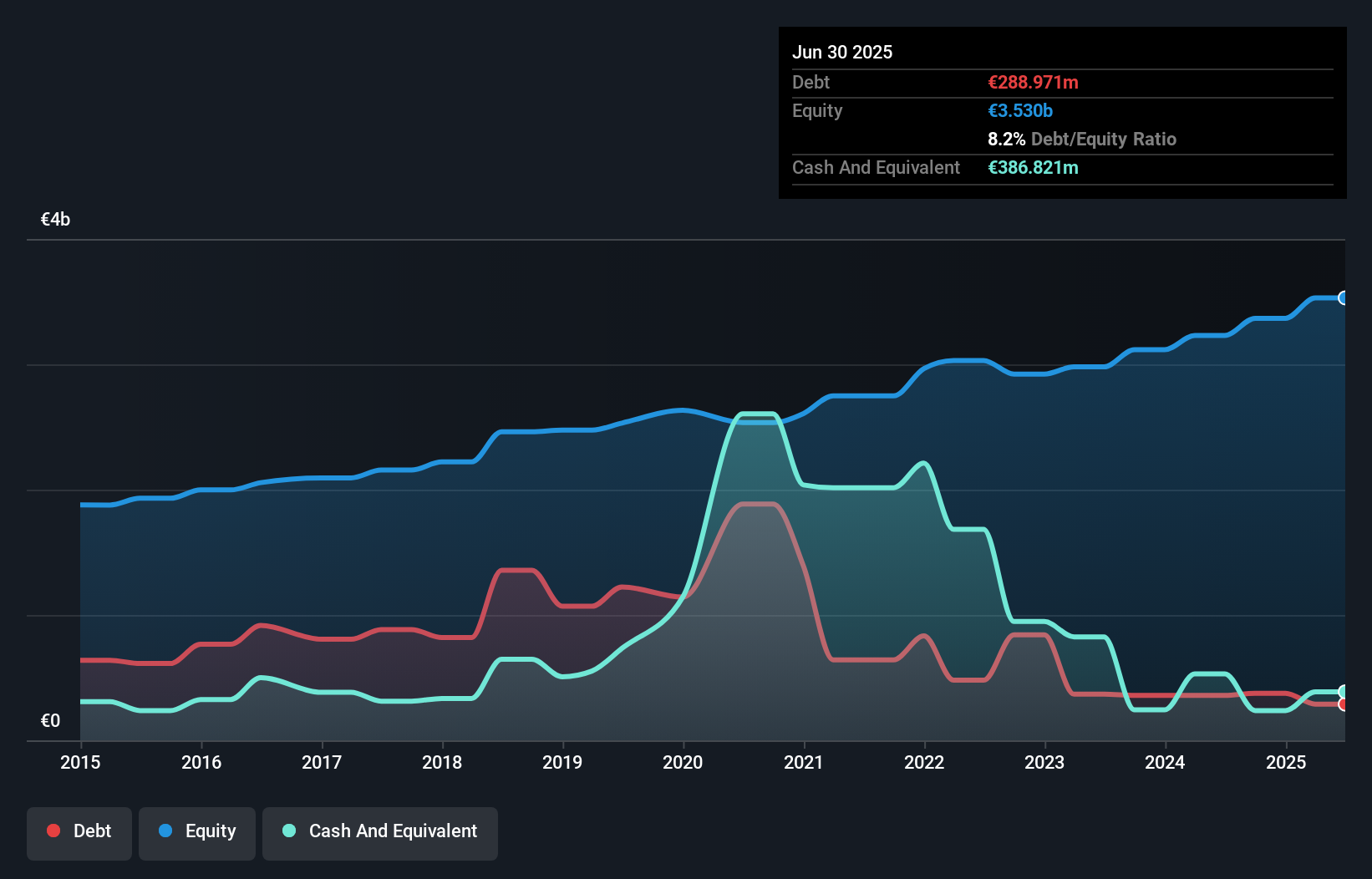

With earnings growth of 0.3% over the past year, Groupe CRIT is outpacing its industry, which saw an -18.3% change. Despite a debt to equity ratio rising from 5.3 to 30.6 over five years, the company holds more cash than total debt, indicating financial stability. Trading at a significant discount of 66.6% below estimated fair value suggests potential for appreciation in share price. Recent full-year results show sales climbing to €3,124 million from €2,536 million and net income slightly increasing to €73 million from €72.8 million last year, reflecting steady performance amid market challenges.

- Take a closer look at Groupe CRIT's potential here in our health report.

Assess Groupe CRIT's past performance with our detailed historical performance reports.

Caisse Régionale de Crédit Agricole Mutuel Sud Rhône Alpes (ENXTPA:CRSU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Caisse Régionale de Crédit Agricole Mutuel Sud Rhône Alpes offers a range of banking products and services in France, with a market capitalization of approximately €641.12 million.

Operations: CRSU generates revenue primarily from its banking sector, amounting to €394.61 million. The company's financial performance is influenced by its net profit margin, which stands at 19.5%.

Caisse Régionale de Crédit Agricole Mutuel Sud Rhône Alpes, with assets totaling €27.4B and equity of €3.4B, is a financial entity that stands out for its robust health and value proposition. The bank's total deposits are €23.1B against loans of €23.0B, indicating balanced operations supported by low-risk funding sources comprising 96% customer deposits. Its allowance for bad loans is low at 82%, while non-performing loans remain appropriate at 1.5%. Despite earnings growing at 7.6% annually over five years, recent growth of 3.2% lagged behind the industry average of 6.2%. Trading significantly below estimated fair value enhances its appeal in the market landscape.

- Delve into the full analysis health report here for a deeper understanding of Caisse Régionale de Crédit Agricole Mutuel Sud Rhône Alpes.

Learn about Caisse Régionale de Crédit Agricole Mutuel Sud Rhône Alpes' historical performance.

Seize The Opportunity

- Click here to access our complete index of 345 European Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CEN

Groupe CRIT

Provides temporary staffing and recruitment services in France and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives