- Italy

- /

- Diversified Financial

- /

- BIT:NEXI

Does Nexi Offer Opportunity After 20% Slide Amid Changing Digital Payments Landscape?

Reviewed by Simply Wall St

Are you wondering whether Nexi is a bargain or a value trap after its latest price swings? You’re not alone. Nexi has spent the past year sliding lower, and the numbers jump off the page: down nearly 20% over the last twelve months, and off a staggering 71.2% from its highs five years ago. Even in the short-term, the past week saw an 11.7% dip, which only adds to concerns for shareholders. On the surface, some of these moves reflect shifts in how investors perceive risk in the payment processing sector, especially after recent changes in competition and digital payments regulations across European markets.

But here’s where things get interesting, and maybe a bit confusing for would-be investors. Based on a common valuation scoring system that checks whether a company appears undervalued on six different measures, Nexi only landed a 1 out of 6. That means it looks undervalued on just one metric out of the six we typically use to spot bargains. Is that a red flag, or an overlooked opportunity?

If you’re trying to decide whether to buy, sell, or just keep an eye on Nexi, stick with me. In the next section, I’ll break down what each valuation approach tells us about where Nexi stands today. And before we’re done, I’ll show you the smarter angle for getting to the heart of what this stock is really worth.

Nexi scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Nexi Excess Returns Analysis

The Excess Returns model closely examines how much value a company generates from its investments compared to the minimum return required by shareholders, known as the cost of equity. By comparing Nexi’s return on equity to this threshold, analysts can estimate whether the firm is producing “excess returns,” which are gains above and beyond what shareholders could earn elsewhere, or if the company is falling short.

In Nexi’s case, the numbers are clear. The company’s average return on equity stands at 7.37%, with a stable earnings per share projected at €0.72 (based on future return estimates from nine analysts). Against a cost of equity of €1.37 per share, Nexi actually produces an excess return of €-0.66 per share, signaling that the company delivers less than the required rate of return on its book value. The stable book value itself is set at €9.76 per share (from a consensus of seven analysts), slightly above the most recent figure of €8.86 per share.

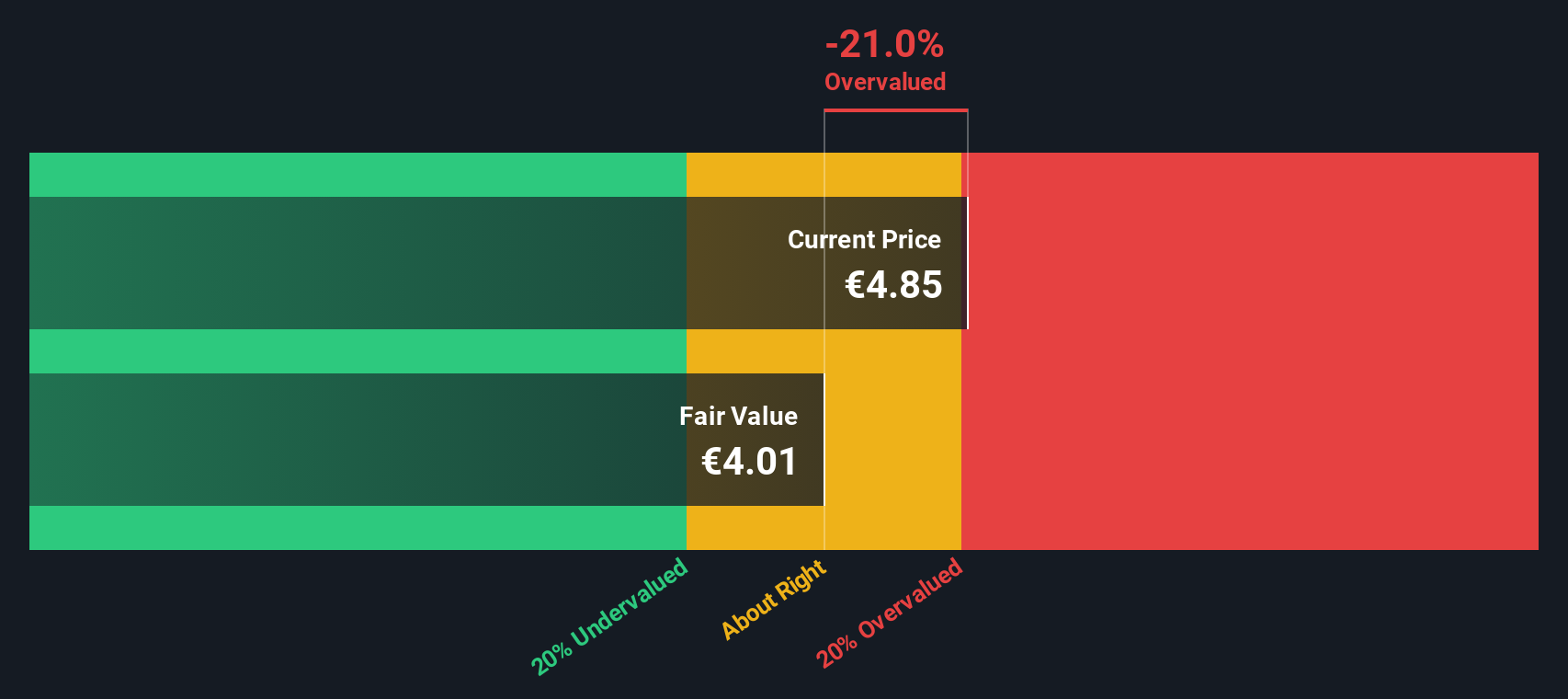

The Excess Returns model estimates Nexi’s intrinsic value at €3.92 per share. Given where the stock currently trades, this implies Nexi is 18.5% overvalued based on these projections.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Nexi.

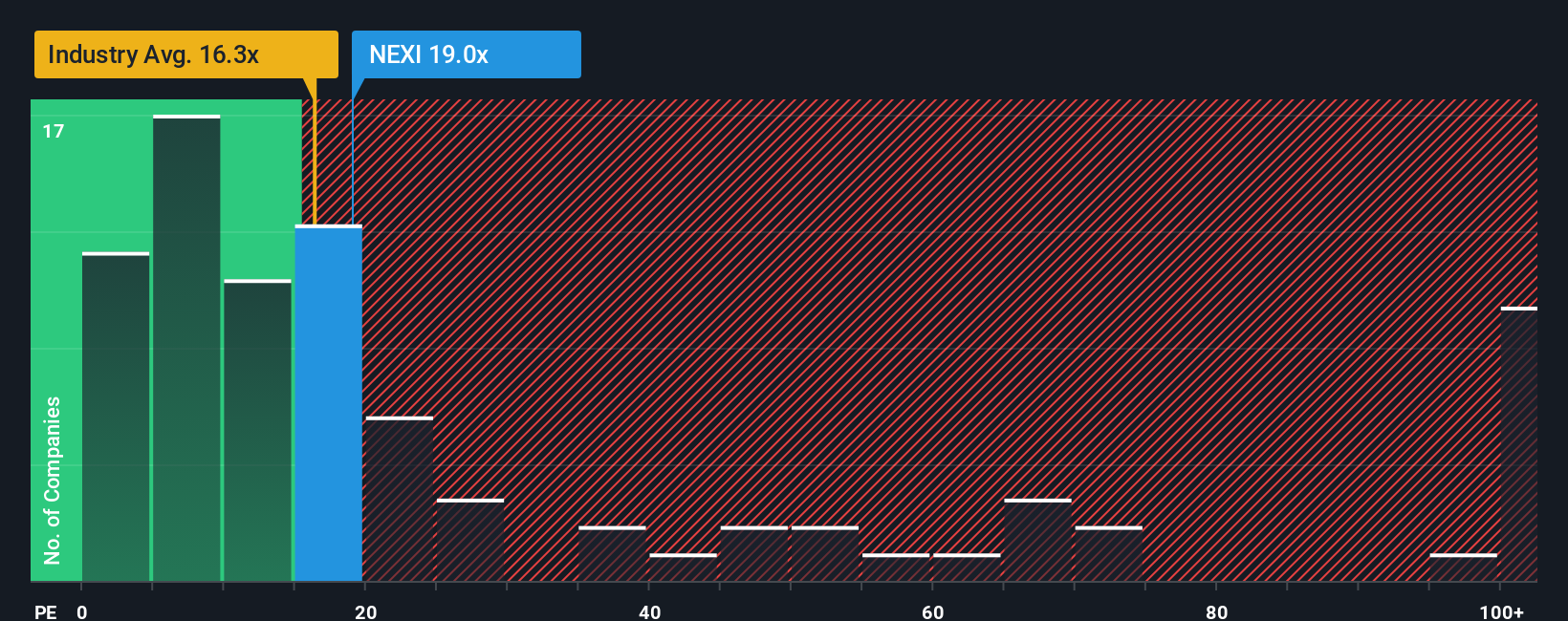

Approach 2: Nexi Price vs Earnings

The price-to-earnings (PE) ratio is one of the most widely used metrics for valuing profitable companies. It is especially useful because it shows how much investors are willing to pay for each euro of a company’s earnings, which is a direct indication of market expectations for profitability and growth.

What makes a “normal” or “fair” PE ratio can vary significantly depending on a company’s expected growth, risk profile, and how stable its earnings are. Higher growth prospects or lower perceived risk often justify a higher PE, whereas slower growth or greater uncertainty typically leads to a lower one.

Today, Nexi trades on a PE ratio of 18.2x. That is a premium to both its peer group’s average of 12.9x and the Diversified Financial industry average of 15.2x. However, Simply Wall St’s proprietary Fair Ratio, which is based on factors like Nexi’s earnings growth outlook, market capitalization, profit margins and specific risks, comes in at 24.1x. This Fair Ratio aims to capture the true context for Nexi, looking beyond surface-level peer comparisons to what the business genuinely deserves given its fundamentals and future potential.

With Nexi’s current PE of 18.2x sitting well below its Fair Ratio of 24.1x, the shares look undervalued on this measure.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Nexi Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your opportunity to connect your story and expectations about a company to the numbers themselves, letting you define your own assumptions for Nexi’s future revenue, earnings, and margins, and see how that story translates into a fair value today.

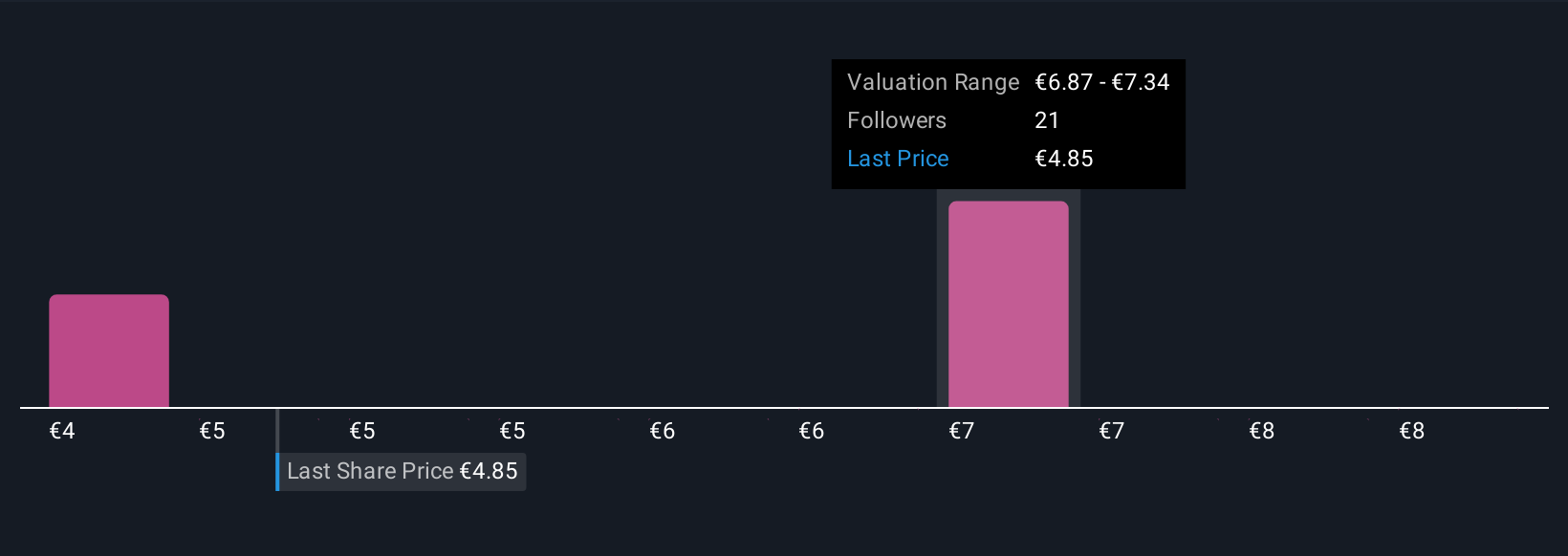

With Narratives, you move beyond just the ratios to build a scenario that matches your perspective. For example, you might anticipate rapid digital payments adoption or worry about contract losses, and you can instantly see if Nexi appears overvalued or undervalued based on your assumptions.

This approach links the company’s business story directly to a quantitative forecast, and then clearly maps that forecast to a fair value, helping you decide whether to buy or sell by comparing your fair value with Nexi’s current market price. Narratives are not static; they update dynamically as news and earnings roll in, so your valuation stays relevant in real time. Millions of investors already use Narratives on Simply Wall St’s Community page because it is intuitive, accessible, and gives you a powerful edge.

For instance, one Narrative sees Nexi’s fair value as high as €8.75 because they believe digital payments growth and expanding margins will outperform. Another projects as low as €4.5, concerned about contract losses and tougher competition. Your Narrative gives you the clarity to act with confidence.

Do you think there's more to the story for Nexi? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nexi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:NEXI

Nexi

Provides electronic money and payment services to banks, small and medium-sized enterprises, large international corporations, institutions, and public administrations in Italy, Nordics and Baltics, Germany, Austria, Switzerland, Poland, Southeast Europe, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives