New Forecasts: Here's What Analysts Think The Future Holds For Comer Industries S.p.A. (BIT:COM)

Shareholders in Comer Industries S.p.A. (BIT:COM) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. The revenue forecast for this year has experienced a facelift, with analysts now much more optimistic on its sales pipeline.

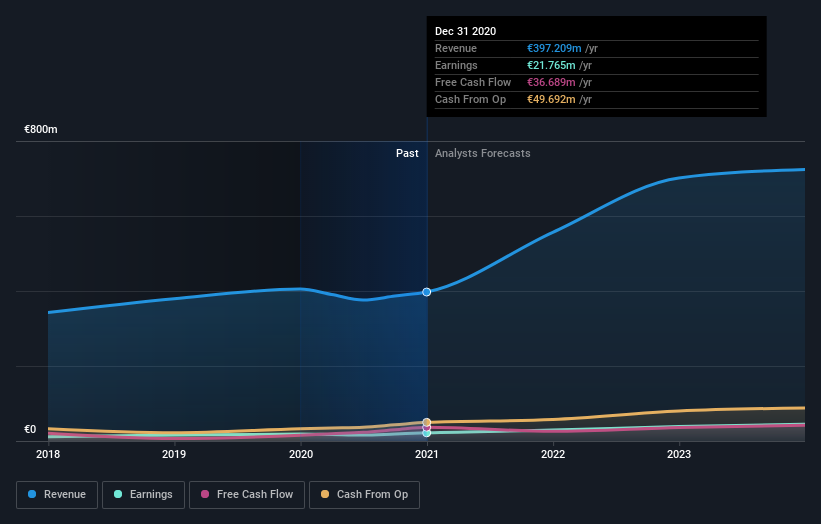

Following the upgrade, the most recent consensus for Comer Industries from its two analysts is for revenues of €557m in 2021 which, if met, would be a major 40% increase on its sales over the past 12 months. Per-share earnings are expected to jump 22% to €1.30. Prior to this update, the analysts had been forecasting revenues of €439m and earnings per share (EPS) of €1.27 in 2021. The most recent forecasts are noticeably more optimistic, with a chunky increase in revenue estimates and a lift to earnings per share as well.

Check out our latest analysis for Comer Industries

Of course, another way to look at these forecasts is to place them into context against the industry itself. The analysts are definitely expecting Comer Industries' growth to accelerate, with the forecast 40% annualised growth to the end of 2021 ranking favourably alongside historical growth of 4.7% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 11% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Comer Industries to grow faster than the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for this year, expecting improving business conditions. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at Comer Industries.

Better yet, our automated discounted cash flow calculation (DCF) suggests Comer Industries could be moderately undervalued. You can learn more about our valuation methodology on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you’re looking to trade Comer Industries, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:COM

Comer Industries

Designs and produces engineering systems and mechatronic solutions for power transmission applications in North America, Latin America, the Asia pacific, Europe, the Middle East, and Africa.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026