- Italy

- /

- Energy Services

- /

- BIT:SPM

A Look at Saipem (BIT:SPM) Valuation After Strong Q3 Profit Growth and New Contract Wins

Reviewed by Simply Wall St

Saipem (BIT:SPM) just posted a 29% increase in third-quarter adjusted core profit, along with confirmation of its full-year profit guidance and the award of 3.2 billion euros in new contracts. These results highlight the company’s ongoing operational strength and new business activity, even with oil market headwinds present.

See our latest analysis for Saipem.

While Saipem has delivered a steady stream of positive business updates, including major contract wins and a focus on innovative tech, the share price has had a tough year, falling more than 15% year-to-date. That said, long-term investors have seen an impressive 152% total shareholder return over the past three years. This points to significant outperformance even as near-term momentum remains subdued.

If Saipem’s story has you wondering what other opportunities might be out there, now’s your chance to discover fast growing stocks with high insider ownership.

With shares down this year and strong profit growth, along with an analyst price target nearly 36% higher than today’s close, the question for investors now is whether Saipem is undervalued or if the market has already priced in brighter prospects.

Most Popular Narrative: 27% Undervalued

With Saipem shares recently closing at €2.26 and the most-widely followed narrative assigning fair value around €3.09, the gap is striking. This sets up a story where market skepticism meets bullish long-term projections. Let’s look at one of the key drivers behind this stance.

A record-high, well-diversified order backlog and robust commercial pipeline (€53 billion) provide strong revenue visibility into 2025 and 2026, positioning Saipem to benefit from global energy infrastructure demand driven by population growth, urbanization, and heightened focus on energy security. These factors support sustained revenue growth.

Want to know what goes into building conviction about Saipem? The narrative is shaped by ambitious earnings and margin ambitions, banking on big industry tailwinds and operational transformation. Unpack the numbers and see what’s driving this fair value target. What if it’s the start of a bigger industry shift?

Result: Fair Value of €3.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

Still, lingering legacy contract risks and intense competition could disrupt Saipem’s positive momentum and pose challenges to the earnings growth story analysts expect.

Find out about the key risks to this Saipem narrative.

Another View: Multiples Paint a Different Picture

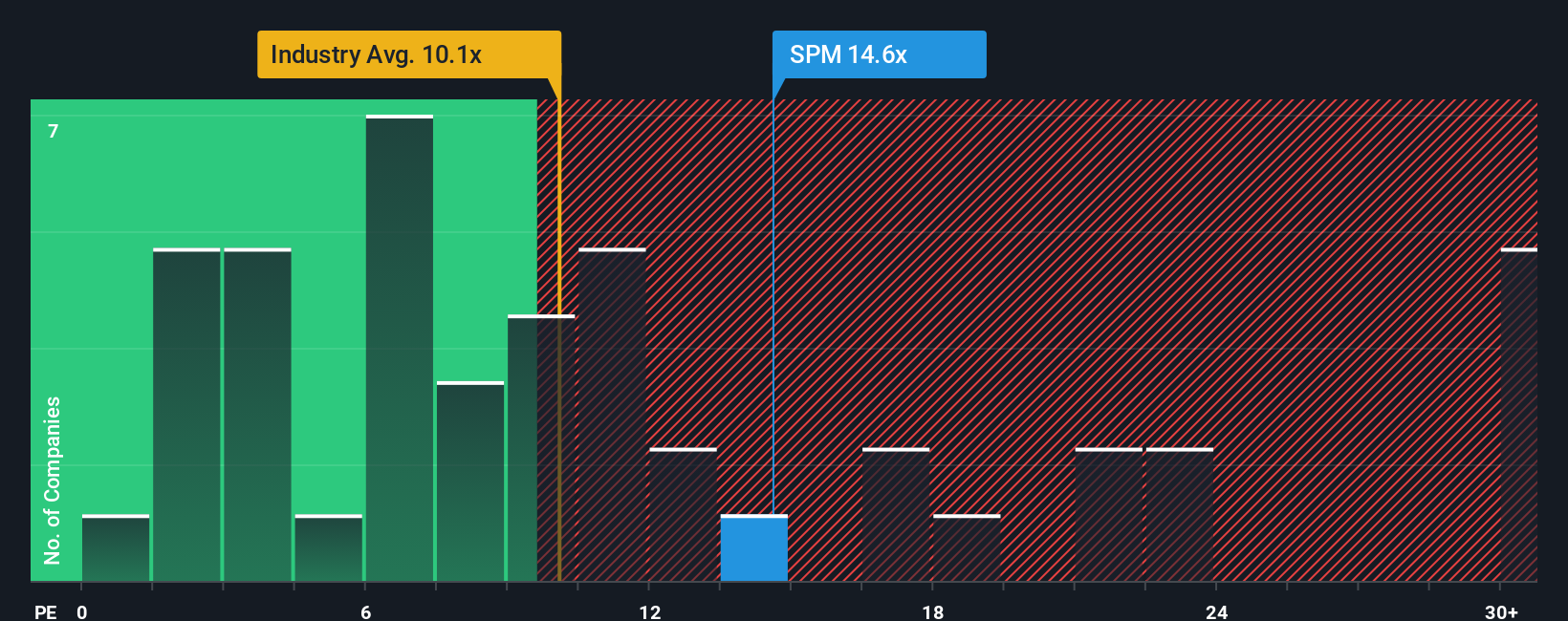

Looking beyond fair value estimates, Saipem’s current valuation based on its PE ratio (13.8x) signals a premium compared to the European industry average (10.1x). However, it trades below its peer group average (17.6x). Additionally, it sits under the fair ratio of 16.5x, suggesting there could be more room for appreciation if sentiment shifts. Does this premium reflect justified confidence, or does it widen the potential downside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Saipem Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can build a personal view of Saipem’s outlook in just minutes. Do it your way

A great starting point for your Saipem research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Elevate your strategy by checking out fast-moving stocks, untapped ideas, and high-potential sectors that others might be missing. Take charge and secure your spot ahead of the curve.

- Capitalize on early-stage growth by targeting these 3558 penny stocks with strong financials with strong fundamentals and the potential to transform entire industries.

- Boost your income potential by tapping into these 17 dividend stocks with yields > 3% featuring consistent payouts and yields over 3% for reliable returns.

- Stay ahead of innovation trends by seeking out these 27 AI penny stocks powering breakthroughs in automation, machine learning, and digital transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:SPM

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)