Assessing Danieli (BIT:DAN)’s Valuation After Major India and Japan Contract Wins

Reviewed by Simply Wall St

Danieli & C. Officine Meccaniche (BIT:DAN) is back on investors’ radar after landing roughly 500 million euros of plant orders from Steel Authority of India and new furnace technology business in Japan.

See our latest analysis for Danieli & C. Officine Meccaniche.

Those contracts with Steel Authority of India and JFE Bars & Shapes seem to have supercharged sentiment, with the share price up 9.58% over the past month and a powerful 110.33% year to date share price return. Multi year total shareholder returns also point to momentum still building rather than fading.

If Danieli’s run has you thinking about where the next industrial winners might emerge, it could be worth scanning fast growing stocks with high insider ownership for other fast growing, high conviction ideas.

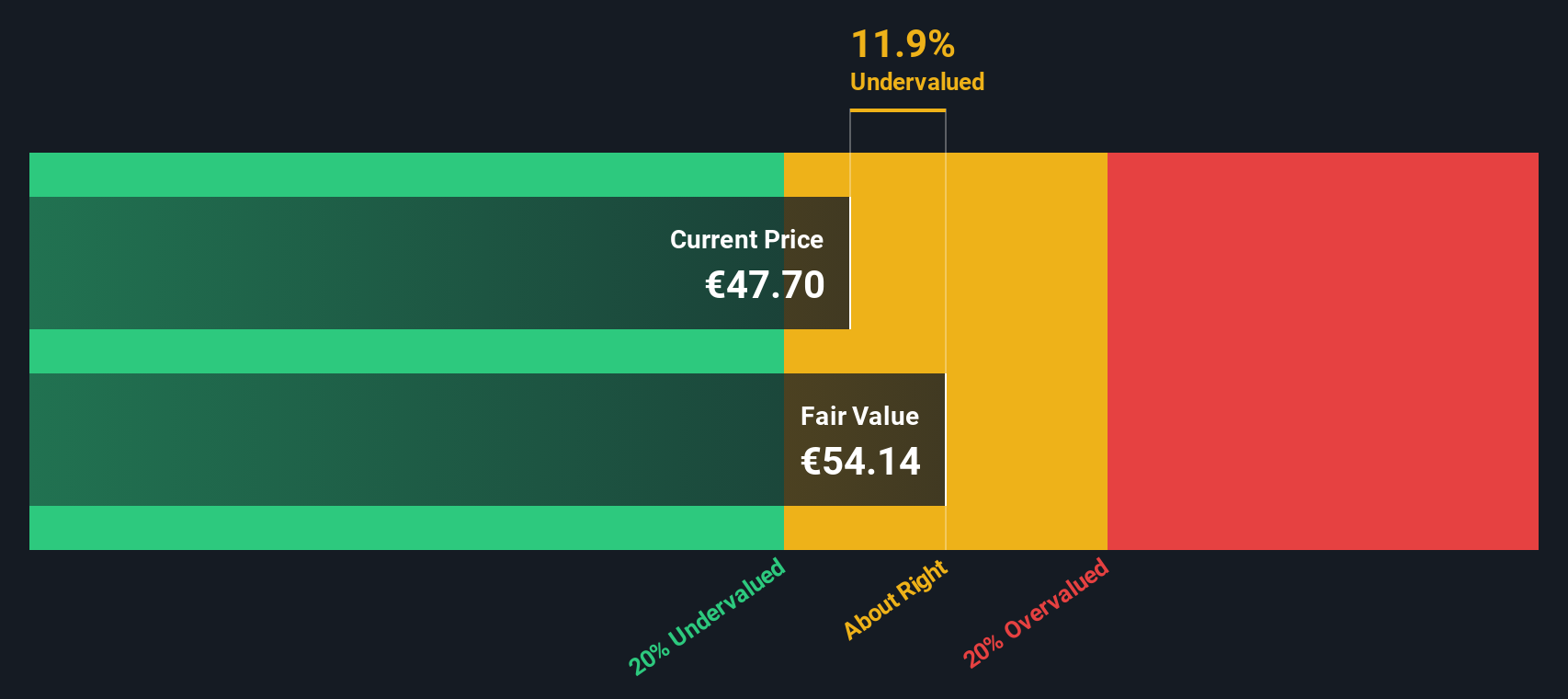

Yet with the shares already more than doubling this year and trading only modestly below analyst estimates, investors now face a tougher question: is Danieli still undervalued, or is the market already pricing in years of future growth?

Price-to-Earnings of 17.1x: Is it justified?

Danieli & C. Officine Meccaniche looks modestly undervalued on earnings, with a 17.1x price to earnings ratio supporting the recent share price surge.

The price to earnings multiple compares the current share price with per share earnings, making it a useful gauge of what investors are willing to pay for Danieli’s current and future profit stream.

At 17.1x earnings, Danieli trades slightly below both its peer group average of 17.6x and the wider European machinery sector on 20.6x. This suggests the market is not fully pricing in its forecast double digit profit growth or high quality earnings. Relative to an estimated fair price to earnings of 19.9x, there is also scope for the multiple to move higher if execution and contract wins continue.

Compared with the European machinery industry average of 20.6x, Danieli’s discount looks notable rather than marginal. This implies the market is assigning a more conservative valuation than the fair ratio model and peer benchmarks indicate.

Explore the SWS fair ratio for Danieli & C. Officine Meccaniche

Result: Price-to-Earnings of 17.1x (UNDERVALUED)

However, risks remain, ranging from cyclicality in global steel capex to execution challenges on large contracts, either of which could quickly cool today’s optimism.

Find out about the key risks to this Danieli & C. Officine Meccaniche narrative.

Another View: Our DCF Lens

Our DCF model also points to modest upside, with Danieli trading around 4.7% below its estimated fair value of €53.4. That is a thinner margin of safety than the earnings multiple implies, raising the question: how much optimism is already in the price?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Danieli & C. Officine Meccaniche for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Danieli & C. Officine Meccaniche Narrative

If you would rather stress test these assumptions yourself and follow your own thesis, you can build a personalised view in just minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Danieli & C. Officine Meccaniche.

Looking for more investment ideas?

If Danieli’s surge has sharpened your appetite for opportunities, do not stop here. Use the Simply Wall St Screener to explore other candidates for your next high conviction idea.

- Review these 3611 penny stocks with strong financials to find companies that already support their stories with solid financial foundations.

- Consider these 26 AI penny stocks to gain exposure to businesses involved in automation, data, and intelligent software and infrastructure.

- Explore these 908 undervalued stocks based on cash flows to identify companies where cash flow characteristics are not yet fully reflected in market prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:DAN

Danieli & C. Officine Meccaniche

Designs, builds, and sells plants for the iron and steel industry in Europe, Russia, the Middle East, the Americas, and South East Asia.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)