- Italy

- /

- Healthcare Services

- /

- BIT:AMP

Amplifon S.p.A.'s (BIT:AMP) largest shareholders are private companies who were rewarded as market cap surged €163m last week

Key Insights

- Significant control over Amplifon by private companies implies that the general public has more power to influence management and governance-related decisions

- A total of 4 investors have a majority stake in the company with 51% ownership

- Institutional ownership in Amplifon is 27%

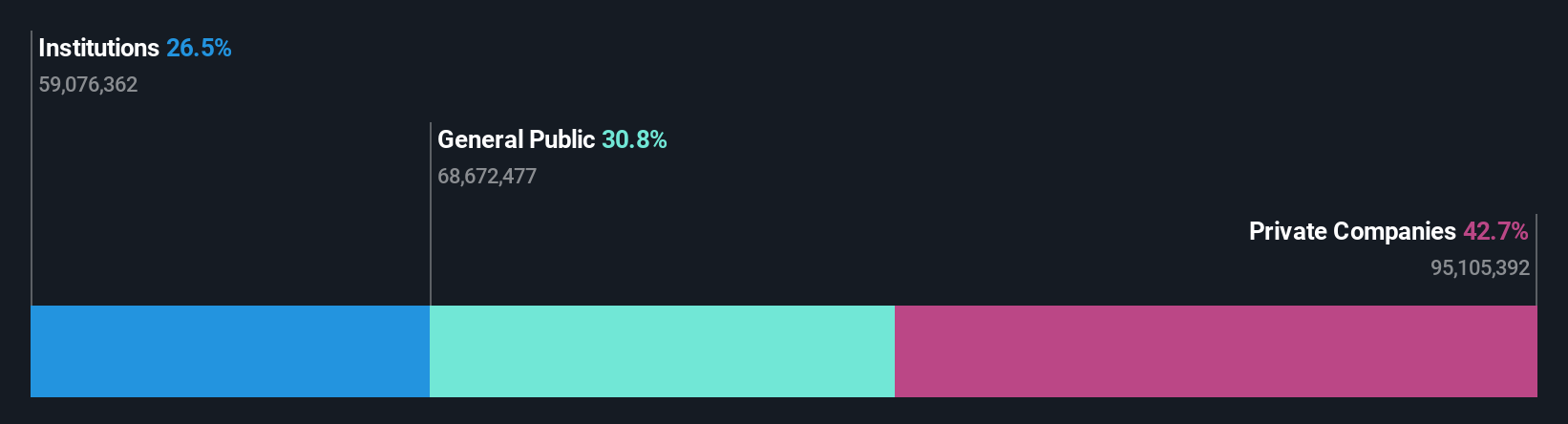

If you want to know who really controls Amplifon S.p.A. (BIT:AMP), then you'll have to look at the makeup of its share registry. And the group that holds the biggest piece of the pie are private companies with 43% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

As a result, private companies were the biggest beneficiaries of last week’s 5.2% gain.

In the chart below, we zoom in on the different ownership groups of Amplifon.

See our latest analysis for Amplifon

What Does The Institutional Ownership Tell Us About Amplifon?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

We can see that Amplifon does have institutional investors; and they hold a good portion of the company's stock. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Amplifon's earnings history below. Of course, the future is what really matters.

Hedge funds don't have many shares in Amplifon. Our data shows that Ampliter N.V. is the largest shareholder with 43% of shares outstanding. Meanwhile, the second and third largest shareholders, hold 3.4% and 2.3%, of the shares outstanding, respectively.

On looking further, we found that 51% of the shares are owned by the top 4 shareholders. In other words, these shareholders have a meaningful say in the decisions of the company.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of Amplifon

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

We note our data does not show any board members holding shares, personally. Not all jurisdictions have the same rules around disclosing insider ownership, and it is possible we have missed something, here. So you can click here learn more about the CEO.

General Public Ownership

The general public, who are usually individual investors, hold a 31% stake in Amplifon. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Company Ownership

It seems that Private Companies own 43%, of the Amplifon stock. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Amplifon better, we need to consider many other factors. For example, we've discovered 3 warning signs for Amplifon (1 is significant!) that you should be aware of before investing here.

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:AMP

Amplifon

Engages in the distribution of hearing solutions and the fitting of customized products that helps people to rediscover various emotions of sound in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Good value average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)