- Italy

- /

- Commercial Services

- /

- BIT:ICC

International Care Company S.p.A.'s (BIT:ICC) Low P/S No Reason For Excitement

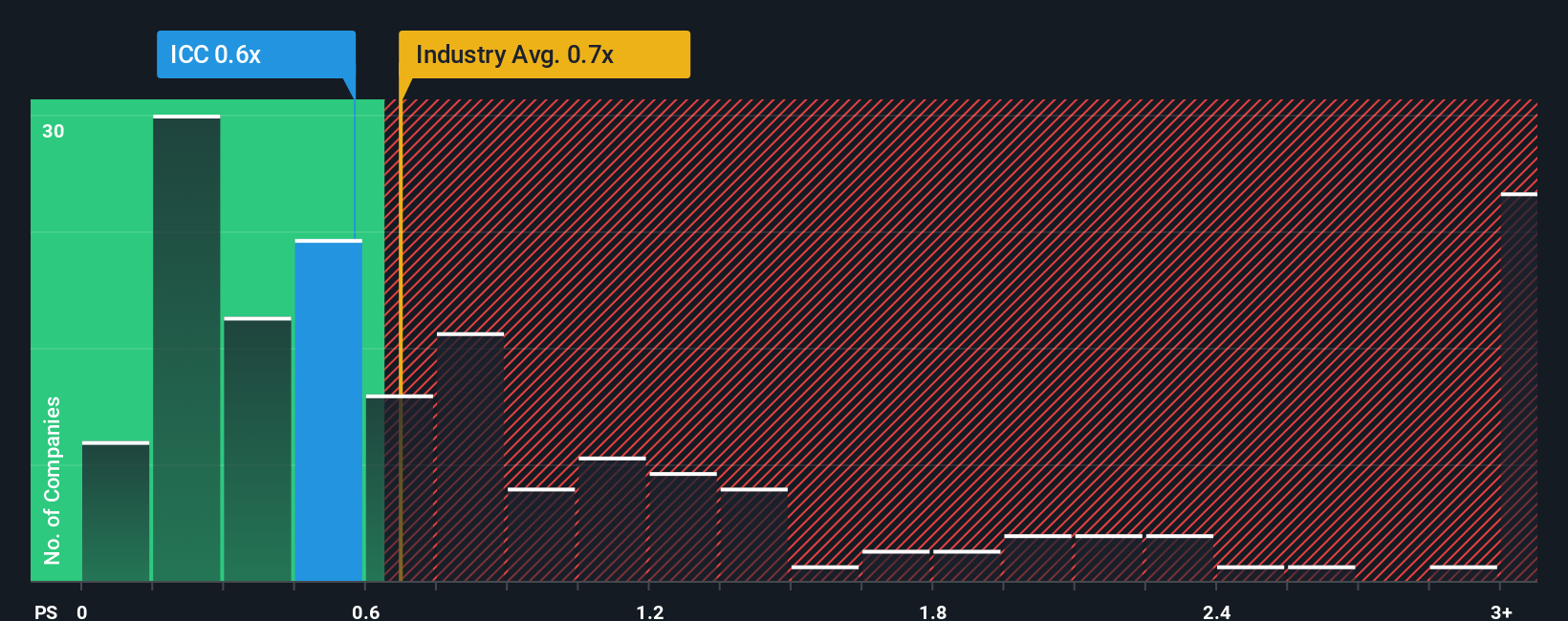

When you see that almost half of the companies in the Commercial Services industry in Italy have price-to-sales ratios (or "P/S") above 1.2x, International Care Company S.p.A. (BIT:ICC) looks to be giving off some buy signals with its 0.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for International Care

What Does International Care's P/S Mean For Shareholders?

International Care certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on International Care will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For International Care?

In order to justify its P/S ratio, International Care would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. Pleasingly, revenue has also lifted 63% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 12% as estimated by the one analyst watching the company. That's shaping up to be materially lower than the 17% growth forecast for the broader industry.

With this in consideration, its clear as to why International Care's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does International Care's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of International Care's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for International Care that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:ICC

International Care

Provides digital health care services in Italy and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives