- Italy

- /

- Auto Components

- /

- BIT:SGF

Optimistic Investors Push Sogefi S.p.A. (BIT:SGF) Shares Up 26% But Growth Is Lacking

Sogefi S.p.A. (BIT:SGF) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 17% is also fairly reasonable.

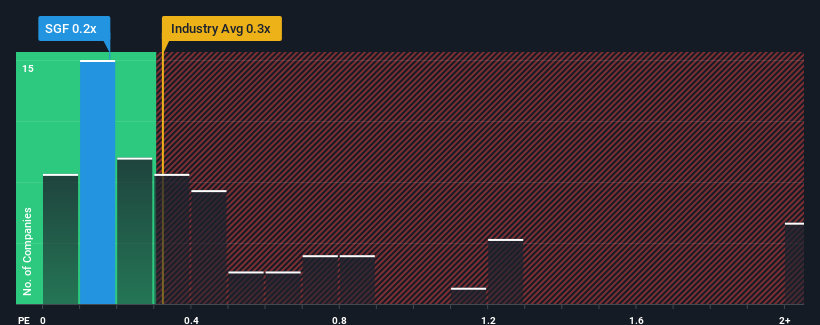

Although its price has surged higher, you could still be forgiven for feeling indifferent about Sogefi's P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Auto Components industry in Italy is also close to 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Sogefi

What Does Sogefi's P/S Mean For Shareholders?

Sogefi certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sogefi.Do Revenue Forecasts Match The P/S Ratio?

Sogefi's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 34%. The latest three year period has also seen a 18% overall rise in revenue, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue growth is heading into negative territory, declining 13% per year over the next three years. With the industry predicted to deliver 4.1% growth per annum, that's a disappointing outcome.

In light of this, it's somewhat alarming that Sogefi's P/S sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From Sogefi's P/S?

Sogefi appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It appears that Sogefi currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

Before you settle on your opinion, we've discovered 1 warning sign for Sogefi that you should be aware of.

If you're unsure about the strength of Sogefi's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:SGF

Sogefi

Designs, develops, and produces filtration systems, suspension components, air intake products, and engine cooling systems for the automotive industry in Europe, South America, North America, China, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives