- Italy

- /

- Commercial Services

- /

- BIT:DOV

Earnings Update: doValue S.p.A. (BIT:DOV) Just Reported Its Full-Year Results And Analysts Are Updating Their Forecasts

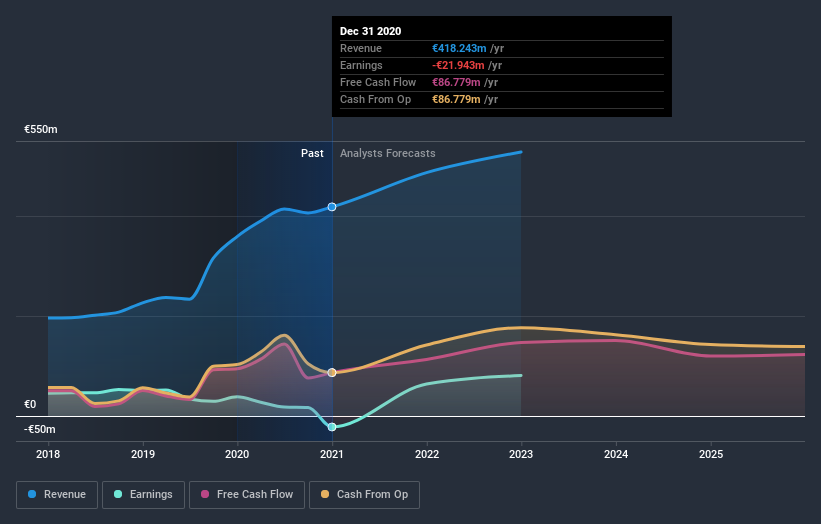

As you might know, doValue S.p.A. (BIT:DOV) recently reported its yearly numbers. The results were positive, with revenue coming in at €418m, beating analyst expectations by 6.5%. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

See our latest analysis for doValue

Taking into account the latest results, the consensus forecast from doValue's five analysts is for revenues of €486.7m in 2021, which would reflect a notable 16% improvement in sales compared to the last 12 months. doValue is also expected to turn profitable, with statutory earnings of €0.78 per share. Before this earnings report, the analysts had been forecasting revenues of €486.7m and earnings per share (EPS) of €0.78 in 2021. The consensus analysts don't seem to have seen anything in these results that would have changed their view on the business, given there's been no major change to their estimates.

It will come as no surprise then, to learn that the consensus price target is largely unchanged at €11.21. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on doValue, with the most bullish analyst valuing it at €12.10 and the most bearish at €10.00 per share. Still, with such a tight range of estimates, it suggeststhe analysts have a pretty good idea of what they think the company is worth.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the doValue's past performance and to peers in the same industry. We would highlight that doValue's revenue growth is expected to slow, with the forecast 16% annualised growth rate until the end of 2021 being well below the historical 26% p.a. growth over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenue shrink 50% per year. Factoring in the forecast slowdown in growth, it's pretty clear that doValue is still expected to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with the analysts reconfirming that the business is performing in line with their previous earnings per share estimates. On the plus side, they made no changes to their revenue estimates - and they expect sales to perform better than the wider industry. The consensus price target held steady at €11.21, with the latest estimates not enough to have an impact on their price targets.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple doValue analysts - going out to 2022, and you can see them free on our platform here.

Plus, you should also learn about the 2 warning signs we've spotted with doValue (including 1 which is a bit unpleasant) .

When trading doValue or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:DOV

doValue

Engages in the management of non-performing loans (NLP), unlikely to pay (UTP), early arrears, and performing loans for banks and investors in Italy, Spain, Greece, and Cyprus.

High growth potential and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)