As global markets react to recent political developments and economic data, with U.S. stocks reaching record highs amid optimism over trade policies and AI investments, investors are increasingly seeking stability in their portfolios. In this environment, dividend stocks can offer a reliable income stream while potentially benefiting from market growth, making them an attractive option for those looking to balance risk and reward in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.51% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.97% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.78% | ★★★★★★ |

Click here to see the full list of 1948 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

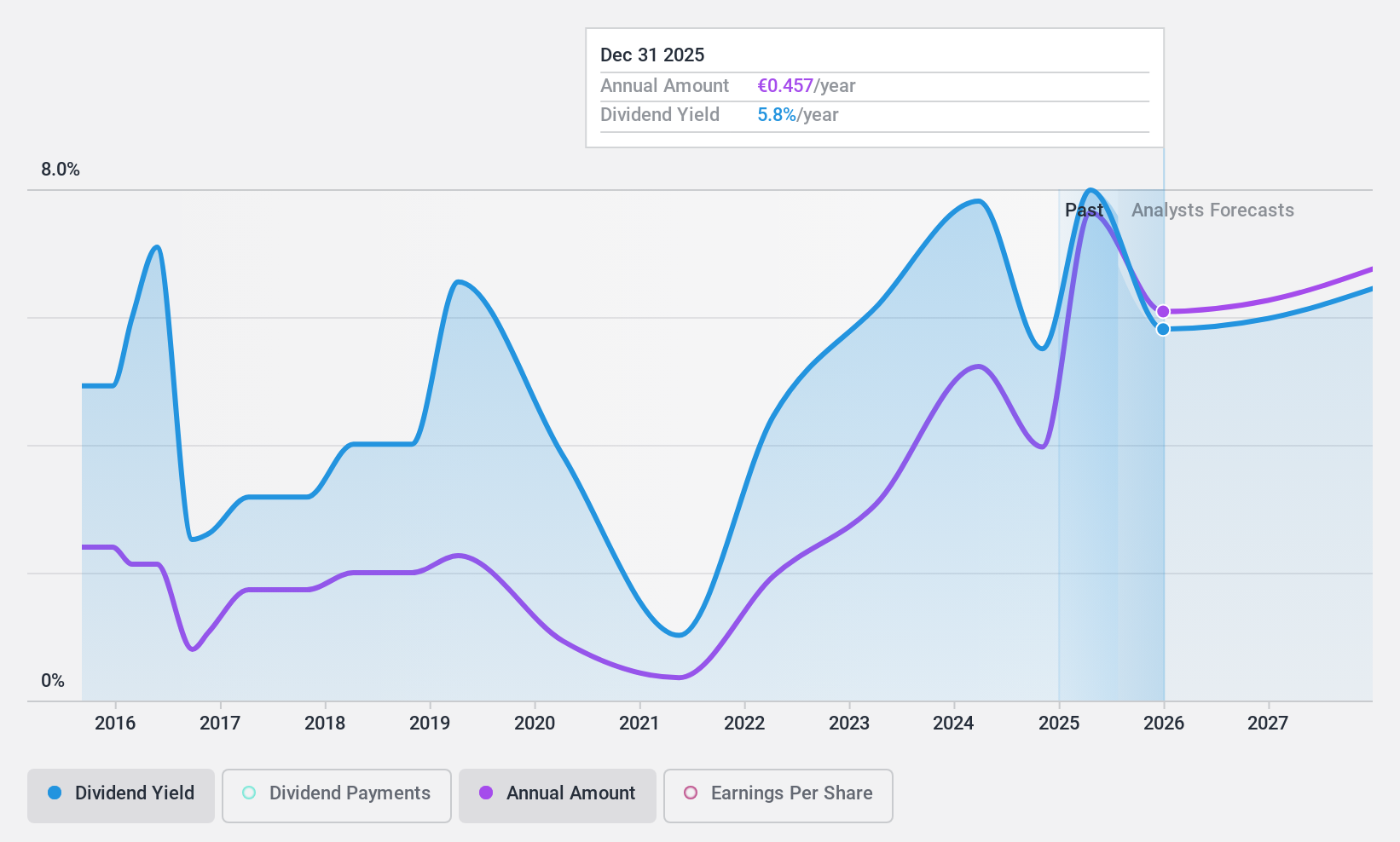

UniCredit (BIT:UCG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: UniCredit S.p.A. is a commercial banking institution operating in Italy, Germany, Central Europe, and Eastern Europe with a market cap of €69.59 billion.

Operations: UniCredit S.p.A.'s revenue segments are comprised of €10.88 billion from Italy, €5.27 billion from Germany, €4.29 billion from Central Europe, €2.87 billion from Eastern Europe, and €1.36 billion from Russia.

Dividend Yield: 4.1%

UniCredit's dividend payments are well covered by earnings, with a current payout ratio of 46.3%, expected to rise to 56.5% in three years. However, its dividend yield of 4.13% is below the top tier in Italy, and past payments have been volatile and unreliable. Despite trading at a discount to estimated fair value and peers, challenges include high bad loans (2.4%) and an unstable dividend track record amidst recent fixed-income offerings totaling over €3 billion since November 2024.

- Navigate through the intricacies of UniCredit with our comprehensive dividend report here.

- Our valuation report here indicates UniCredit may be undervalued.

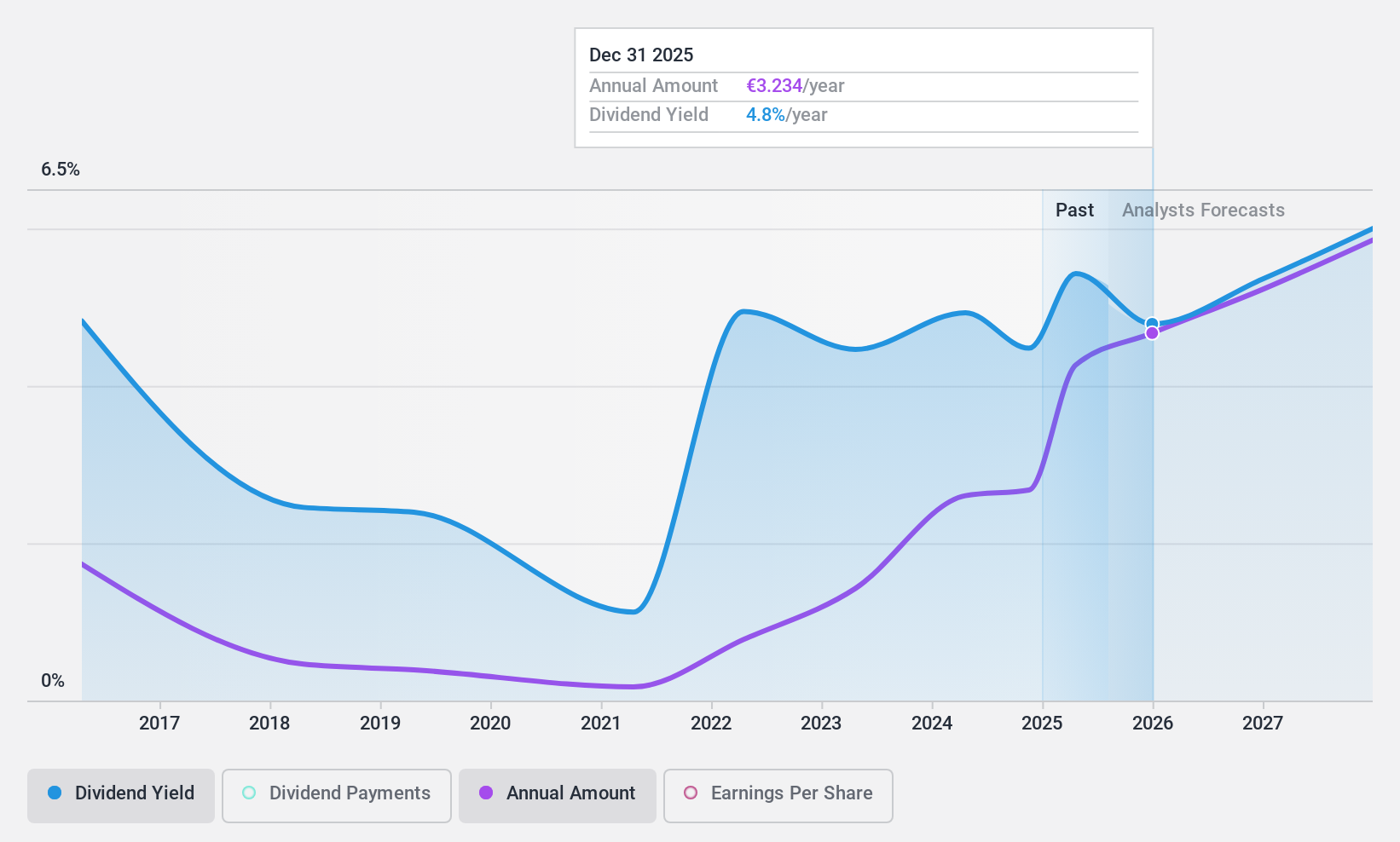

CaixaBank (BME:CABK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CaixaBank, S.A. is a financial institution offering a range of banking products and services in Spain and internationally, with a market cap of €42.71 billion.

Operations: CaixaBank's revenue is derived from several segments, including Banking (Incl. Non-Core Real Estate) at €10.67 billion, Insurance at €1.83 billion, Portuguese Investment Bank (BPI) at €1.21 billion, and the Corporate Center contributing €153 million.

Dividend Yield: 5%

CaixaBank's dividend payments are covered by earnings with a payout ratio of 76.2%, though its yield of 5.03% is slightly below the top Spanish dividend payers. Despite past volatility and unreliability in dividends, recent earnings growth of 26.4% offers some optimism, although earnings are forecast to decline by 1% annually over the next three years. Recent fixed-income offerings totaling €99.6 million reflect ongoing financial activities amidst government stake management discussions worth €6.6 billion ($6.9 billion).

- Get an in-depth perspective on CaixaBank's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that CaixaBank is priced lower than what may be justified by its financials.

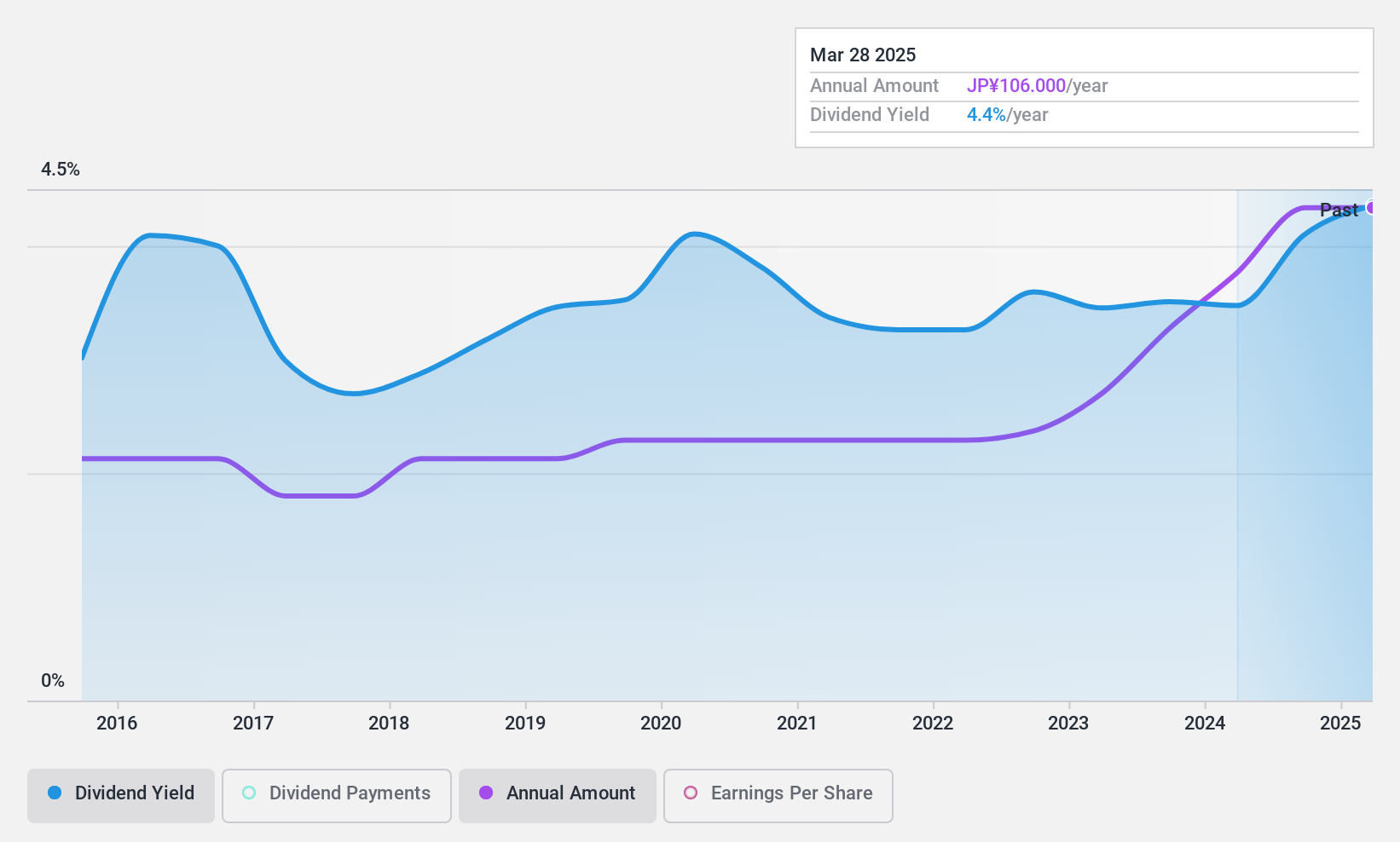

Ryoden (TSE:8084)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ryoden Corporation is engaged in the sale of factory automation systems, cooling and heating systems, information and communication technologies, facilities systems, and electronics both in Japan and internationally, with a market cap of ¥53.99 billion.

Operations: Ryoden Corporation's revenue is primarily derived from its Electronics segment at ¥149.31 billion, followed by Factory Automation Systems at ¥49.93 billion, and X - Tech contributing ¥7.51 billion.

Dividend Yield: 4.3%

Ryoden's dividend payments are well-covered by both earnings and cash flows, with a payout ratio of 51.8% and a cash payout ratio of 25.1%. However, the company has an unstable dividend track record over the past decade, marked by volatility. Despite this, dividends have grown during this period. Ryoden's recent guidance revision indicates lower expected profits due to delayed recovery in FA systems and weakness in the Chinese economy, potentially impacting future payouts.

- Click to explore a detailed breakdown of our findings in Ryoden's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Ryoden shares in the market.

Where To Now?

- Get an in-depth perspective on all 1948 Top Dividend Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:CABK

CaixaBank

Provides various banking products and financial services in Spain and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives