Amidst a backdrop of steady interest rates from the European Central Bank and moderate gains in major European stock indexes, investors are closely examining dividend stocks as a potential source of income. With the pan-European STOXX Europe 600 Index rising by 1.03% recently, identifying stocks that offer attractive yields becomes crucial for those looking to enhance their portfolio's income potential in today's market environment.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.33% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.82% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.43% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.50% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.90% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.30% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.45% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.67% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.44% | ★★★★★☆ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.70% | ★★★★★☆ |

Click here to see the full list of 220 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Banca Generali (BIT:BGN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banca Generali S.p.A. provides financial products and services to high net worth, affluent, and private customers in Italy through financial advisors, with a market cap of €5.81 billion.

Operations: Banca Generali's revenue segments include €0.17 billion from the Corporate Center, €91.76 million from Senior Partner (SP CGU), and €0.71 billion from Private Banking (PB CGU).

Dividend Yield: 5.5%

Banca Generali's dividend yield is among the top 25% in Italy, with a payout ratio of 81.5%, indicating dividends are currently covered by earnings and forecast to remain so. Despite past volatility, dividends have grown over the last decade. Recent events include a share buyback program financed from distributable profits and reserves, while a proposed acquisition by Mediobanca was canceled due to insufficient shareholder support. Earnings for H1 2025 decreased compared to the previous year.

- Navigate through the intricacies of Banca Generali with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Banca Generali is priced higher than what may be justified by its financials.

Sydbank (CPSE:SYDB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sydbank A/S, with a market cap of DKK24.76 billion, offers a range of banking products and services to corporate, private, retail, and institutional clients in Denmark and internationally through its subsidiaries.

Operations: Sydbank generates revenue through its segments, including Banking (DKK5.62 billion), Treasury (DKK83 million), Sydbank Markets (DKK365 million), and Asset Management (DKK499 million).

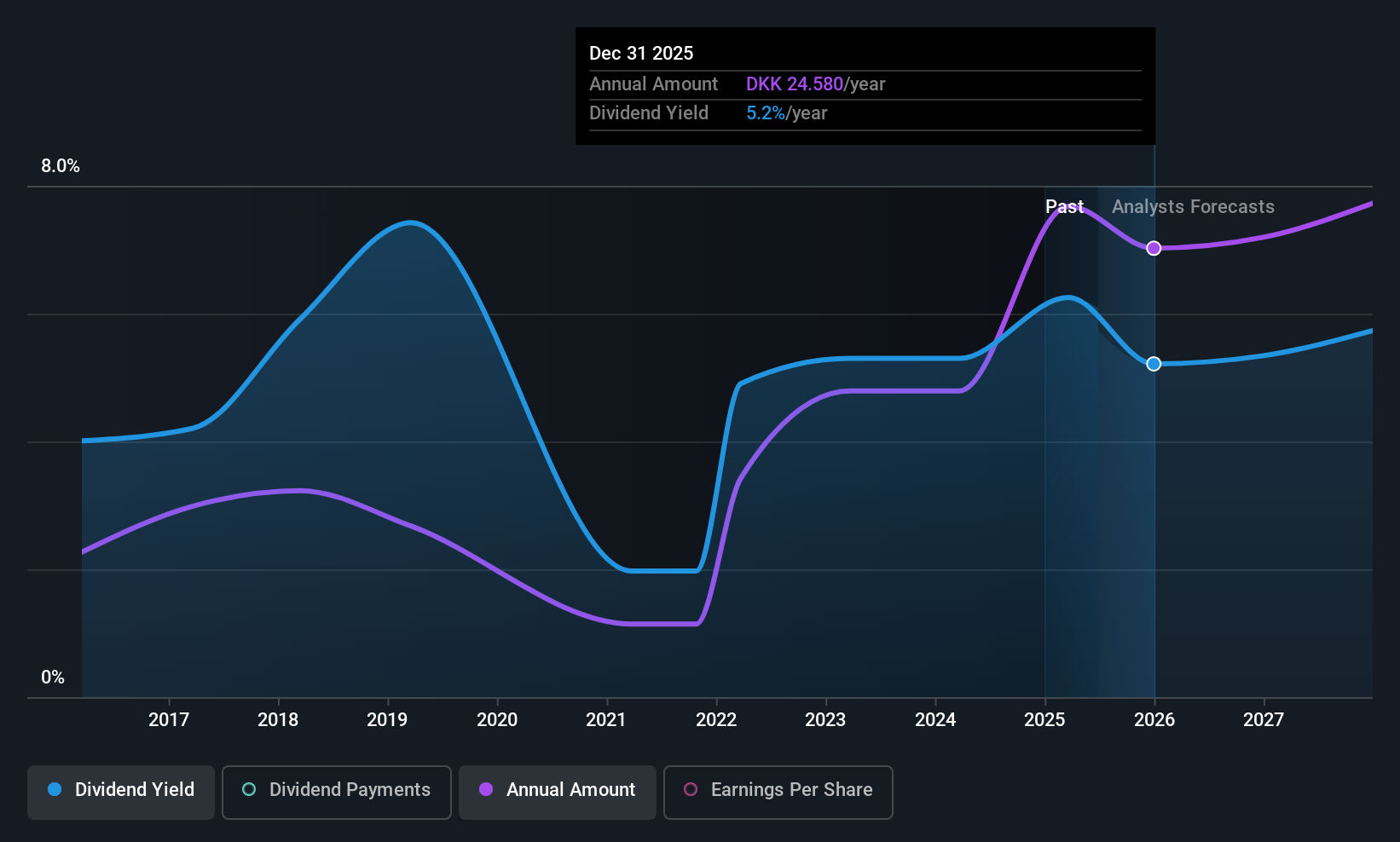

Dividend Yield: 5.4%

Sydbank's dividend yield ranks in the top 25% of Denmark, supported by a payout ratio of 60.2%, ensuring current coverage by earnings and forecasted sustainability. Despite historical volatility, dividends have grown over the past decade. The bank faces challenges with high bad loans at 2.2%. Recent activities include completing a share buyback program worth DKK 490 million and reporting decreased net income for H1 2025 compared to last year, impacting earnings stability.

- Dive into the specifics of Sydbank here with our thorough dividend report.

- The valuation report we've compiled suggests that Sydbank's current price could be inflated.

SpareBank 1 Nord-Norge (OB:NONG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SpareBank 1 Nord-Norge offers banking services in Northern Norway and has a market cap of NOK14.21 billion.

Operations: SpareBank 1 Nord-Norge generates revenue primarily from its Retail Market segment (NOK2.54 billion), Corporate Banking excluding SMB (NOK1.79 billion), and other services including Eiendoms-Megler 1 Nord-Norge (NOK198 million), Sparebank 1 Finans Nord-Norge (NOK369 million), and Sparebank 1 Regnskaps-Huset Nord-Norge (NOK332 million).

Dividend Yield: 6.2%

SpareBank 1 Nord-Norge offers a reliable dividend yield of 6.18%, with a stable payout history over the past decade, supported by a manageable payout ratio of 49.7%. Earnings have grown significantly, enhancing dividend coverage and sustainability. However, the bank's high bad loans at 2.6% pose potential risks. Recent financial activities include issuing NOK 500 million in bonds and reporting increased earnings for H1 2025, with net income rising to NOK 1.74 billion from NOK 1.45 billion last year.

- Delve into the full analysis dividend report here for a deeper understanding of SpareBank 1 Nord-Norge.

- In light of our recent valuation report, it seems possible that SpareBank 1 Nord-Norge is trading behind its estimated value.

Make It Happen

- Click here to access our complete index of 220 Top European Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NONG

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives