As the pan-European STOXX Europe 600 Index continues its upward trend, driven by optimism over easing trade tensions between China and the U.S., investors are increasingly turning their attention to dividend stocks as a potential source of stable income. In such a dynamic market environment, selecting dividend stocks with strong fundamentals and consistent payout histories can be an effective strategy for those seeking reliable returns amidst economic fluctuations.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.38% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.55% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.38% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.38% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.75% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.00% | ★★★★★★ |

| S.N. Nuclearelectrica (BVB:SNN) | 9.48% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.73% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.50% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.60% | ★★★★★★ |

Click here to see the full list of 230 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

BPER Banca (BIT:BPE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BPER Banca SpA offers a range of banking products and services to individuals, businesses, and professionals both in Italy and internationally, with a market capitalization of approximately €11.28 billion.

Operations: BPER Banca SpA's revenue segments include banking products and services tailored for individuals, businesses, and professionals across Italy and international markets.

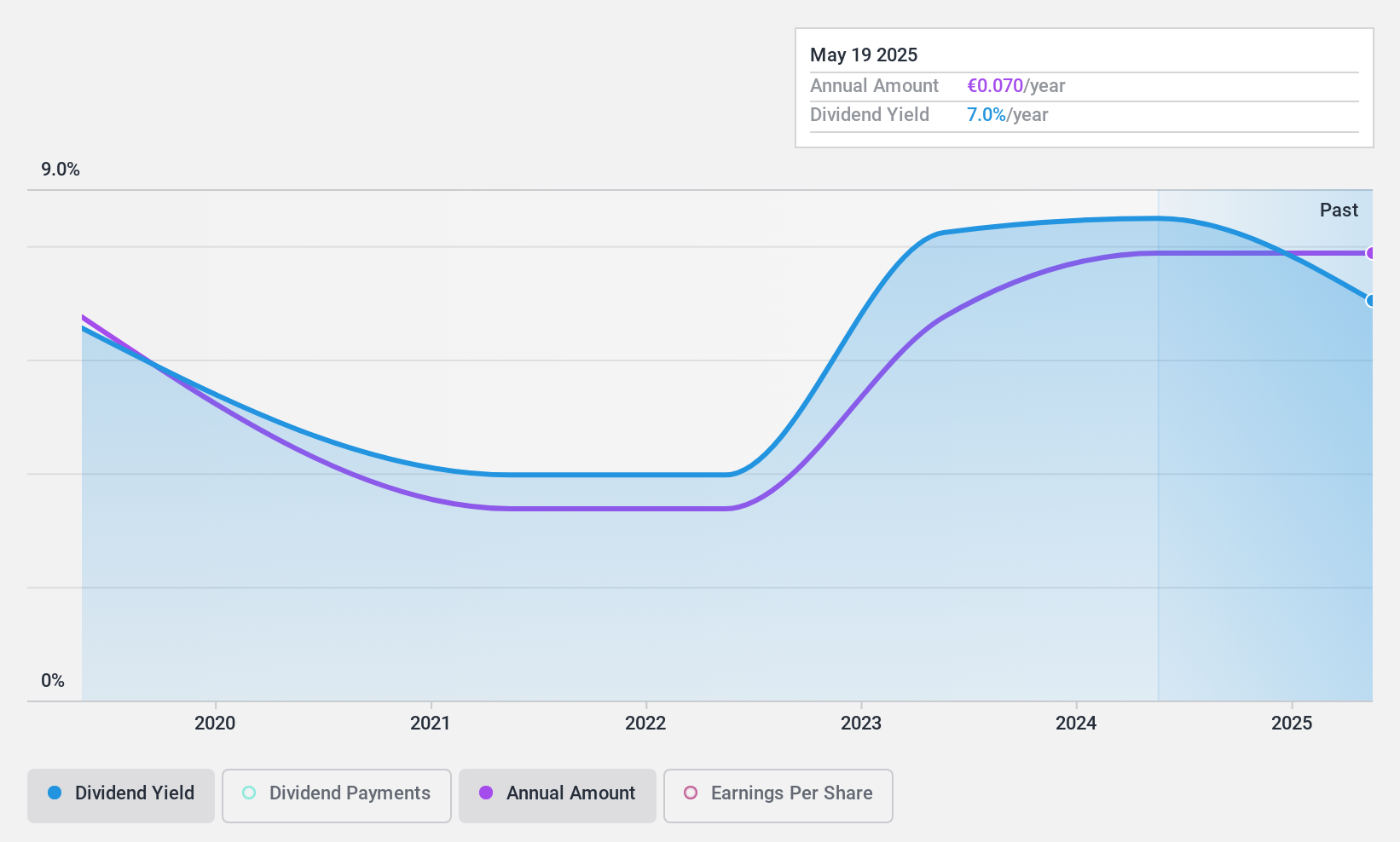

Dividend Yield: 7.5%

BPER Banca's dividend yield is attractive, ranking in the top 25% of Italian market payers. However, its dividend history is unreliable with volatility and a high bad loans ratio at 2.1%. Despite this, dividends are currently covered by earnings with a payout ratio of 60.6%, forecasted to remain sustainable at 77.5% in three years. Recent Q1 earnings showed net income slightly decreased to €442.93 million from last year’s €457.28 million, highlighting potential challenges ahead.

- Click here and access our complete dividend analysis report to understand the dynamics of BPER Banca.

- In light of our recent valuation report, it seems possible that BPER Banca is trading behind its estimated value.

RCS MediaGroup (BIT:RCS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: RCS MediaGroup S.p.A. offers multimedia publishing services both in Italy and internationally, with a market cap of €563.95 million.

Operations: RCS MediaGroup S.p.A.'s revenue segments include €65.20 million from Magazines Italy, €369.40 million from Italy Newspapers, €217.70 million from Unidad Editorial, and €283.30 million from Advertising and Sport, along with contributions of €80.90 million from Corporate and Other Activities.

Dividend Yield: 6.4%

RCS MediaGroup's dividend yield ranks in the top 25% of Italian market payers, with a recent annual dividend of €0.0700 per share. Despite only six years of payments and some volatility, dividends are covered by earnings (58.4% payout ratio) and cash flows (38.3% cash payout ratio). Recent earnings growth to €62 million from €57 million supports sustainability, though shareholder dilution occurred last year, impacting long-term reliability perceptions.

- Delve into the full analysis dividend report here for a deeper understanding of RCS MediaGroup.

- The analysis detailed in our RCS MediaGroup valuation report hints at an deflated share price compared to its estimated value.

Burgenland Holding (WBAG:BHD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Burgenland Holding Aktiengesellschaft, with a market cap of €219 million, operates through its investment in Burgenland Energie AG to generate and sell electricity in Austria.

Operations: Burgenland Holding generates revenue primarily through its investment in Burgenland Energie AG, focusing on electricity generation and sales within Austria.

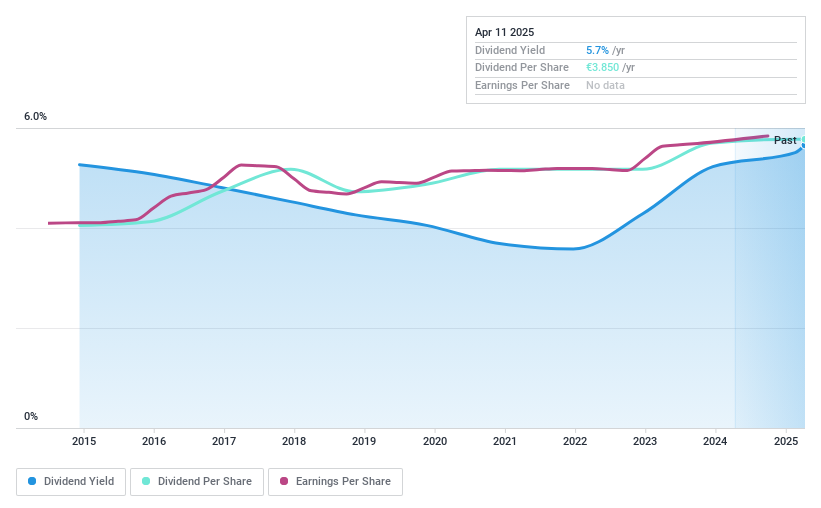

Dividend Yield: 5.3%

Burgenland Holding's dividend yield is among the top 25% in Austria, with a recent annual dividend of €3.85 per share. Despite a decade of stable and reliable payments, the dividends are not well covered by earnings (98.9% payout ratio) or free cash flows (101.1% cash payout ratio). Earnings have grown at 3.1% annually over five years, yet the stock trades at 31.6% below its estimated fair value, raising concerns about sustainability despite growth in dividend payments over ten years.

- Click here to discover the nuances of Burgenland Holding with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Burgenland Holding's current price could be inflated.

Taking Advantage

- Take a closer look at our Top European Dividend Stocks list of 230 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BPER Banca might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BPE

BPER Banca

Provides banking products and services for individuals, and businesses and professionals in Italy and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives