- Italy

- /

- Aerospace & Defense

- /

- BIT:LDO

Why Leonardo (BIT:LDO) Is Up 6.3% After Geopolitical Comments Boost Defense Sector Sentiment

Reviewed by Sasha Jovanovic

- Earlier this week, oil prices rose and defense sector sentiment strengthened after former President Trump stated Ukraine could potentially regain all of its territory from Russia, driving renewed attention to defense companies including Leonardo.

- This shift in geopolitical outlook has triggered heightened interest in defense technologies as investors weigh the possibility of increased demand for advanced military solutions.

- We will explore how renewed optimism for elevated defense spending, sparked by recent geopolitical comments, could influence Leonardo’s broader investment case.

Find companies with promising cash flow potential yet trading below their fair value.

Leonardo Investment Narrative Recap

If you are considering Leonardo as a shareholder, you need to believe in the resilience of global defense budgets and the company’s ability to capture rising demand for advanced military technology. While recent comments from former President Trump might boost short-term sentiment and reinforce expectations for higher European defense spending, a known growth catalyst, the most significant near-term risk remains the company’s ongoing losses in its Aerostructures division, which continue to weigh on overall profitability. If the impact of geopolitical news proves short-lived, the underlying financial and operational risks may remain the more critical focus for investors.

Of particular interest is Leonardo’s late July teaming agreement with Textron Aviation Defense, targeting the U.S. Navy’s Undergraduate Jet Training System. This move aligns with increased investor attention on military upgrades and order growth following the renewed focus on European and allied defense support, as highlighted this week. Announcements like this could reinforce the company’s broader growth story as long as defense sector catalysts remain robust.

Yet in contrast to the optimistic headlines, investors should be aware of the persistent cash drain in certain divisions, which means…

Read the full narrative on Leonardo (it's free!)

Leonardo's outlook projects €23.1 billion in revenue and €1.5 billion in earnings by 2028. This requires 7.2% annual revenue growth and a €0.5 billion increase in earnings from the current €1.0 billion.

Uncover how Leonardo's forecasts yield a €53.38 fair value, in line with its current price.

Exploring Other Perspectives

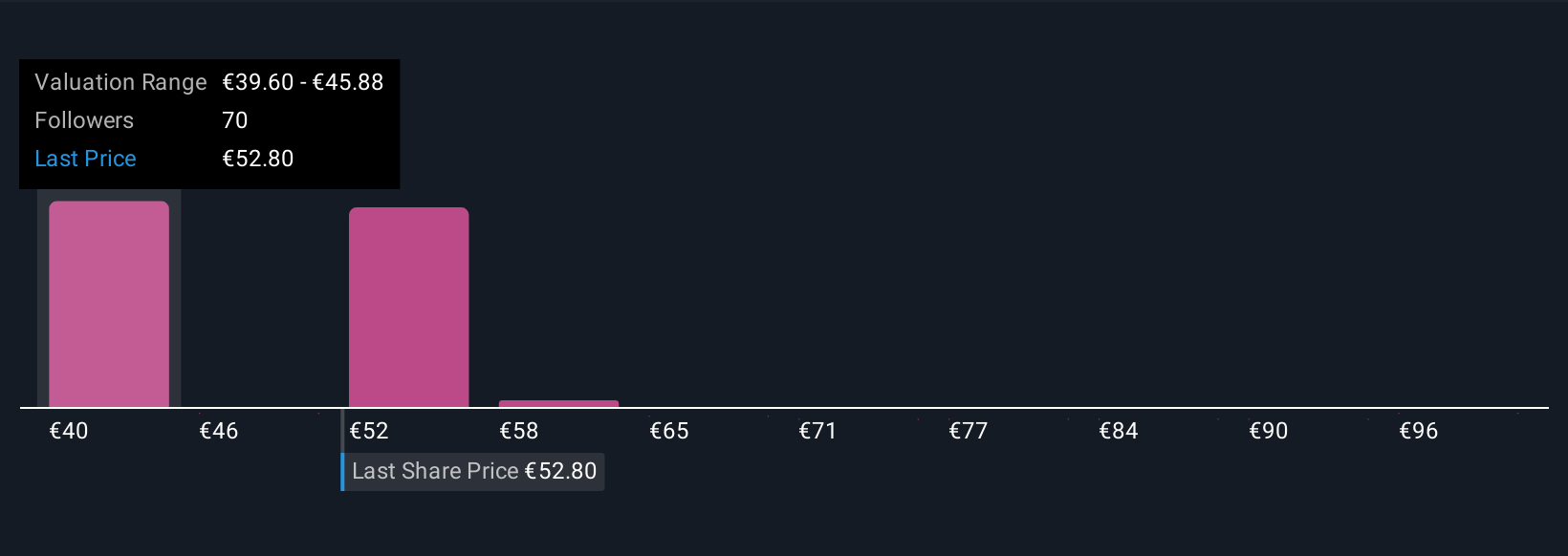

Simply Wall St Community members have submitted 13 different fair value opinions for Leonardo, ranging from €38.57 to €102.37 per share. With future European defense spending a major catalyst, the wide gap in projections signals that you should carefully consider multiple points of view when assessing the company’s long-term strength.

Explore 13 other fair value estimates on Leonardo - why the stock might be worth 27% less than the current price!

Build Your Own Leonardo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Leonardo research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Leonardo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Leonardo's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:LDO

Leonardo

An industrial and technological company, engages in the helicopters, defense electronics and security, cyber security and solutions, aircraft, aerostructures, and space sectors in Italy, the United Kingdom, rest of Europe, the United States of America, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives