- Italy

- /

- Diversified Financial

- /

- BIT:NEXI

Will Nexi's (BIT:NEXI) Offline Digital Euro Project Redefine Its Competitive Position in Payments?

Reviewed by Sasha Jovanovic

- Earlier this month, the European Central Bank announced that a consortium including Giesecke+Devrient, Nexi, and Capgemini was selected as the first-ranked tenderer to deliver the offline digital euro payments solution, marking a step forward in developing a secure and private payment method for Europe.

- This project highlights Nexi's growing influence in the evolving digital payments landscape, particularly through its role in enabling cash-like, private transactions with the digital euro.

- We'll explore how Nexi's pivotal role in the ECB's digital euro offline project could shape its investment outlook going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Nexi Investment Narrative Recap

To be a Nexi shareholder today, you have to believe that Europe's accelerating shift to digital payments and Nexi's role in major projects like the ECB's digital euro will offset ongoing revenue headwinds from lost Italian bank contracts and intense regional competition. While the ECB selection spotlights Nexi's payment technology, the most immediate catalyst remains its ability to stabilize transaction volumes and retain key banking partners, a risk that the digital euro news may not materially solve in the short term.

Recently, Nexi announced the repurchase of 36,380,075 shares for EUR 184 million. While the digital euro project highlights Nexi's drive for technological relevance, the ongoing buyback program indicates a focus on supporting shareholder value during a period of margin and volume uncertainty.

Yet, alongside these optimistic developments, it's important for investors to remember the pressure Nexi faces from continued shifts in bank distribution agreements, especially as...

Read the full narrative on Nexi (it's free!)

Nexi's narrative projects €4.1 billion in revenue and €813.9 million in earnings by 2028. This assumes a 13.7% annual revenue decline and an earnings increase of €509.1 million from current earnings of €304.8 million.

Uncover how Nexi's forecasts yield a €6.74 fair value, a 47% upside to its current price.

Exploring Other Perspectives

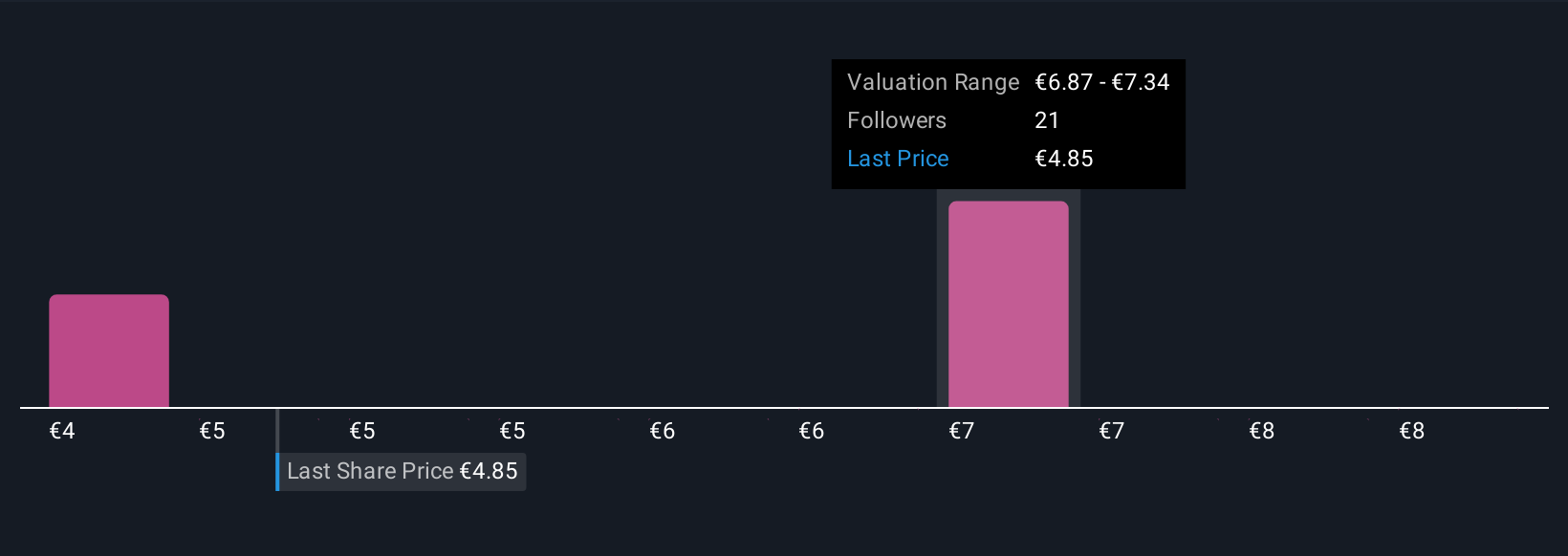

The Simply Wall St Community’s five fair value estimates for Nexi range from €4.12 to €8.75 per share, reflecting a broad spectrum of investor outlooks. With persistent revenue risk from lost Italian bank partnerships, these differing views invite you to explore several alternative perspectives on Nexi’s future.

Explore 5 other fair value estimates on Nexi - why the stock might be worth 10% less than the current price!

Build Your Own Nexi Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nexi research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nexi research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nexi's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 39 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nexi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:NEXI

Nexi

Provides electronic money and payment services to banks, small and medium-sized enterprises, large international corporations, institutions, and public administrations in Italy, Nordics and Baltics, Germany, Austria, Switzerland, Poland, Southeast Europe, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives