Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Gas Plus S.p.A. (BIT:GSP) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Gas Plus

What Is Gas Plus's Net Debt?

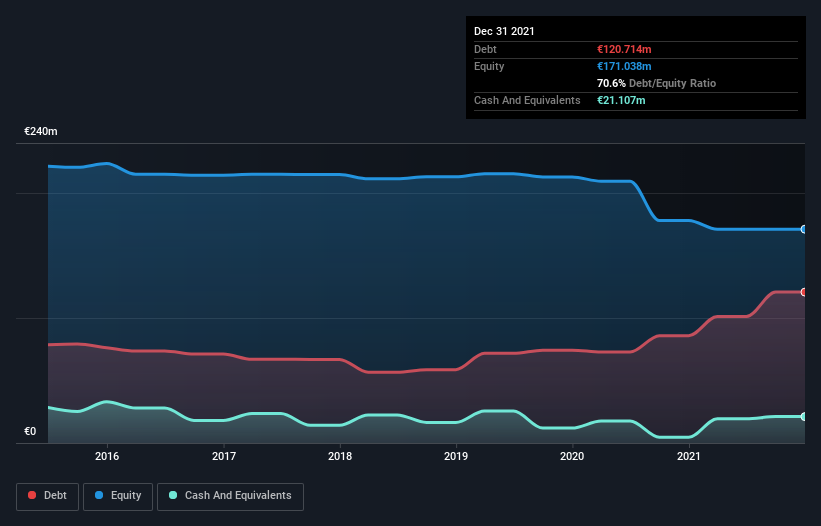

As you can see below, at the end of December 2021, Gas Plus had €120.7m of debt, up from €85.8m a year ago. Click the image for more detail. However, it also had €21.1m in cash, and so its net debt is €99.6m.

How Healthy Is Gas Plus' Balance Sheet?

The latest balance sheet data shows that Gas Plus had liabilities of €101.9m due within a year, and liabilities of €234.8m falling due after that. On the other hand, it had cash of €21.1m and €50.3m worth of receivables due within a year. So its liabilities total €265.3m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the €133.8m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Gas Plus would probably need a major re-capitalization if its creditors were to demand repayment. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Gas Plus's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Gas Plus wasn't profitable at an EBIT level, but managed to grow its revenue by 18%, to €84m. We usually like to see faster growth from unprofitable companies, but each to their own.

Caveat Emptor

Importantly, Gas Plus had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost €3.2m at the EBIT level. When we look at that alongside the significant liabilities, we're not particularly confident about the company. It would need to improve its operations quickly for us to be interested in it. But on the bright side the company actually produced a statutory profit of €3.1m and free cash flow of €3.0m. So one might argue that there's still a chance it can get things on the right track. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 4 warning signs for Gas Plus you should be aware of, and 1 of them doesn't sit too well with us.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:GSP

Gas Plus

Engages in the extraction, distribution, and sale of natural gas in Italy.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)