Market Participants Recognise Iveco Group N.V.'s (BIT:IVG) Earnings Pushing Shares 31% Higher

Iveco Group N.V. (BIT:IVG) shares have continued their recent momentum with a 31% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 53% in the last year.

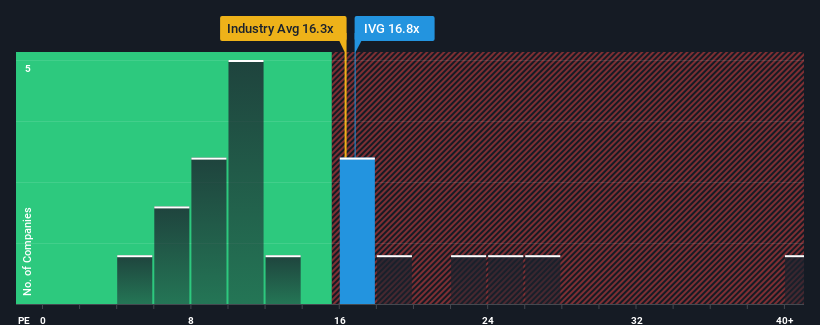

Since its price has surged higher, Iveco Group may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 16.8x, since almost half of all companies in Italy have P/E ratios under 13x and even P/E's lower than 8x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Iveco Group certainly has been doing a good job lately as it's been growing earnings more than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Iveco Group

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Iveco Group's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered an exceptional 49% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the ten analysts covering the company suggest earnings should grow by 40% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 12% each year, which is noticeably less attractive.

In light of this, it's understandable that Iveco Group's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Iveco Group's P/E?

The large bounce in Iveco Group's shares has lifted the company's P/E to a fairly high level. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Iveco Group's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - Iveco Group has 2 warning signs we think you should be aware of.

Of course, you might also be able to find a better stock than Iveco Group. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:IVG

Iveco Group

Engages in the design, production, marketing, sale, servicing, and financing of trucks, commercial vehicles, buses and specialty vehicles, combustion engines, alternative propulsion systems, transmissions, axles, engines, alternative propulsion systems, construction equipment, marine, and power generation applications in Europe, South America, North America, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives