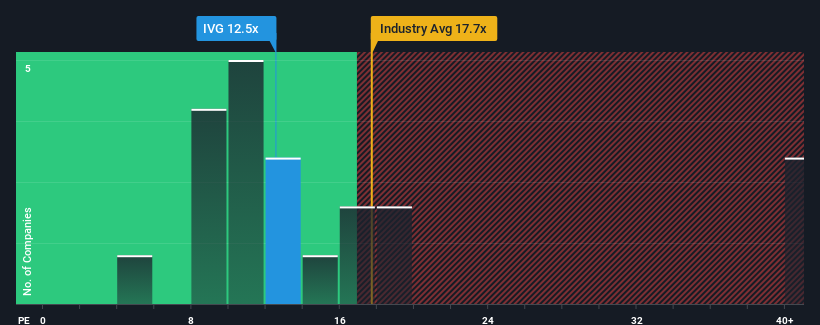

It's not a stretch to say that Iveco Group N.V.'s (BIT:IVG) price-to-earnings (or "P/E") ratio of 12.5x right now seems quite "middle-of-the-road" compared to the market in Italy, where the median P/E ratio is around 14x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Iveco Group certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Iveco Group

How Is Iveco Group's Growth Trending?

The only time you'd be comfortable seeing a P/E like Iveco Group's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 25% gain to the company's bottom line. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the ten analysts covering the company suggest earnings should grow by 37% per annum over the next three years. With the market only predicted to deliver 18% per annum, the company is positioned for a stronger earnings result.

In light of this, it's curious that Iveco Group's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Iveco Group's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Iveco Group's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you take the next step, you should know about the 4 warning signs for Iveco Group that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

If you're looking to trade Iveco Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:IVG

Iveco Group

Engages in the design, production, marketing, sale, servicing, and financing of trucks, commercial vehicles, buses and specialty vehicles, combustion engines, alternative propulsion systems, transmissions, axles, engines, alternative propulsion systems, construction equipment, marine and power generation applications in Europe, South America, North America, and internationally.

Undervalued with solid track record.