- Italy

- /

- Diversified Financial

- /

- BIT:NEXI

Could Nexi's (BIT:NEXI) New Irish Partnership Reveal Its Next Digital Payments Playbook?

Reviewed by Simply Wall St

- On September 9, 2025, Nexi S.p.A. participated in Euronext Virtual Sustainability Week, where Zippay, a new person-to-person mobile payment service in collaboration with major Irish banks, was announced for launch in early 2026.

- This move expands Nexi's presence in Ireland, leveraging integration with AIB, Bank of Ireland, and PTSB banking apps to increase adoption of instant digital payments by consumers.

- We’ll examine how Nexi’s partnership with Ireland’s leading banks to launch Zippay could affect its digital payments growth strategy.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Nexi Investment Narrative Recap

To be a shareholder in Nexi, you generally need to believe in the accelerating adoption of digital payments across Europe, offsetting current challenges in Southern Europe and banking partnerships. The launch of Zippay in Ireland may boost Nexi’s geographic reach and open fresh transaction streams, but in the short term, it does not materially address the most pressing risk: continued loss and renegotiation of key bank distribution contracts in its core markets, especially Italy, which pose ongoing revenue and margin headwinds. The move highlights Nexi’s efforts to diversify beyond traditional geographies, but investors should continue monitoring whether fresh cross-border launches translate to durable, profitable volume growth in the face of regional contract pressure. Among recent company announcements, the confirmation of 2025 revenue guidance is especially relevant. While momentum in product launches like Zippay can drive optimism, management continues to expect only low-to-mid-single digit top line growth this year, underscoring the persistent structural challenge from existing contract losses and bank partner renegotiations. For shareholders, these events reinforce the importance of distinguishing between new business initiatives and the underlying earnings power from Nexi’s established distribution channels. But in contrast, investors should also be aware that ongoing revenue headwinds linked to contract churn and pricing pressure...

Read the full narrative on Nexi (it's free!)

Nexi's narrative projects €4.1 billion revenue and €813.9 million earnings by 2028. This requires a 13.7% annual revenue decline and an earnings increase of €509.1 million from current earnings of €304.8 million.

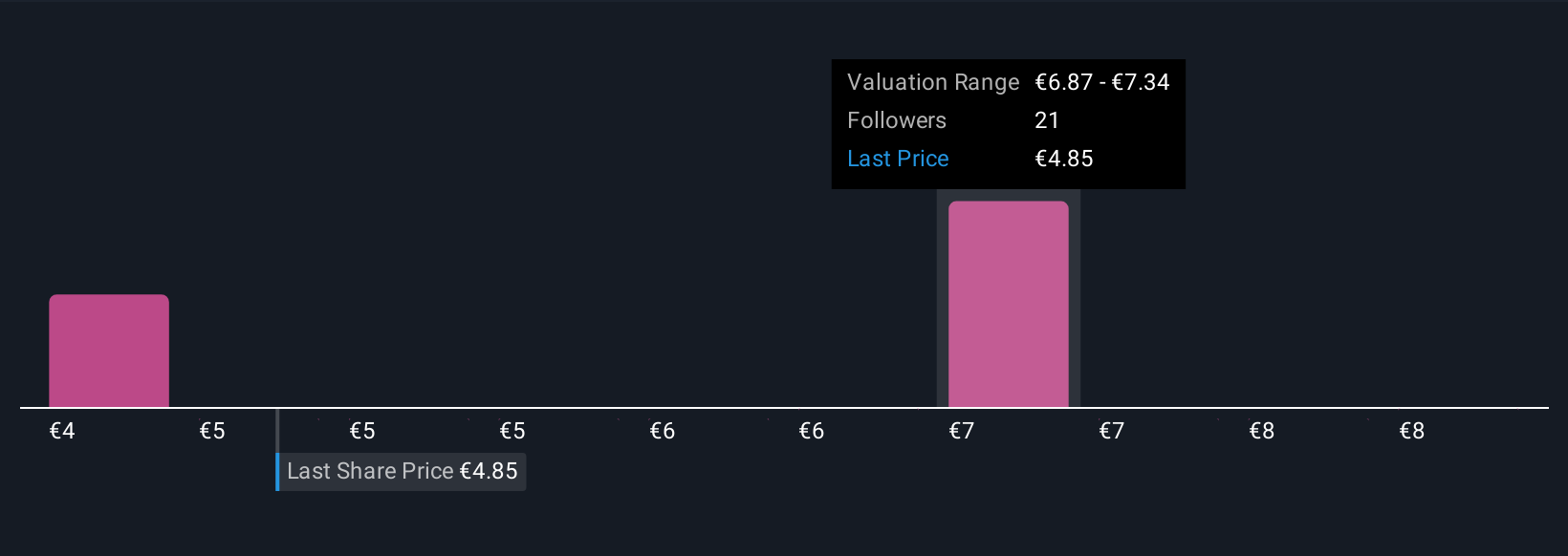

Uncover how Nexi's forecasts yield a €6.90 fair value, a 49% upside to its current price.

Exploring Other Perspectives

Four retail contributors in the Simply Wall St Community estimate Nexi’s fair value from €3.92 to €7 per share. Opinions like these reflect diverse outlooks, especially as contract renewal risks may weigh on future performance, inviting you to compare several perspectives before forming an opinion.

Explore 4 other fair value estimates on Nexi - why the stock might be worth 16% less than the current price!

Build Your Own Nexi Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nexi research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nexi research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nexi's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nexi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:NEXI

Nexi

Provides electronic money and payment services to banks, small and medium-sized enterprises, large international corporations, institutions, and public administrations in Italy, Nordics and Baltics, Germany, Austria, Switzerland, Poland, Southeast Europe, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives