Does the Surge in Cucinelli Shares Signal Sustainable Growth in 2025?

Reviewed by Simply Wall St

Thinking about making a move on Brunello Cucinelli stock? You’re definitely not the only one. With luxury retailers back in the spotlight, this Italian fashion house has grabbed plenty of attention, and for good reason. Just look at that five-year return of 330.2%. That’s not just steady growth; it signals a business that has managed to thrive well beyond the industry average, especially as global demand for high-end goods bounced back. Over the last year alone, Brunello Cucinelli has rewarded shareholders with a 25.4% return, and the past month delivered a solid 5.9%. If you’ve been tracking the luxury sector, you know this momentum is notable and puts some investors on high alert for risks as shares climb.

Of course, a hot stock price doesn’t always mean a great deal. That brings us to the million dollar question: is Brunello Cucinelli undervalued, overvalued, or right on the money? According to our valuation scorecard, the company checked zero out of six boxes for being undervalued, which gives it a value score of 0. That’s a telling result, but as you know, numbers rarely tell the whole story at a glance.

Let’s break down what these valuation approaches can actually tell us, and stick around, because we’ll finish with an even smarter way to put all this in perspective at the end.

Brunello Cucinelli scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Brunello Cucinelli Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) analysis estimates what a company is worth today by projecting its future cash flows and then discounting those amounts back to their present value. This approach helps reveal whether a stock’s current price reflects its true earning power in the future.

For Brunello Cucinelli, the current Free Cash Flow is €98.2 million. Over the coming years, analysts expect this figure to rise significantly, reaching €230.1 million by 2027. Looking out even further, Simply Wall St extrapolates cash flows through 2035 and projects continued growth. It is important to note that only the next five years are based directly on analyst estimates. All values are in euros. Since none of the projected cash flows exceed one billion euros, millions remain the frame of reference.

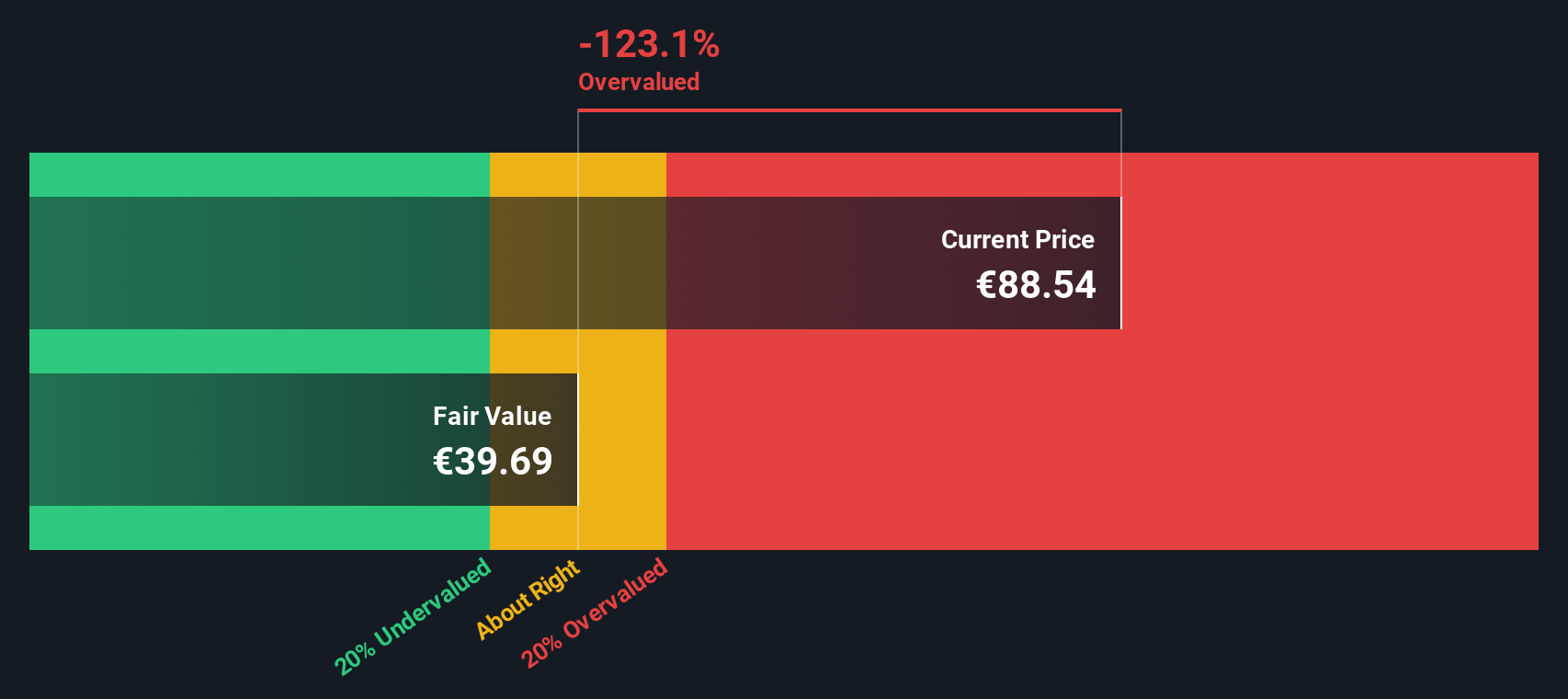

Using these projections and discounting them to the present, the intrinsic value for Brunello Cucinelli shares is calculated at €40.82. Compared to the current market price, this valuation indicates the stock is 159.7% overvalued according to the DCF method.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Brunello Cucinelli.

Approach 2: Brunello Cucinelli Price vs Earnings

For profitable companies like Brunello Cucinelli, the Price-to-Earnings (PE) ratio is often a go-to tool for investors. It helps connect a company’s share price directly to its underlying earnings, offering a simple snapshot of how much the market is willing to pay for each euro of profit.

A company’s PE ratio is not one-size-fits-all. Strong earnings growth and lower risk profiles can justify higher multiples, while slower growers or riskier businesses often trade at lower ratios. That means it is critical to weigh current growth prospects, profitability, and the market’s overall outlook when interpreting the number.

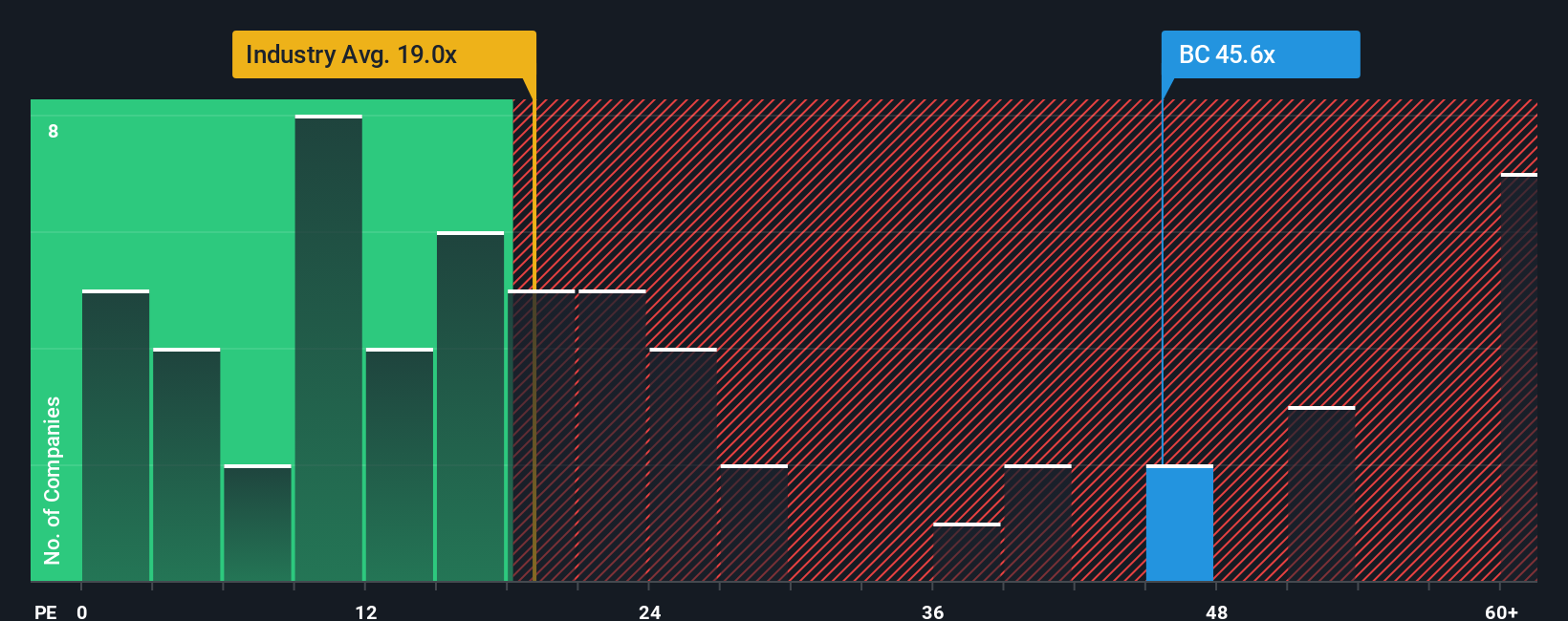

As of now, Brunello Cucinelli trades at a PE of 54.6x, which is notably higher than the luxury industry average of 18.6x and the peer group average at 20.8x. At first glance, this premium suggests an expensive stock. But instead of just matching up against the sector or peers, Simply Wall St's proprietary “Fair Ratio” offers deeper insight. It weighs the company’s earnings growth, profit margins, industry dynamics, and risk factors, all tailored for this market cap. For Brunello Cucinelli, the Fair Ratio is calculated at 22.9x.

By stacking up the actual PE of 54.6x against a fair value estimate of 22.9x, the stock appears meaningfully overvalued on this metric alone, even accounting for its strong growth prospects and market position.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Brunello Cucinelli Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is more than just crunching numbers; it is your chance to connect the company's unique story with your expectations for its future, bringing together your view on revenue, margins, and its fair value. Narratives help you go beyond traditional ratios by linking the “why” behind the numbers with a personalized financial forecast, so you can see exactly how your views translate into an actionable fair value estimate.

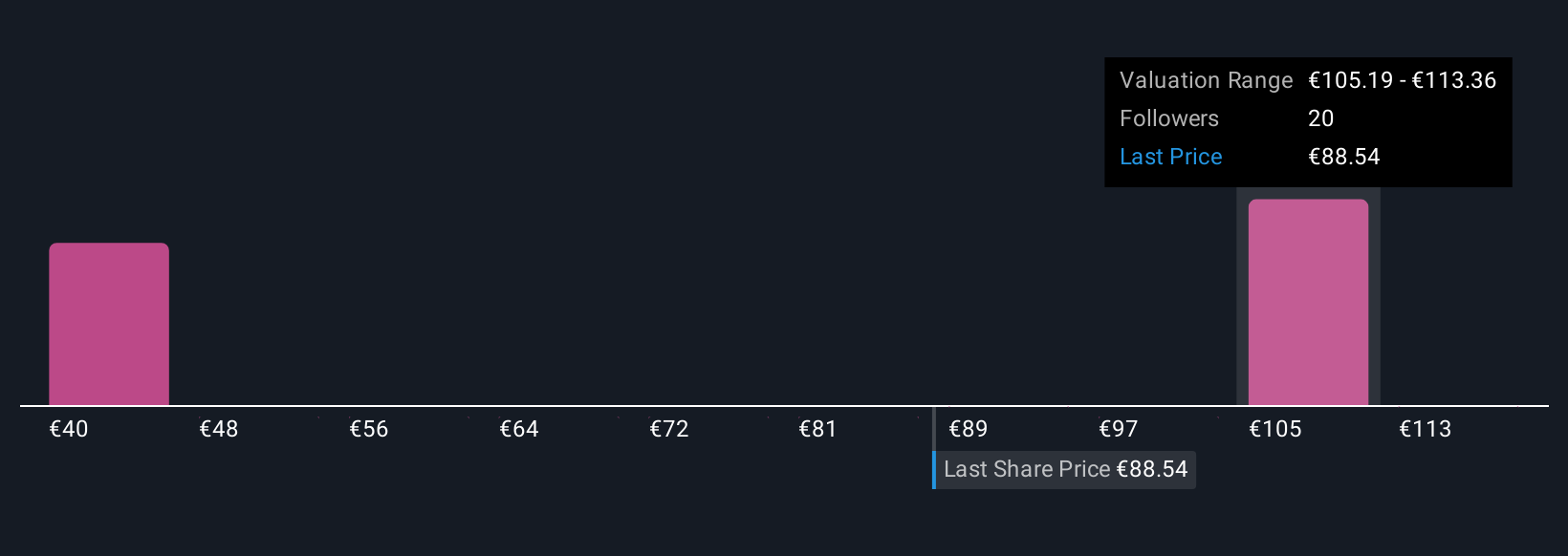

With Simply Wall St's Community page, used by millions of investors, Narratives are quick and accessible, letting you decide at a glance whether you believe a company is a buy, sell, or hold by comparing your fair value to the current price. They update dynamically as news and earnings roll in, so your view stays current as the story evolves. For Brunello Cucinelli, for example, some investors see long-term growth drivers in global luxury demand and set fair values as high as €125, while others worry about rising debt and assign targets closer to €68. This is a reminder that your Narrative is entirely your own, shaped by both facts and perspective.

Do you think there's more to the story for Brunello Cucinelli? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brunello Cucinelli might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BC

Brunello Cucinelli

Engages in the production and sale of clothing, accessories, and lifestyle products in Italy, Europe, the United States, and Asia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives