- Italy

- /

- Aerospace & Defense

- /

- BIT:LDO

Can Leonardo’s 167% Rally Continue After Strong Defense Sector Momentum?

Reviewed by Bailey Pemberton

If you are contemplating whether to buy, hold, or watch Leonardo stock right now, you are not alone. After all, with shares closing at 55.36 and posting a staggering 167.1% gain over the past year, it is only natural to wonder what is driving this momentum and whether the rally can last. Leonardo has not just bounced back; it has soared, with a return of 112.4% year-to-date and an eye-popping 1075.4% climb over five years. Those numbers turn heads in any market.

Part of this surge tracks broader market optimism in the industry, as investors have watched major global players in defense and aerospace attract more attention, particularly as international demand and geopolitical shifts put companies like Leonardo in the spotlight. While it is tempting to focus on the headline returns, it is equally important to dig into what the stock is actually worth today.

On a valuation basis, Leonardo scores a 3 out of 6 for being undervalued. Put simply, that means the company checks the box for undervaluation in half of the key ways analysts typically assess companies, but not in all of them. This raises a vital question: is Leonardo still a bargain, or are investors already pricing in much of its growth story?

Let us break down the numbers using several fundamental valuation approaches, and stay tuned for a perspective at the end that just might redefine how you look at value altogether.

Why Leonardo is lagging behind its peers

Approach 1: Leonardo Discounted Cash Flow (DCF) Analysis

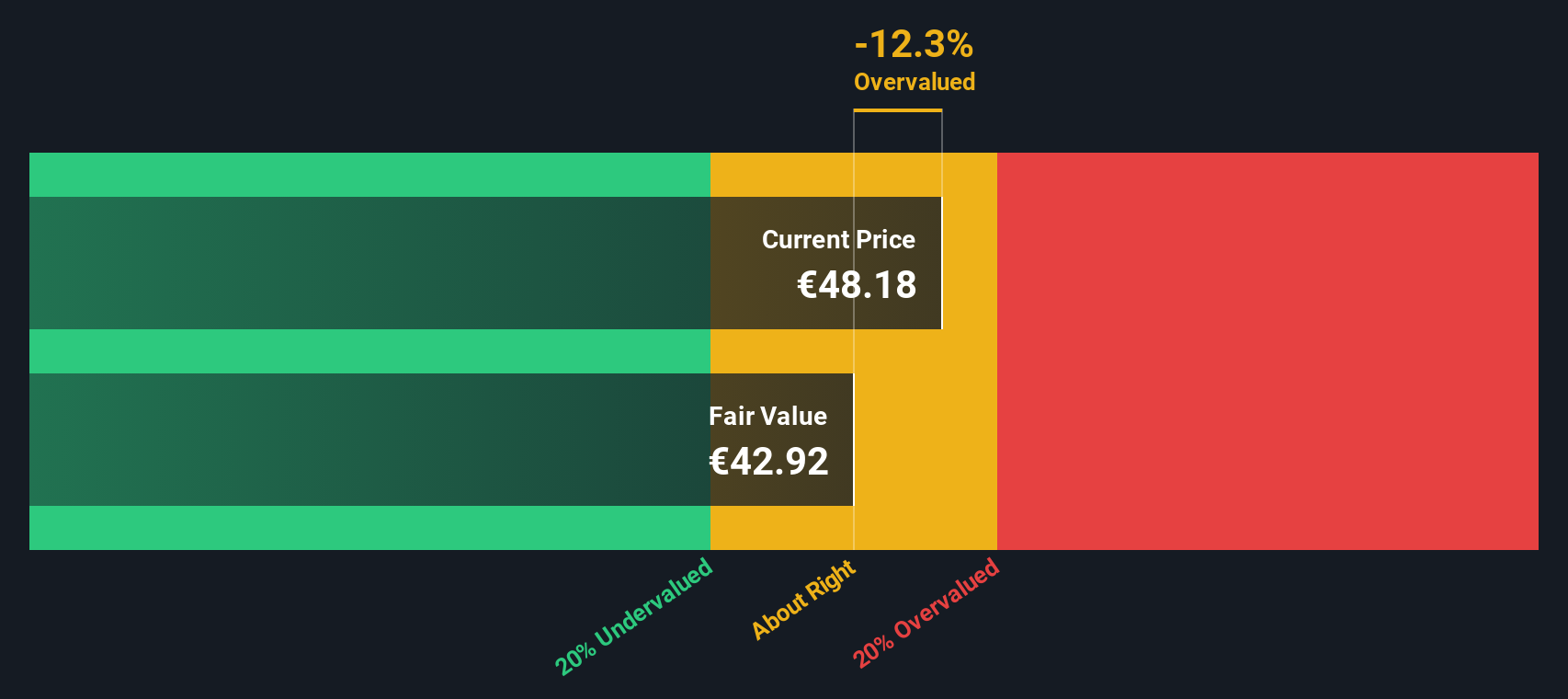

The Discounted Cash Flow (DCF) model is centered on projecting the company’s future cash flows and then bringing them back to today’s value, which helps estimate what Leonardo may truly be worth. In the case of Leonardo, analysts start by looking at the most recent Free Cash Flow figure, which stands at €604.4 Million. Over the coming years, these annual cash flows are projected to grow significantly, with analyst estimates reaching €1.77 Billion by the end of 2029. Up to five years of projections are based on analyst consensus, while any numbers beyond that are extrapolations by Simply Wall St and should be treated with some extra caution.

By adding up and discounting these future cash flows, the DCF model calculates a fair value of €41.78 per share for Leonardo. With the recent share price at €55.36, this suggests that the stock is currently 32.5% overvalued according to this approach. In summary, the strong momentum in the share price might have pushed it well above the company’s fundamentals as measured by cash flow analysis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Leonardo may be overvalued by 32.5%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Leonardo Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular valuation tool, especially for established, profitable companies like Leonardo. It reflects how much investors are willing to pay today for a euro of the company's earnings. A higher PE can signal strong market optimism about future growth, while a lower one may indicate lower expectations or perceived risks.

Leonardo currently trades at a PE ratio of 30.5x. For context, the average PE in the Aerospace & Defense industry is higher at 47.4x, while peer companies average an even higher 54.2x. This suggests that Leonardo is valued more conservatively compared to its sector and close competitors, possibly reflecting its own growth profile, risk factors, or investor sentiment.

Simply Wall St’s Fair Ratio provides a more comprehensive benchmark by factoring in Leonardo’s earnings growth prospects, risk exposure, profit margins, industry positioning, and market cap. Unlike a simple peer or industry comparison, the Fair Ratio offers a tailored sense of what a reasonable multiple should be, given the business’s unique characteristics. For Leonardo, the Fair Ratio is 31.7x, just above its actual PE ratio.

Comparing these numbers, Leonardo’s PE is almost perfectly aligned with its Fair Ratio. This suggests that the market is pricing Leonardo’s earnings potential appropriately based on the company’s fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Leonardo Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives.

A Narrative is your personal investment story: a clear explanation of how you see a company’s future, connecting your estimate of its fair value with your expectations for revenue, earnings, and margins, and describing why you see things that way.

With Narratives on Simply Wall St’s Community page, you can quickly translate your perspective on Leonardo into a transparent financial forecast, see what fair value that predicts, and easily compare it to the current market price. This helps you decide whether to buy, hold, or sell.

Unlike static analysis, Narratives update automatically whenever new information such as earnings or news emerges. Your story and fair value estimates always stay relevant.

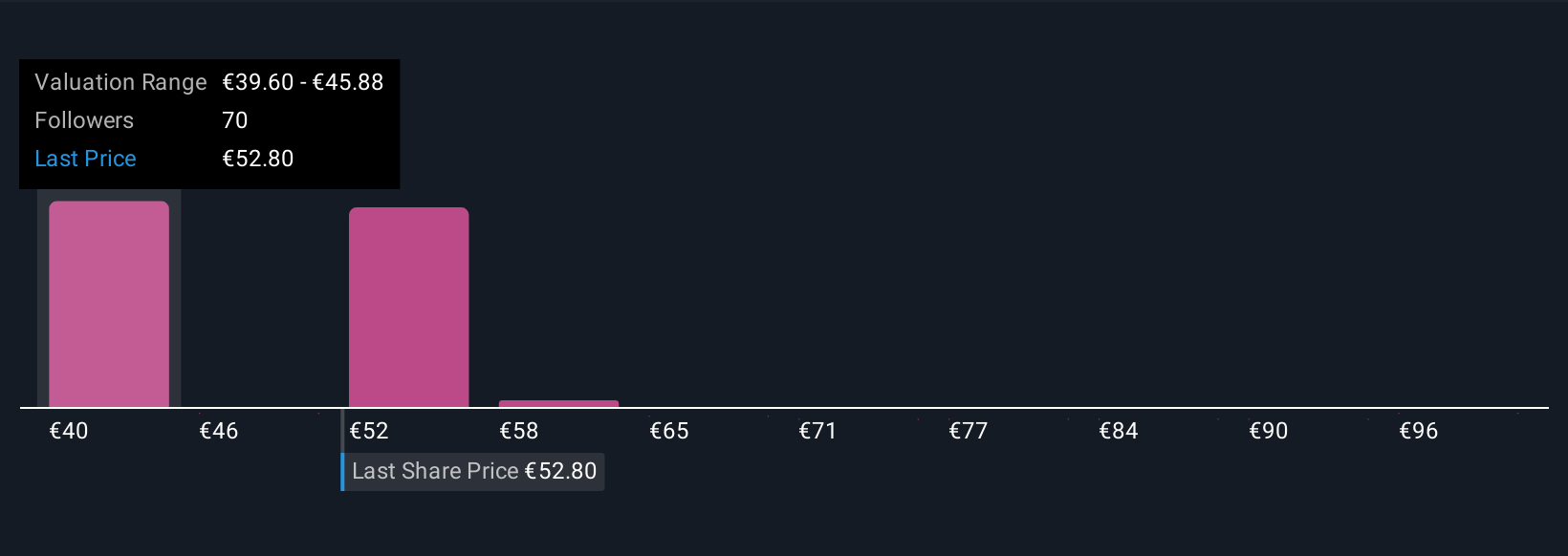

For example, on Leonardo, the most optimistic investors currently see a price target as high as €64.0 driven by surging defense demand, while the most cautious are as low as €35.3 due to margin risks and competition. You can decide which story best matches your view, or create your own.

Do you think there's more to the story for Leonardo? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:LDO

Leonardo

An industrial and technological company, engages in the helicopters, defense electronics and security, cyber security and solutions, aircraft, aerostructures, and space sectors in Italy, the United Kingdom, rest of Europe, the United States of America, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)