As global markets navigate a complex landscape marked by cautious Federal Reserve commentary and political uncertainties, investors are keenly observing the effects of rate adjustments and economic data on stock performance. Despite recent declines in major indices, opportunities may exist for discerning investors to identify undervalued stocks that could offer potential value amid these fluctuations. In such an environment, a good stock often exhibits strong fundamentals and resilience against broader market volatility, making it an attractive prospect for those seeking discounted opportunities.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Round One (TSE:4680) | ¥1310.00 | ¥2607.13 | 49.8% |

| Xiamen Bank (SHSE:601187) | CN¥5.69 | CN¥11.34 | 49.8% |

| Lindab International (OM:LIAB) | SEK226.40 | SEK450.98 | 49.8% |

| Absolent Air Care Group (OM:ABSO) | SEK255.00 | SEK509.76 | 50% |

| NCSOFT (KOSE:A036570) | ₩205500.00 | ₩409953.04 | 49.9% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| STIF Société anonyme (ENXTPA:ALSTI) | €24.60 | €49.15 | 49.9% |

| Informa (LSE:INF) | £7.992 | £15.92 | 49.8% |

| Surgical Science Sweden (OM:SUS) | SEK159.10 | SEK317.10 | 49.8% |

| Nanjing King-Friend Biochemical PharmaceuticalLtd (SHSE:603707) | CN¥13.24 | CN¥26.38 | 49.8% |

We're going to check out a few of the best picks from our screener tool.

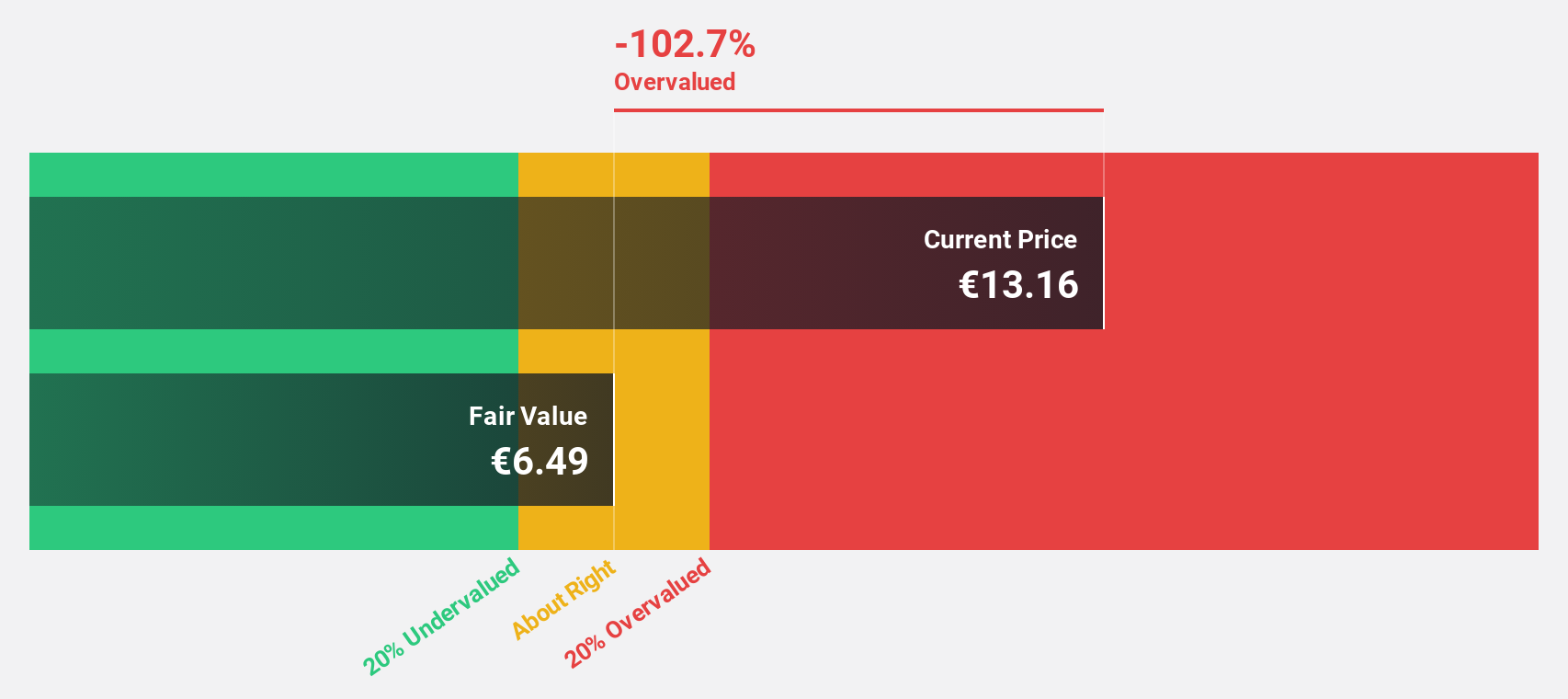

GPI (BIT:GPI)

Overview: GPI S.p.A. specializes in social-healthcare IT and hi-tech services for healthcare markets both in Italy and internationally, with a market cap of €296.75 million.

Operations: The company's revenue is primarily derived from Software (€283.27 million) and Care (€161.11 million) segments in the healthcare IT and hi-tech services sector.

Estimated Discount To Fair Value: 18.6%

GPI's recent financial performance shows a strong turnaround, with net income reaching €85.9 million from a previous loss, driven by increased sales of €230.5 million. The stock trades at €10.3, below its estimated fair value of €12.65, indicating potential undervaluation based on cash flows despite low forecasted ROE and insufficient earnings coverage for interest payments. Earnings are expected to grow significantly at 35.2% annually, outpacing the Italian market growth rate.

- According our earnings growth report, there's an indication that GPI might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of GPI.

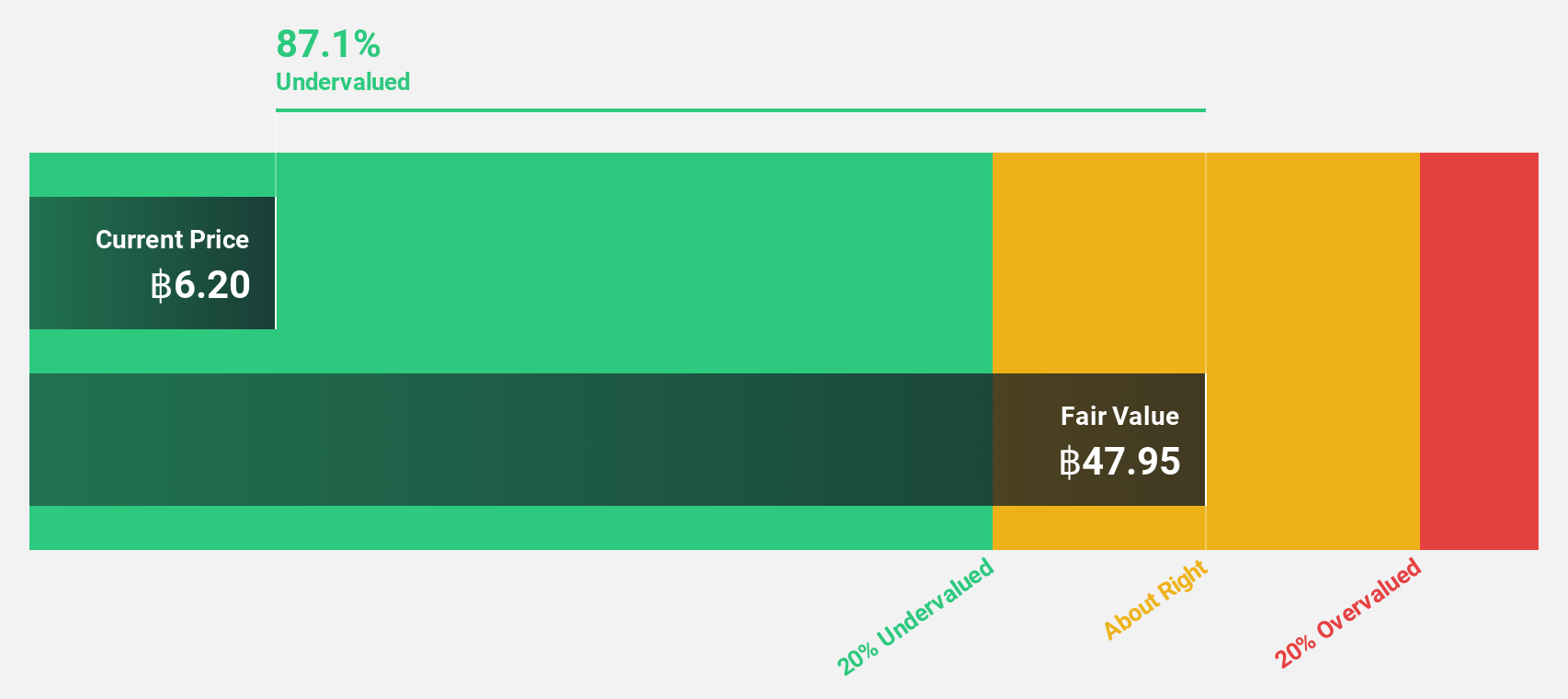

Pluk Phak Praw Rak Mae (SET:OKJ)

Overview: Pluk Phak Praw Rak Mae Public Company Limited specializes in cultivating organic vegetables and fruits in Thailand with a market cap of THB8.89 billion.

Operations: The company's revenue is primarily derived from its restaurant business, which generates THB2.25 billion.

Estimated Discount To Fair Value: 49.8%

Pluk Phak Praw Rak Mae's stock, following its recent IPO raising THB 1.07 billion, is trading at THB 15.5, significantly below its estimated fair value of THB 30.86. This suggests it may be undervalued based on cash flows. The company forecasts robust revenue growth of 22.6% annually and earnings growth of 23.5%, both outpacing the Thai market averages despite a volatile share price and modest future return on equity projections at 15.7%.

- Our expertly prepared growth report on Pluk Phak Praw Rak Mae implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Pluk Phak Praw Rak Mae with our comprehensive financial health report here.

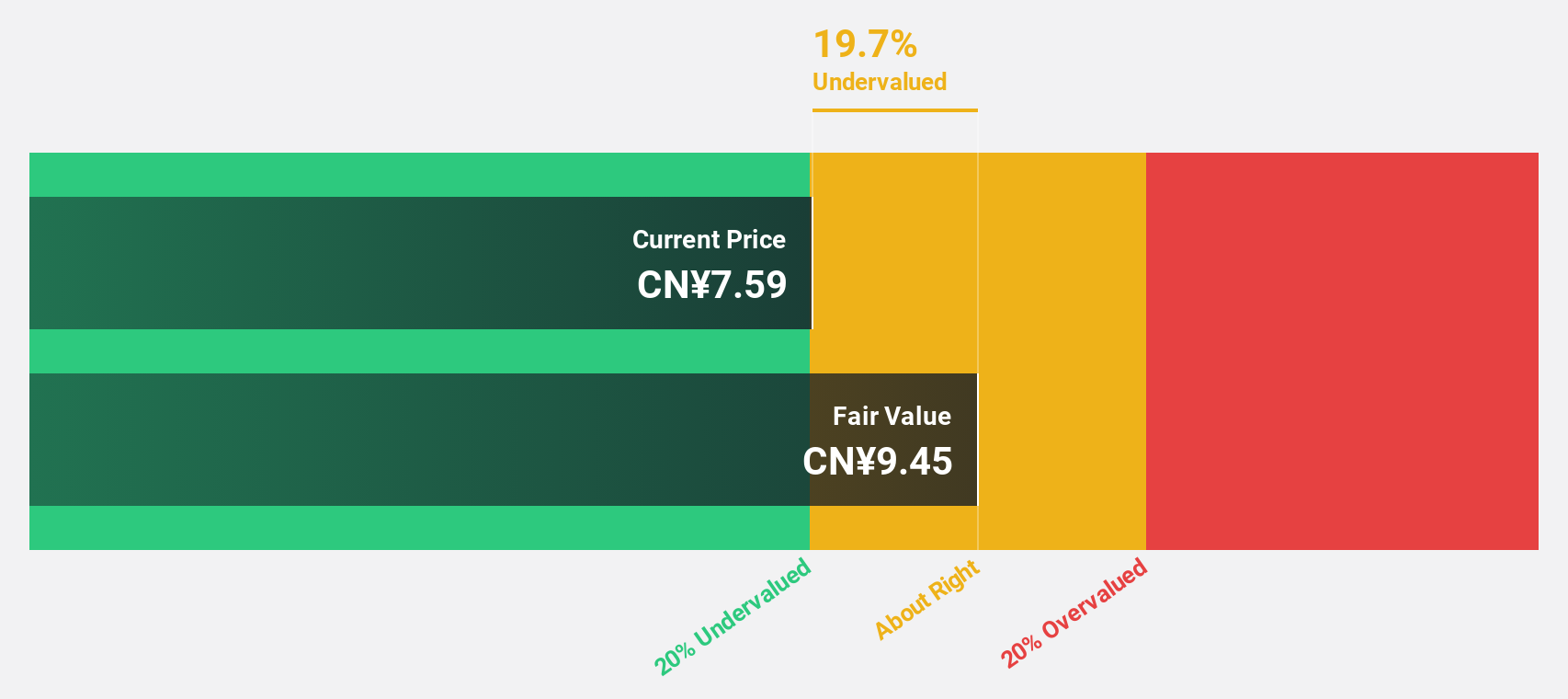

Xiamen Bank (SHSE:601187)

Overview: Xiamen Bank Co., Ltd. offers a range of banking products and services to individuals, corporate customers, and small and micro finance businesses, with a market cap of CN¥14.94 billion.

Operations: Xiamen Bank generates revenue through its diverse offerings, including banking products and services tailored for individuals, corporate clients, as well as small and micro finance enterprises.

Estimated Discount To Fair Value: 49.8%

Xiamen Bank is trading at CN¥5.69, significantly below its estimated fair value of CN¥11.34, highlighting potential undervaluation based on cash flows. The bank's earnings are forecasted to grow 26.36% annually, surpassing the Chinese market average of 25.5%. Despite a decline in net interest income for the nine months ending September 2024, net income increased to CN¥720.44 million in Q3 from CN¥635.04 million a year ago, reflecting strong operational performance amidst market challenges.

- Our growth report here indicates Xiamen Bank may be poised for an improving outlook.

- Take a closer look at Xiamen Bank's balance sheet health here in our report.

Key Takeaways

- Delve into our full catalog of 870 Undervalued Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601187

Xiamen Bank

Provides various banking products and services to individuals, corporate customers, and small and micro finance businesses.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives