- Italy

- /

- Healthcare Services

- /

- BIT:AMP

Taking a Fresh Look at Amplifon (BIT:AMP) Valuation After Recent Share Price Stability

Reviewed by Simply Wall St

Most Popular Narrative: 22.9% Undervalued

The leading narrative sees Amplifon as undervalued at today's price, suggesting that the company’s fundamentals are not fully reflected in its current valuation.

Structural demand drivers, industry consolidation, and regulatory support position Amplifon for accelerated growth, increased market share, and long-term profitability gains. Cost-reduction initiatives and technological innovation are expected to enhance margins, improve operational efficiency, and broaden customer appeal.

Curious how Amplifon's margin expansion ambitions are shaping big expectations? There is a specific forecast here that could completely change your perspective on what drives its valuation. Find out which future profit leap and a market-beating financial assumption could justify this price surge. What hidden numbers are behind this bullish narrative?

Result: Fair Value of €20.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slowing organic sales and Amplifon's heavy dependence on Southern Europe could challenge the bullish outlook if market recovery takes longer than expected.

Find out about the key risks to this Amplifon narrative.Another View: Market-Based Valuation

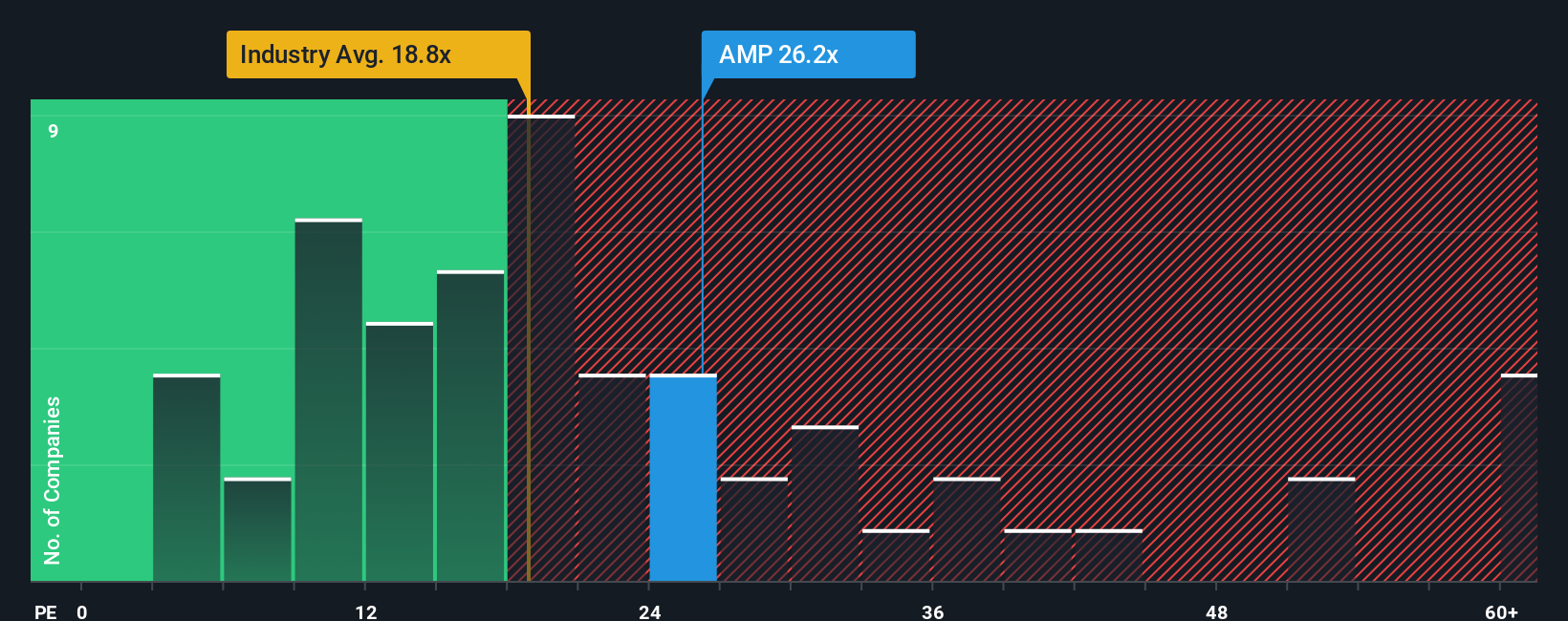

Looking at Amplifon's value from a market angle, its current share price appears expensive compared to the broader European healthcare sector. This approach challenges the narrative that the stock is undervalued right now. Could these industry comparisons reveal risks that the pure growth story might be missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amplifon Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your Amplifon research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Standout Investment Opportunities?

Smart investors never settle for yesterday’s gains. Take control of your wealth by uncovering fast-moving stocks and big opportunities others might overlook and grab your investing edge now.

- Supercharge your returns with stocks offering impressive yields and sustainable payout ratios by using our dividend stocks with yields > 3% to spot the most reliable income sources.

- Fuel your portfolio with cutting-edge technology by tapping into AI penny stocks, where trailblazers are driving innovation in artificial intelligence and automation.

- Zero in on hidden bargains across global markets and hunt for stocks trading below their true value thanks to our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About BIT:AMP

Amplifon

Engages in the distribution of hearing solutions and the fitting of customized products that helps people to rediscover various emotions of sound in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Good value average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)