Institutions own 33% of Intesa Sanpaolo S.p.A. (BIT:ISP) shares but retail investors control 57% of the company

Key Insights

- Intesa Sanpaolo's significant retail investors ownership suggests that the key decisions are influenced by shareholders from the larger public

- The top 25 shareholders own 35% of the company

- 33% of Intesa Sanpaolo is held by Institutions

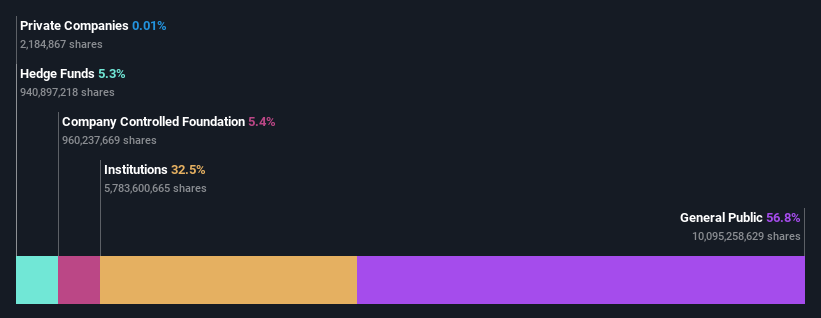

If you want to know who really controls Intesa Sanpaolo S.p.A. (BIT:ISP), then you'll have to look at the makeup of its share registry. And the group that holds the biggest piece of the pie are retail investors with 57% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

Meanwhile, institutions make up 33% of the company’s shareholders. Generally speaking, as a company grows, institutions will increase their ownership. Conversely, insiders often decrease their ownership over time.

In the chart below, we zoom in on the different ownership groups of Intesa Sanpaolo.

See our latest analysis for Intesa Sanpaolo

What Does The Institutional Ownership Tell Us About Intesa Sanpaolo?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

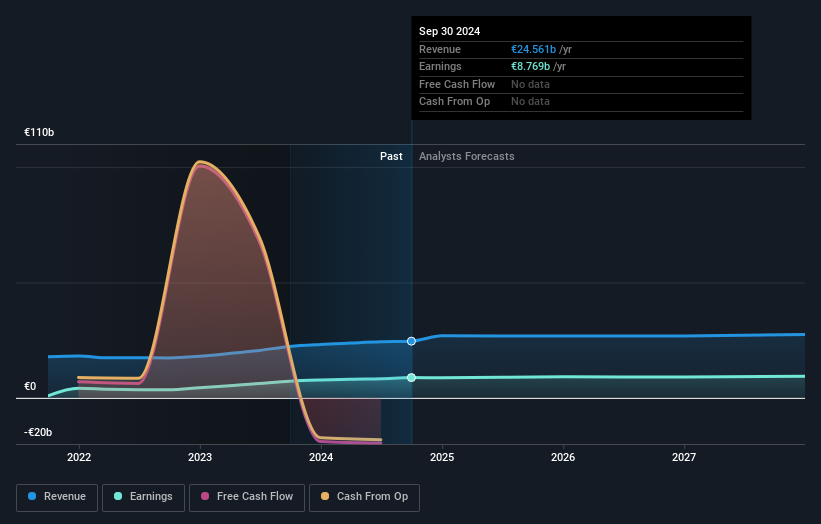

As you can see, institutional investors have a fair amount of stake in Intesa Sanpaolo. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Intesa Sanpaolo's historic earnings and revenue below, but keep in mind there's always more to the story.

Our data indicates that hedge funds own 5.3% of Intesa Sanpaolo. That worth noting, since hedge funds are often quite active investors, who may try to influence management. Many want to see value creation (and a higher share price) in the short term or medium term. Compagnia Di San Paolo, Endowment Arm is currently the largest shareholder, with 6.7% of shares outstanding. For context, the second largest shareholder holds about 5.4% of the shares outstanding, followed by an ownership of 5.3% by the third-largest shareholder.

On studying our ownership data, we found that 25 of the top shareholders collectively own less than 50% of the share register, implying that no single individual has a majority interest.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Intesa Sanpaolo

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our data cannot confirm that board members are holding shares personally. Given we are not picking up on insider ownership, we may have missing data. Therefore, it would be interesting to assess the CEO compensation and tenure, here.

General Public Ownership

The general public, mostly comprising of individual investors, collectively holds 57% of Intesa Sanpaolo shares. This size of ownership gives investors from the general public some collective power. They can and probably do influence decisions on executive compensation, dividend policies and proposed business acquisitions.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Intesa Sanpaolo better, we need to consider many other factors. Take risks for example - Intesa Sanpaolo has 1 warning sign we think you should be aware of.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:ISP

Intesa Sanpaolo

Provides various financial products and services in Italy, Central/Eastern Europe, the Middle East, and North Africa.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion