- Italy

- /

- Consumer Durables

- /

- BIT:PWS

How Much Did Powersoft's(BIT:PWS) Shareholders Earn From Share Price Movements Over The Last Year?

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Investors in Powersoft S.p.A. (BIT:PWS) have tasted that bitter downside in the last year, as the share price dropped 20%. That falls noticeably short of the market decline of around 6.6%. We wouldn't rush to judgement on Powersoft because we don't have a long term history to look at. It's down 2.5% in the last seven days.

View our latest analysis for Powersoft

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

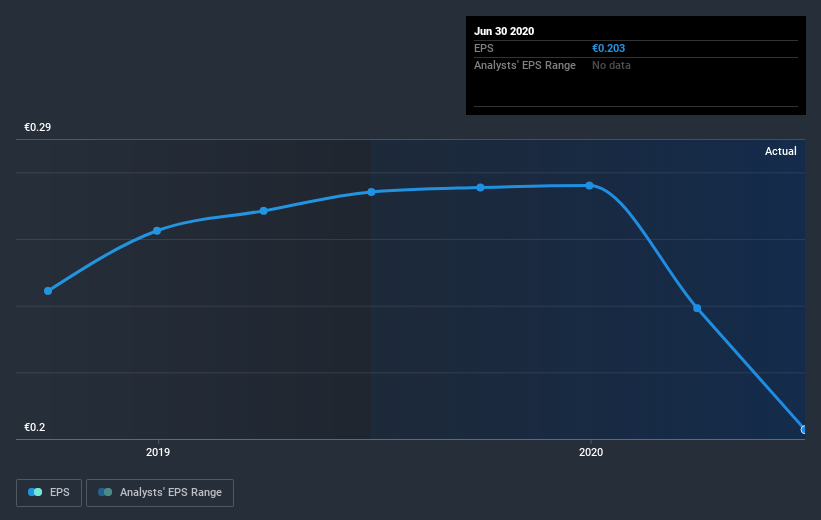

Unfortunately Powersoft reported an EPS drop of 26% for the last year. The share price fall of 20% isn't as bad as the reduction in earnings per share. It may have been that the weak EPS was not as bad as some had feared.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

We doubt Powersoft shareholders are happy with the loss of 20% over twelve months. That falls short of the market, which lost 6.6%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. It's great to see a nice little 6.5% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. It's always interesting to track share price performance over the longer term. But to understand Powersoft better, we need to consider many other factors. For instance, we've identified 1 warning sign for Powersoft that you should be aware of.

But note: Powersoft may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

If you decide to trade Powersoft, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:PWS

Powersoft

Engages in the design, production, and marketing of power amplifiers, loudspeaker components, and software in Italy and internationally.

High growth potential and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)